March 2018 personal income and spending Programming note: I’ve been working on a mega-post about housing, that is now complete except for a few graphs. So, please excuse the brevity otherwise. March 2018 real personal income and spending were both positive. So far, so good. The personal saving rate fell slightly: Again, this is consistent with a late cycle dynamic where consumers are more stretched than they were earlier in the expansion. Real personal spending continues to outstrip real retail sales (quarterly to reduce noise, through Q1 in the graph below): This is also a typical late cycle dynamic (a relationship that holds for 10 of the last 11 expansions). But since neither shows signs of significant declines, there is no imminent danger of a

Topics:

NewDealdemocrat considers the following as important: politics, Taxes/regulation, US/Global Economics

This could be interesting, too:

Robert Skidelsky writes Lord Skidelsky to ask His Majesty’s Government what is their policy with regard to the Ukraine war following the new policy of the government of the United States of America.

Joel Eissenberg writes No Invading Allies Act

Ken Melvin writes A Developed Taste

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

March 2018 personal income and spending

Programming note: I’ve been working on a mega-post about housing, that is now complete except for a few graphs. So, please excuse the brevity otherwise.

March 2018 real personal income and spending were both positive. So far, so good.

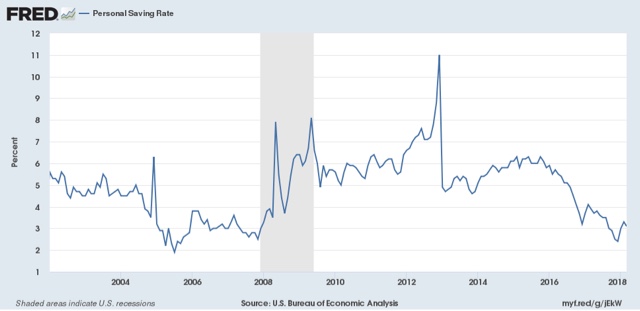

The personal saving rate fell slightly:

Again, this is consistent with a late cycle dynamic where consumers are more stretched than they were earlier in the expansion.

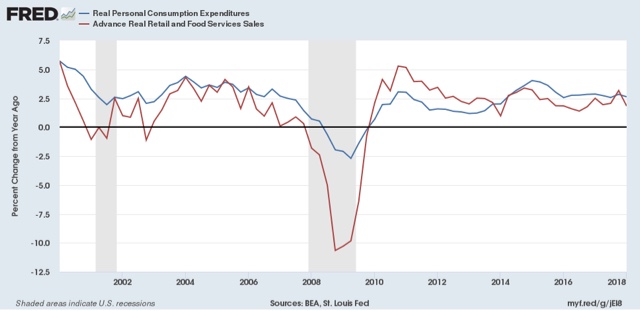

Real personal spending continues to outstrip real retail sales (quarterly to reduce noise, through Q1 in the graph below):

This is also a typical late cycle dynamic (a relationship that holds for 10 of the last 11 expansions). But since neither shows signs of significant declines, there is no imminent danger of a downturn.

As has been the case for the last several years.