The Missing Piece in Plans for an All-Electric Vehicle Fleet: Electricity The New York Times has a piece today on barriers to the replacement of internal combustion-powered vehicles to an all-electric fleet in the United States. It talks about production costs, the availability of key minerals and the need for a charging station infrastructure, but it oddly passes over the most obvious impediment, at least from the perspective of climate change, the...

Read More »From Employer Coverage to Single Payer Health Insurance

From Employer Coverage to Single Payer Health Insurance This holiday season I’ve heard several tales of woe from working class acquaintances, mostly self-employed, about Obamacare: how they are just above the subsidy cutoff and would rather pay the fine than buy expensive individual policies, or how they are just below and can’t afford to put in more hours per week. I can understand why there is a lot of disappointment with the Democrats. So what about...

Read More »Corporatizatizing The All-Administrative University

Corporatizatizing The All-Administrative University One of the few good things that appears to have happened in the conference committee on the generally awful impending GOP tax bill is that the hits students were going to take have been eliminated. However, even without that additional burden, college students face costs that are far higher than any other nation and have been rising above inflation rates for decades. While` students in Denmark...

Read More »Tipping Point

Via the Economic Policy Intstitute: The Department of Labor (DOL) released a proposed rule that would allow restaurants to take the tips that servers earn and share them with untipped employees such as cooks and dishwashers.1 But, crucially, the rule doesn’t actually require that employers distribute “pooled” tips to workers. Under the administration’s proposed rule, as long as tipped workers earn minimum wage, employers could legally pocket those tips....

Read More »Fake news

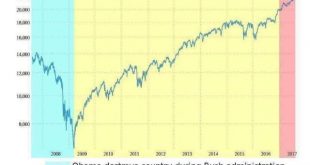

This chart caught my fancy after reading the interview with Rep. Tom Cole from the previous post. There is still the tendency to see the stock market (or GDP) as a proxy for the economy. And it is a time honored tradition for politicians to claim credit for economic gain in convoluted story telling: (I could not find the attribution for this graph but will add when I find it) Trump bump versus Obama effect on the stock market for the first nine months in...

Read More »A path to voting yes on tax cut bill

An interview on CNBC with Rep.Tom Cole offers some insight into the path to voting yes on the tax bill… Alhough mainstream forecasters like the Joint Committee on Taxation and University of Pennsylvania have issued unflattering analyses of GOP proposals, Cole says his tax-committee colleagues tell him other models offer sunnier results in line with his core belief that lower taxes boost the economy… … He doesn’t know what those models are, but doesn’t...

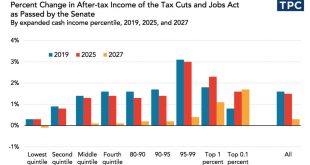

Read More »The GOP Tax Bill Disses the Working Class

The GOP Tax Bill Disses the Working Class Here’s something about the GOP House and the GOP Senate: they each passed tax bills (supposed to come out in a “conference” agreement sometime today) that diss the United States’ working class taxpayers. White or black, Christian or Jew or other, citizen by birth or naturalized citizen–workers are treated as an inferior “taker” class and owners are treated as a superior “maker” class–the same old GOP class...

Read More »The text of the GOP tax complication legislation

The text of the GOP tax complication legislation The Republicans, after holding one sham “public hearing” on their conference bill (without any text released) have on late Friday released the text of their (Republicans only) agreed-upon final bill that will be put to a House and Senate vote as early as Tuesday, December 19, even though there is no score from the Congressional Budget Office or analysis from the Joint Committee on Taxation. Here’s the...

Read More »The Republican Party’s Heartlessness–the Casualty Loss Provision of the purported “tax reform” legislation

The Republican Party’s Heartlessness–the Casualty Loss Provision of the purported “tax reform” legislation The GOP is cruising towards passage of its class warfare tax legislation that continues the long trend of Republican tax policy to redistribute upwards to the very rich. The legislation, however, is supported by a small minority of the American public (latest polls put support for the tax legislation at less than 30%). See, e.g., Allan...

Read More »Real wages stagnate YoY, decline significantly since July

Real wages stagnate YoY, decline significantly since July So lackluster has wage growth been that even the modest uptick in consumer inflation to 2.2% YoY in November means that non-managerial workers have seen virtually no real growth in their paychecks over the last 12 months. With yesterday’s +0.4% increase in consumer prices, here’s what YoY real wages look like for non-managers (blue) and all employees including managers (red): All wages...

Read More » Heterodox

Heterodox