Summary:

The last estimate of real GDP growth in the fourth quarter of 2015 indicates that the economy expanded at 1.4%. Not very fast. Also, this week the Bureau of Economic Analysis (BEA) announced that personal consumption expenditures (PCE) increased 0.1%, and revised down the January number to 0.1%. In other words, consumption is slowing down, or so it seems. More importantly, the report says: "The February PCE price index increased 1.0 percent from February a year ago. The February PCE price index, excluding food and energy, increased 1.7 percent from February a year ago." In other words, core inflation remains below the 2% target, and it has decelerated a bit, since in the previous report it was indicated that core inflation increased 1.3% on a yearly basis.So there are good reasons for Janet Yellen to remain dovish, and suggest that interest rates will not increase significantly. Actually, there are good domestic reasons for that, even if she seems to emphasize the uncertain international economy.PS: There is also the question of whether we are (or not; and we aren't) at full employment. But that's a topic for another post.

Topics:

Matias Vernengo considers the following as important: BEA, Slow recovery, Yellen

This could be interesting, too:

The last estimate of real GDP growth in the fourth quarter of 2015 indicates that the economy expanded at 1.4%. Not very fast. Also, this week the Bureau of Economic Analysis (BEA) announced that personal consumption expenditures (PCE) increased 0.1%, and revised down the January number to 0.1%. In other words, consumption is slowing down, or so it seems. More importantly, the report says: "The February PCE price index increased 1.0 percent from February a year ago. The February PCE price index, excluding food and energy, increased 1.7 percent from February a year ago." In other words, core inflation remains below the 2% target, and it has decelerated a bit, since in the previous report it was indicated that core inflation increased 1.3% on a yearly basis.So there are good reasons for Janet Yellen to remain dovish, and suggest that interest rates will not increase significantly. Actually, there are good domestic reasons for that, even if she seems to emphasize the uncertain international economy.PS: There is also the question of whether we are (or not; and we aren't) at full employment. But that's a topic for another post.

Topics:

Matias Vernengo considers the following as important: BEA, Slow recovery, Yellen

This could be interesting, too:

Angry Bear writes Early Bureau of Economic Analysis (BEA) Numerics for November 2024

Matias Vernengo writes On central bank independence, and Brazilian monetary policy

Mike Norman writes My new podcast episode is out

Mike Norman writes My new podcast episode is out.

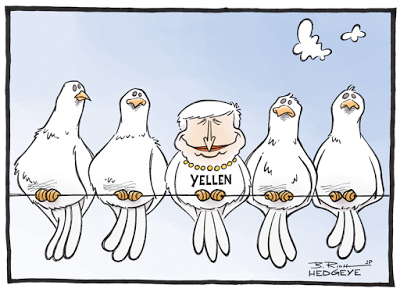

The last estimate of real GDP growth in the fourth quarter of 2015 indicates that the economy expanded at 1.4%. Not very fast. Also, this week the Bureau of Economic Analysis (BEA) announced that personal consumption expenditures (PCE) increased 0.1%, and revised down the January number to 0.1%. In other words, consumption is slowing down, or so it seems. More importantly, the report says: "The February PCE price index increased 1.0 percent from February a year ago. The February PCE price index, excluding food and energy, increased 1.7 percent from February a year ago." In other words, core inflation remains below the 2% target, and it has decelerated a bit, since in the previous report it was indicated that core inflation increased 1.3% on a yearly basis.

So there are good reasons for Janet Yellen to remain dovish, and suggest that interest rates will not increase significantly. Actually, there are good domestic reasons for that, even if she seems to emphasize the uncertain international economy.

PS: There is also the question of whether we are (or not; and we aren't) at full employment. But that's a topic for another post.