Reading Varoufakis: Frustrated Strategist of Greek Financial Deterrence (click here for the original site) by Adam Tooze Adam Tooze holds the Shelby Cullom Davis chair of History at Columbia University and serves as Director of the European Institute. He is currently at work on a history of the global financial crisis 2008-2018, which will appear in time for the anniversary in September 2018. Adults in the Room is a book that anyone interested in modern European politics should read. To say it is the best memoir of the Eurozone crisis is an understatement. It is a devastating indictment of current state of Europe and a fascinating inside account of the logic of reformist politics and its limits and why it

Topics:

Yanis Varoufakis considers the following as important: Adults in the Room, Books, DiEM25, English, European Crisis, Greek crisis, Politics and Economics, Review

This could be interesting, too:

Robert Skidelsky writes A Tale of Frankenstein – Lecture at Bard College

Robert Skidelsky writes In Memory of David P. Calleo – Bologna Conference

Robert Skidelsky writes Keen On Podcast: Episode 2229: Robert Skidelsky worries about the Human Condition in the Age of Artificial Intelligence

Michael Hudson writes Temples of Enterprise

Reading Varoufakis: Frustrated Strategist of Greek Financial Deterrence (click here for the original site)

by Adam Tooze

Adam Tooze holds the Shelby Cullom Davis chair of History at Columbia University and serves as Director of the European Institute. He is currently at work on a history of the global financial crisis 2008-2018, which will appear in time for the anniversary in September 2018.

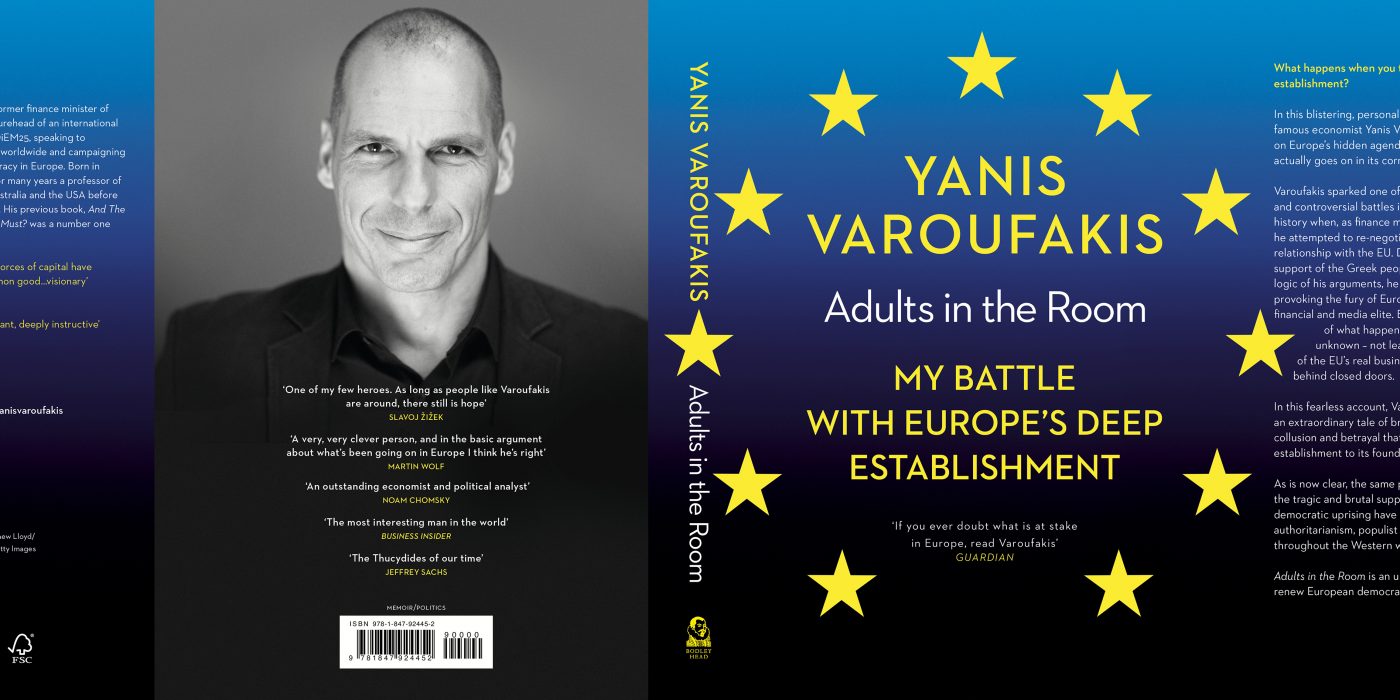

Adults in the Room is a book that anyone interested in modern European politics should read. To say it is the best memoir of the Eurozone crisis is an understatement. It is a devastating indictment of current state of Europe and a fascinating inside account of the logic of reformist politics and its limits and why it keeps going anyway.

It’s a truly complex document for a variety of reasons:

It’s a highly personal even confessional memoir of recent history.

Varoufakis is an intensely self-conscious historical subject.

He has a pronounced aesthetic and writerly self-consciousness. One may argue as to taste.

He has an outsized ego and this was seized on by the world’s media, who made his persona into the target for vast amounts of public comment and criticism. He has reason to feel victimized.

He is also an academic and an intellectual with wide-ranging interests: political theory, social theory and economics.

And he is a political activist with a cause, DiEM25, to promote.

All of these interests and concerns inflect the text. All of them would be worth expanding on at some length. But I’ll focus on three of the more “substantive” aspects of his memoir.

The complex logic of the battle

Despite what at least one of the jacket blurbs suggest, this is not an account of how the “forces of capital have prevailed over the common good”. Varoufakis’s account of the Greek debt crisis of 2015 is not that of a death match between democracy and bond vigilantes. It cannot be simply because by 2015 Greece owed relatively little money to banks, insurance funds or hedge funds. Private debt holders had been repaid, converted or wiped out in the 2012 restructuring. 85 % of Greece’s debts were owed to official agencies and other European governments. Only 15 % was owed to banks and other private investors and Varoufakis started the debt negotiations by reassuring the private creditors that their interests would be protected. The struggle was with the governments of the Eurogroup and the troika “institutions” i.e. EU Commission, ECB, IMF. If this was a battle with “capitalism”, it was a highly mediated one and one in which Varoufakis actually tried to bring the “markets” and their spokespeople over to his side against the recalcitrance of the Eurogroup. Varoufakis’s gamble was to play the logic of the market against the “ideology” of the creditors.

This has a noticeable impact on his account of his dealings with London and Washington, on which more below. It also inflected his dealings with the IMF. The Syriza government resisted the IMF as a member of the troika and sought to curb the overbearing authority of its officials in dealings with elected Greek Ministers. But at the same time Varoufakis and his team tried to win the IMF as a center of macroeconomic expertise and orthodox “best practice” policy over to their side. Since the crucial issue was debt sustainability, Athens played on the Fund’s guilty conscience about the patently unsustainable debt deal the IMF had endorsed in 2010 and then re-endorsed in 2012. In so doing the IMF violated its own internal code of operations laid down after the Argentine debacle that barred lending to insolvent debtors. What Varoufakis wanted above all was for the IMF to announce that it was finally going to stick to its guns and to refuse any participation in a debt deal that was not sustainable, i.e. one that did not offer dramatic debt reduction. He was to be disappointed.

Varoufakis’s position, in the terms of Geoff Mann’s recent book, is the quintessence of Keynesian liberalism – and I say that approvingly. For Varoufakis the Greek debt crisis by 2015 was essentially unnecessary. It was, in Keynes’s terms, “a muddle” that clear-headed people of good will ought to be able to resolve, provided they have the right kind of leadership and are willing to make “brave”, “honorable” and “honest” political sacrifices.

In the Varoufakis account, the “muddle” starts with the panic-stricken reaction of European politicians to the recurrence in Greece in 2010 of the bank-debt crisis, which they thought they had put to bed in 2008-2009. The “muddle” arises because for reasons of political expediency, the politicians decided in May 2010 to hide their second rescue of the French and German banks by disguising it as “assistance for Greece”. Why? This was convenient for the banks, of course. But that was not the main reason. The main reason was that the politicians feared being punished by the electorate if they had to ask parliaments to endorse another round of direct assistance for the banks, which would have been necessary if the Greek debt had been immediately written down. So, instead, they asked for funds for Greece, which were then paid to the banks in various more or less direct ways. The result was that Greece ended up owing more not less money and owing it not to banks but to governments and tax-payers.

Once the baneful 2010 Greek program was put in place there was no going back. The narrative was set. The political investments were made. It was incredibly difficult to get to the 2012 the debt restructuring. It was predictable that it would be inadequate. What it did, was not so much to cut Greece’s debts to manageable levels, as to complete the substitution of public funds for private lending.

Once the troika structure was established in 2010, another logic came into play. This too was a logic of “power” or “technocracy”, but not capital in any obvious sense. The troika built an apparatus of control with which to oversee and discipline the debtors. That apparatus and its apparatchiks began to take on a life of their own. Much of the fury that animated Syriza and Varoufakis in 2015 was directed at the humiliating cavalcades of unelected technocrats who descended on Athens in their “convoys of Mercedes-Benzes and BMWs”. In Varoufakis’s kind of leftism, questions of recognition, of sovereignty, dignity and equality are key. Poverty is grinding, but above all it is humiliating. The troika operated in Greece not a productive colony that it was exploiting, but a prison from which Syriza must lead the escape.

Beyond the self-serving logic of a bureaucracy bent on preserving its own authority and control, beyond the need of politicians to cover their tracks, what purpose does this apparatus serve? This is less clear. For Varoufakis, after all, the troika program makes no economic sense. On his “Keynesian” reading, everyone is worse off as a result of austerity. Greek oligarchs may have been relatively well protected. But they can hardly have been said to have profited from austerity. Greece’s banks were bailed out but they were kept on a drip. Varoufakis does not claim that the interests of the German economy were best served by the ruinous policy, though it was certainly convenient for some of its banks in the short-run. The main function of disciplining Greece, Varoufakis tells us, was to serve as a warning to the French of the price of fiscal indiscipline. In other words its purpose was to perpetuate and widen discipline. But that in turn was not so much an economic as a political problem. Berlin wanted to avoid the terrifyingly difficult distributional politics of even larger scale exercises in cross border bail outs and “transfers”. Holding the line in Greece was a way of containing what could have become a spiraling political disaster for the CDU and their coalition partners. The specific economic interests that this strategy served or the wider macroeconomic rationale is not spelled out. And it is indeed obscure. Varoufakis and any other reasonable economist must clearly conclude that Europe as a whole, including Germany, would be more prosperous under a regime that was more expansive all around. If it took a short, sharp debt cut in 2010, 2011, 2012 or whenever else, to get there, so be it. Only once in passing does Varoufakis point to a larger strategic rationale. In one conversation with Schäuble, the German Finance Minister revealed a morbid fascination with the pressures of globalization and the necessary adjustments Europe must make to its welfare state. As wee know, this is also a preoccupation shared by Chancellor Merkel. But with this vision in mind, Greece is once again a means to an end. It is the first country in which a comprehensive rollback of the European welfare state will be put into effect.

Whether this elaborate construction is a fully convincing characterization of the crisis is a question for another time. But it is this characterization, which allows Varoufakis to position himself as the clear-eyed surgeon, whose decisive intervention will resolve the conflict. Insolvency will be acknowledged. Greece will find a way out of its disastrous economic impasse. Greece’s humanitarian crisis will be relieved. But the stakes go beyond the social crisis. In a more general sense Europe’s reputation, “European civilization” will be restored – dignity, honesty, the value of ancient civilizations etc. One could hardly ask for a more classic instance of what are, in Mann’s term, the deep preoccupations of “Keynesianism”.

The insanity of the Europe’s deep establishment

Varoufakis does not stop at this general characterization of “the muddle”. It is never a good idea to look inside a sausage factory. But Varoufakis’s account of the operations of EU “decision-making” is truly shocking. He delivers a truly shocking anatomy of an apparatus bent on perpetuating its own bad logic and excluding alternatives.

The Kafkaesque absurdities of the Brussels process occupy the bulk of the book. But in a few brilliant pages Varoufakis helpfully breaks down the basic obstructionist tactics used against Syriza:

(1) The Eurozone runaround: In the Eurogroup meetings of the member states, the Germans have the upper hand. When you talk to Schäuble he refers you to the “institutions”. When you talk to the Commission, the lead EU institution, they nod and smile and then in the Eurogroup they are overruled by the nation states under the influence of Germany … and you are back to square one.

(2) Constructive proposals are simply met with silence. In the Eurogroup in particular it is a breach of protocol either to table specific proposals or to circulate them by email since this would require parliaments to be notified which would require them to be discussed. So the aim of the meeting is simply to draft a communique … of the meeting.

(3) External requests for data became a method not just of asserting control but of endlessly deferring a decision.

(4) Truth reversal – under which the Greeks were accused of time wasting whilst the troika and Eurogroup insisted on the need for a “comprehensive” solution that actually excluded the single question that was most fundamental i.e. debt restructuring.

(5) Blaming the victim: in which the ECB banned Greek banks from buying treasury bills because they were unsafe, and the bills traded at a large discount because the markets were unsettled by advanced warning that the ECB intended to strictly apply rules which it had otherwise been willing to bend.

(6) Demanding that Greece explore all possible avenues for reform, privatization and foreign investment, whilst applying pressure behind the scenes to ensure that potential outside investors such as the Chinese remained away.

It is a one sided account, no doubt, but illuminating as to how the agonizing process appeared to Athens.

Varoufakis is at pains, throughout, to stress his own desire to pursue a rational solution. He was not a Syriza insider and he describes himself as determined to overcome “archaic” and “boorish” leftism within the party. He stresses throughout his deep agreement with Schäuble. But this resulted in its own ridiculous spiral, in which Varoufakis sees both Greece and Germany as being caught.

Schäuble and Varoufakis agreed that Greece was insolvent. They neither of them wanted to go on pretending. But neither Varoufakis nor Schäuble had the mandate to negotiate a restructuring and/or Grexit. Furthermore, the position of both their principals, Tsipras and Merkel respectively, was unclear. Furthermore, Schäuble did not want to put Merkel in a position where she had to suggest Grexit to Tsipras, because Athens would leak this to the press and use it against Germany. So Schäuble briefed Varoufakis to tell Tsipras to open the door, by asking Merkel to deny rumors that Schäuble favored Grexit. On that basis they could then start a conversation without either the Chancellor or the Prime Minister having initiated it. But the ploy did not work. Merkel did not want to discuss Schäuble’s proposal. So when Tsipras brought him up, Merkel shut the conversation down, leaving Schäuble and Varoufakis in the lurch. In the end, for Varoufakis, Schäuble emerges as a tragic figure, caught in a political logic that denies the logic of his position and ultimately produces one pseudo-solution after another.

Against the craziness of the inner workings of the EU, it is striking how positively Varoufakis characterizes his interactions with the Anglophone world. His closest advisors are Americans, Jamie Galbraith and Jeff Sachs. The book starts with a Chandleresque description of an encounter with Larry Summers, who Varoufakis is at pains to present as a skeptical but benevolent mentor to the Syriza government. Would it have been “boorish” or “archaic” to recognize Summers for what he is? Varoufakis’s tastes are truly catholic. Britain’s Tory chancellor of the 1990s Norman Lamont is a friend. Varoufakis enjoyed chummy conversations with George Osborne. These judgements reflect Varoufakis’s personal tastes. But they are also an effect of the structure of his argument and narrative. Europe is caught in a tragic mechanism that blinds it to its own contradictions. Those not caught in the EU’s impasse – outsiders like British and American economists – can see more clearly, are able to imagine how to break the impasse and are thus able to sympathize with Varoufakis. In the background lurks Varoufakis’s belief in the need for a hegemon. Unfortunately, what Varoufakis seriously underestimates is the complicity of the Obama administration and the Geithner Treasury in the construction of the “prison” from which Syriza was trying to escape. In 2010 the Obama administration was determined that there should be no European “Lehman moment”. Washington ruled out restructuring and pushed the IMF into going alone with the botched first bail out. What Varoufakis is reluctant to acknowledge is that Europe’s “extend and pretend” was made in Washington as well as in Brussels, Paris and Frankfurt.

Breaking the deadlock

For Varoufakis the impasse that Greece was in in 2015 was basically a balance of force. If Athens was to escape it needed to shift the balance and it had to devise a strategy to do so. How Varoufakis proposed to do this is the real revelation of the book. It is a bit of a bombshell and it is surprising that its implications have so far not been more widely commented on.

The common view of Varoufakis and the kindest, was that he was an academic and intellectual who was out of his depth. He was a man who took the knife of logic and sweet reason to a gunfight. What the book reveals, or at least is at pains to make us believe, is that Varoufakis fully understood the power play he was caught in, but was prevented from revealing his own heavy weaponry by the divisions within the Syriza government and Tsipras’s slide into collaboration.

The part of Varoufakis’s arsenal that did become common knowledge was the secret plan to prepare a new currency system that would replace the Euro if it came to a “rupture”. This earned him accusations of treachery. But the parallel currency plan was really just a measure of self-defense and functional necessity. The far more dangerous weapon, was the one that Varoufakis proposed to direct against the ECB.

The ECB was key because it controlled the funding of the Greek banks. The banks were the core of the Greek oligarchy but they were also functionally essential for Greek economy and society. The ECB could shut them down. It would act through its local representative, the head of the Greek national bank Stournaras. Varoufakis is convinced that even as New Democracy’s grip on power waned in 2014, a holding position was being prepared involving the insertion of Stournaras as the conservative head of the Greek central bank, where he remains today. But the ECB’s lock grip went beyond control over the Greek banking system. It extended to the Euro area as a whole.

Three days before Syriza was elected in January 2015 Draghi announced a new policy of Quantitative Easing for the Eurozone. This was a measure of last resort against deflation in the Eurozone. But as a side effect it fundamentally altered the balance in the battle with Syriza. By buying the bonds of the other “peripheral” Eurozone countries, the ECB stabilized their debt markets and immunized them against contagion from Greece. QE had been hugely unpopular with conservatives and most notably in Germany. But it was behind the shield of Draghi’s QE that they were able to lay siege to Athens without fear of greater destabilization. They could prioritize the fight against political contagion without having to worry about the financial kind.

How could the Syriza government respond? Was there any way of piercing the QE shield? Greece was not included in the buying program. It could not stop Draghi. The response that Varoufakis’s devised was truly Machiavellian. The Greeks should exploit the divisions amongst their opponents. In particular they should drive a wedge between Draghi, who was trying to make the Eurozone work, and the German conservatives who both opposed QE and wanted to drive Greece out. When bond buying was proposed Draghi had faced legal challenges in Germany. The German constitutional court in February 2014 had referred the case to the European Court of Justice, which had given Draghi a waiver, but on conditions. The way for Greece to blow QE up was to trigger those conditions. What Varoufakis proposed was that Athens should default unilaterally on the Greek bonds that the ECB had purchased in 2010 and 2011 and that the ECB still held. They had not been written down like the rest in 2012. They were under Greek law. Their face value was c. $ 33 bn. If Greece imposed a haircut on those bonds, it would inflict a painful loss on the ECB. That would force it to reevaluate its entire portfolio of Eurozone sovereign bonds and it would throw the door open to a new legal challenge against QE from the right-wing in Germany. Greece would throw a spanner in the works.

Oddly, as far as I can see, none of the reviews to date have noted the significance of this extraordinary plan. Of course, people worried at the time about a disorderly Grexit. But the discussion was couched in terms of general contagion, of which there was in fact little risk, so long as bond buying continued. I have read pretty widely in the newspaper coverage of the period, but I have seen no references to any targeted attack on the political and legal underpinnings of Draghi’s QE. Paul Mason, who was close to Varoufakis and Syriza, referred to the basic idea in one of his reports as the “nuclear button”. But he did not spell out its implications for the wider Eurozone or the way in which it was directed at sabotaging QE. If anyone can point me to references to this plan, I would be most grateful.

In any case, it was ingenious. It was potentially very powerful. It refutes the idea that Varoufakis was naïve. The revelation of this “Greek deterrent” seemed almost too convenient, too precisely calculated to rebut the main criticism leveled at Varoufakis. Was it a retrospective construction? Varoufakis tells us that he warned both Coeuré and Draghi about this plan and both reacted with alarm. I have made enquiries with well-informed sources close to Varoufakis and they confirmed to me that Varoufakis did indeed have the “legal authority” to default on the Greek bonds held by the ECB. “(T)he order was drafted”, but the faction within the Tsipras cabinet that wanted to avoid a break was too strong. Varoufakis was never allowed to make the critical threat at the right moment. Greece was driven to a humiliating compromise without ever having deployed its deterrent.

It was a dramatic plan. But what is striking is that Varoufakis nowhere discusses the likely repercussions of his strategy for the other stressed peripheral borrowers. As far as Portugal, Spain and Italy were concerned the Greek threat carried very real risks. Indeed, the entire point of Varoufakis’s proposal would have been to put them in jeopardy, thereby forcing Draghi and the Germans to back off. How this would have worked out politically, what consequences it might have had for the left in Portugal and Spain, are not questions that Varoufakis takes up.

Mason’s talk of the nuclear option is not wrong. But given Greece’s subordinate position, the threat would seem to be more akin to a “dirty bomb” than an ICBM. Varoufakis was proposing a way to unhinge QE from within, of heightening the political and legal contradictions within the Eurozone. Though the Tsipras government shrank from exercising the option, Varoufakis’s proposal lays out an escalatory logic internal to the Eurozone crisis, by which the politicization of economic policy might take on ever more radical, comprehensive and transnational forms.