By Thomas PalleyThe US is currently enjoying another stock market boom which, if history is any guide, also stands to end in a bust. In the meantime, the boom is having a politically toxic effect by lending support to Donald Trump and obscuring the case for reversing the neoliberal economic paradigm.For four decades the US economy has been trapped in a “Groundhog Day” cycle in which policy engineered new stock market booms cover the tracks of previous busts. But though each new boom...

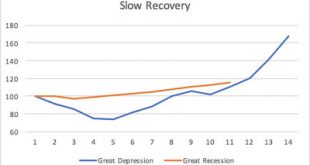

Read More »The slow recovery in historical perspective: 10 years after the Great Recession

It's hard to believe, but it has been almost a decade since the Great Recession. The official recession started in December 2017, but everybody remembers the collapse of Lehman in September of 2008. When you look at the recovery from the last recession in historical perspective, two things are clear. If you take GDP fall, or increase in unemployment, the Great Recession does not compare to the Great Depression, and that means that fiscal policy (automatic stabilizers and stimulus package)...

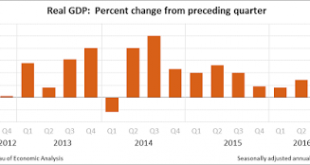

Read More »GDP recovers a bit in the third quarter

According to the BEA, the advance estimate of GDP growth in the third quarter is 2.9%, which is a significant improvement on the second quarter (1.4%). So maybe there is no recession in the near future (Neil Irwin might be right about that), which does not mean Yellen should hike the Fed rate in December anyway.

Read More »Weak jobs report should kill interest rate hike

Or so it seems. The BLS last employment situation summary says that only 38000 jobs were created last month. Unemployment fell to 4.7%, but that is mostly the result of the fall in the participation rate, that is, less people in the labor force (see below). In other words, unemployment rate is lower not because unemployment decreased (at least not much), but because workers stopped looking for jobs. Since the crisis there has been no recovery in the labor force participation rate, as shown...

Read More »Revised GDP and the slow recovery

BEA released the second estimate of the first quarter GDP, and it's up from 0.5 to 0.8%. Not bad, not great. Note that federal government spending is a drag on the recovery (although local and state governments are positive force, and part of that is actually funded by the federal government anyway; so the actual negative impact of contractionary fiscal policy is smaller than what the numbers suggest). At any rate, this will be used to demand higher rates in the next meeting of the FOMC. You...

Read More »More on the slow recovery

The private sector added 156,000 jobs in April, according to the Automatic Data Processing (ADP) report, ahead of the Bureau of Labor Statistics (BLS) more comprehensive release this Friday. As the graph shows there is a slowdown form last month. This adds to weak manufacturing growth,and a smaller trade deficit, resulting from lower imports, that is, a slower economy. I still think a recession might not be in the immediate horizon. However, the data seem to indicate, as I said before, that...

Read More »John Cochrane on economic growth

There are three kinds of lies, "lies, damned lies, and statistics," supposedly said Benjamin Disraeli. This applies to John Cochrane piece in the Wall Street Journal today. Cochrane says that: "Sclerotic growth is America’s overriding economic problem. From 1950 to 2000, the U.S. economy grew at an average rate of 3.5% annually. Since 2000, it has grown at half that rate—1.76%. Even in the years since the bottom of the great recession in 2009, which should have been a time of fast catch-up...

Read More »Slow recovery continues

In the first quarter the economy slowed down grinding nearly to a halt. Real Gross Domestic Product (GDP) slowed to a 0.5% annual growth rate in the first three months of 2016, according to the Bureau of Economic Analysis (BEA). By the way, federal government spending has been a drag on growth. And here in lies the problem. Don't expect any stimulus this year, and very unlikely that this would change significantly any time soon. The problem isn't secular stagnation, it is rather...

Read More »Payroll employment rose by 215,000 in March

That's more or less the same pace of growth as before, and suggests that the slow recovery continues. The unemployment rate ticked up to 5%, since the labor force participation rate increased from previous month. (but still below the pre-recession level, as shown below). So in this case, a slightly higher rate of unemployment is not a bad thing. It means more people are confident they can find jobs. Notice that manufacturing employment has declined for the third month in row. This also...

Read More »Domestic reasons for Yellen to remain dovish

The last estimate of real GDP growth in the fourth quarter of 2015 indicates that the economy expanded at 1.4%. Not very fast. Also, this week the Bureau of Economic Analysis (BEA) announced that personal consumption expenditures (PCE) increased 0.1%, and revised down the January number to 0.1%. In other words, consumption is slowing down, or so it seems. More importantly, the report says: "The February PCE price index increased 1.0 percent from February a year ago. The February PCE price...

Read More » Heterodox

Heterodox