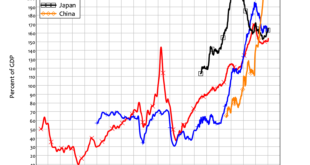

Ann Pettifor’s The Coming First World Debt Crisis (Pettifor 2006) was the first book to warn of the approaching 2007 Global Financial Crisis. More than decade after that crisis, its cause—excessive private debt, created primarily to finance asset bubbles rather than productive investment—is still with us, while we are entrapped in a pandemic crisis, and on the cusp of a climatic one.Figure 1: Private debt levels over the history of capitalismLooking forward to the next ten years, and given so...

Read More »To save the climate – don’t listen to mainstream economists

Ann Pettifor’s The Coming First World Debt Crisis (Pettifor 2006) was the first book to warn of the approaching 2007 Global Financial Crisis. More than decade after that crisis, its cause—excessive private debt, created primarily to finance asset bubbles rather than productive investment—is still with us, while we are entrapped in a pandemic crisis, and on the cusp of a climatic one.Figure 1: Private debt levels over the history of capitalismLooking forward to the next ten years, and given so...

Read More »Austerity: a symptom of globalised rentier capitalism’s failure

Even while the economy is recast for today’s pandemic on the back of the dismal failures of the past decade, austerity is already rearing its ugly head. At one level there must be politics here. The public must not be allowed to think that socialising the economy to meet a pandemic means the economy might be socialised when the pandemic is over. Likewise, obsessing about excessive debt means the greatly more pressing and more dangerous reality of deficient expenditure is side-lined. But it’s...

Read More »Celebrating 10 years of PRIME and facing the 2020s..

As loyal readers know, we are a network of macro- and political economists and environmentalists influenced by Keynes or concerned to restore his thinking. In our mission statement, drafted back in 2010, we considered “that conventional or ‘mainstream’ economic theory has proved of almost no relevance to the ongoing and chronic failure of the global economy and to the gravest threat facing us all: climate change.” We stand by that statement. As the globalised and financialised economy...

Read More »Debt, wealth and climate: globally coordinated Climate Authorities for green financing

By T.Sabri Öncü & Ahmet Öncü This article first appeared in the Indian journal, Economic and Political Weekly on 18 April 2020. The authors’ contact details are at he foot of this article.Abstract Based on the German Currency Reform of 1948 and the “Modern Debt Jubilee” of Steve Keen, a globally coordinated orderly debt deleveraging mechanism is proposed to address the global debt overhang problem. Since the global debt overhang and lack of sufficient climate finance...

Read More »The Use and Abuse of MMT

Image with acknowledgment to Needpix . “Give a man a fish, and you feed him for a day… But give him a loan to buy a boat and net to fish, and he will end up paying you all the fishes he catches.” By Michael Hudson, with Dirk Bezemer, Steve Keen and Sabri Öncü This article first appeared in Naked Capitalism on 10th April 2020Summary After...

Read More »Things that could be done, once the lesson is learned

This is the second of two posts on the current crisis by Professor Massimo Amato, of Bocconi University, Milan. The first, “Lessons to be learnt”, was posted on PRIME on 31st March A new institutional architecture must be thought of. First of all for Europe. Europe has always thought of itself as an experiment and as a process. Now the time has come to experiment with new paths, in view of a new structure after the crisis. In these days, people speak more and more...

Read More »Ways & means of paying Government’s growing bills – financing or cashflow?

“The Bank has always held itself bound to the extent of its power to render the assistance required by the Treasury in any exigency and under any condition of the Money Market.” – James Currie, Governor of Bank of England, July 1885 to Lord Salisbury, Prime MinisterThe new agreement between Government and Bank of England to make the Government’s overdraft with the Bank (the Ways and Means Facility) open-ended has been characterised as direct “monetary financing” of...

Read More »Triggering a Global Financial Crisis: Covid-19 as the Last Straw

Photo - Black swans in Regent’s Park, London - by Jeremy Smith T. Sabri Öncü ([email protected]) is an economist based in İstanbul, Turkey. This article was written on 8 March 2020 and first published in the Indian journal Economic and Political Weekly on 14 March 2020.Whether a black swan or a...

Read More »Bill Mitchell — Inverted yield curves signalling a total failure of the dominant mainstream macroeconomics

At different times, the manias spread through the world’s financial and economic commentariat. We have had regular predictions that Japan was about to collapse, with a mix of hyperinflation, government insolvency, Bank of Japan negative capital and more. During the GFC, the mainstream economists were out in force predicting accelerating inflation (because of QE and rising fiscal deficits), rising bond yields and government insolvency issues (because of rising deficits and debt ratios) and...

Read More » Heterodox

Heterodox