A couple of weeks ago, my old shower broke down, needing replacement. Chatting to bathroom-kitchen store manager, I learnt that business was brisk for them, especially the demand for new bathrooms. In fact, very brisk. Lots of people wanting new bathrooms for their holiday to-be-let homes, with higher rents in mind, as well as for actually lived-in homes. His order book is far stronger than in ‘normal’ times.For those who ‘have’, the times are not – financially speaking – bad at all.All this...

Read More »Spend for recovery & green future, raising corporation tax is ok, & there are no bond vigilantes

A couple of weeks ago, my old shower broke down, needing replacement. Chatting to bathroom-kitchen store manager, I learnt that business was brisk for them, especially the demand for new bathrooms. In fact, very brisk. Lots of people wanting new bathrooms for their holiday to-be-let homes, with higher rents in mind, as well as for actually lived-in homes. His order book is far stronger than in ‘normal’ times. For those who ‘have’, the times are not – financially speaking – bad at all. All...

Read More »Spend for recovery & green future, raising corporation tax is ok, & there are no bond vigilantes

A couple of weeks ago, my old shower broke down, needing replacement. Chatting to bathroom-kitchen store manager, I learnt that business was brisk for them, especially the demand for new bathrooms. In fact, very brisk. Lots of people wanting new bathrooms for their holiday to-be-let homes, with higher rents in mind, as well as for actually lived-in homes. His order book is far stronger than in ‘normal’ times.For those who ‘have’, the times are not – financially speaking – bad at all.All this...

Read More »Is Modern Monetary Theory suited for the EMU?

In 2020, governments all over Europe and beyond enacted unprecedented fiscal stimulus to keep their economies afloat amidst the pandemic. By the end of the year, a country like France will have engaged or guaranteed at least EUR 300 billion, the equivalent of four years of income tax receipts. Institutions of the European Union (EU) also rightly stepped up to the challenge.Of particular importance has been the response of the European Central Bank (ECB) which launched several bond-purchasing...

Read More »Is Modern Monetary Theory suited for the EMU?

In 2020, governments all over Europe and beyond enacted unprecedented fiscal stimulus to keep their economies afloat amidst the pandemic. By the end of the year, a country like France will have engaged or guaranteed at least EUR 300 billion, the equivalent of four years of income tax receipts. Institutions of the European Union (EU) also rightly stepped up to the challenge. Of particular importance has been the response of the European Central Bank (ECB) which launched several...

Read More »Is Modern Monetary Theory suited for the EMU?

In 2020, governments all over Europe and beyond enacted unprecedented fiscal stimulus to keep their economies afloat amidst the pandemic. By the end of the year, a country like France will have engaged or guaranteed at least EUR 300 billion, the equivalent of four years of income tax receipts. Institutions of the European Union (EU) also rightly stepped up to the challenge.Of particular importance has been the response of the European Central Bank (ECB) which launched several bond-purchasing...

Read More »The GND and Europe’s next ten years: a plan for resolving the public debt crisis

The centrality of public debt to private capital marketsIn thinking about the next ten years, we must acknowledge that new times are coming, and they will lead to big changes in the capitalist system. The absolute novelty of the situation in which the COVID-19 crisis has placed the world, and even more markedly, Europe has made the financial and monetary options that have preoccupied economic debate so far, if not obsolete, at least questionable. It is a crisis that obliges us to rethink,...

Read More »The GND and Europe’s next ten years: a plan for resolving the public debt crisis

The centrality of public debt to private capital markets In thinking about the next ten years, we must acknowledge that new times are coming, and they will lead to big changes in the capitalist system. The absolute novelty of the situation in which the COVID-19 crisis has placed the world, and even more markedly, Europe has made the financial and monetary options that have preoccupied economic debate so far, if not obsolete, at least questionable. It is a crisis that obliges us to rethink,...

Read More »The GND and Europe’s next ten years: a plan for resolving the public debt crisis

The centrality of public debt to private capital marketsIn thinking about the next ten years, we must acknowledge that new times are coming, and they will lead to big changes in the capitalist system. The absolute novelty of the situation in which the COVID-19 crisis has placed the world, and even more markedly, Europe has made the financial and monetary options that have preoccupied economic debate so far, if not obsolete, at least questionable. It is a crisis that obliges us to rethink,...

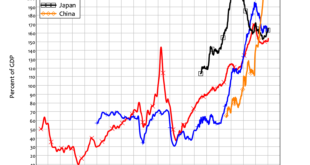

Read More »To save the climate – don’t listen to mainstream economists

Ann Pettifor’s The Coming First World Debt Crisis (Pettifor 2006) was the first book to warn of the approaching 2007 Global Financial Crisis. More than decade after that crisis, its cause—excessive private debt, created primarily to finance asset bubbles rather than productive investment—is still with us, while we are entrapped in a pandemic crisis, and on the cusp of a climatic one.Figure 1: Private debt levels over the history of capitalismLooking forward to the next ten years, and given so...

Read More » Heterodox

Heterodox