Summary:

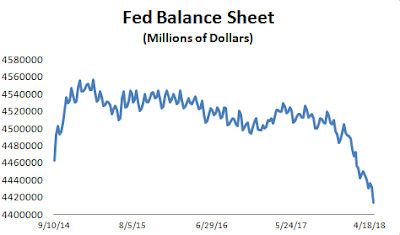

Mike sent this chart out to his subscribers this week; bringing attention to a recent acceleration in the rate at which the Fed seems to be reducing Reserve Balances: This would seem to be confirmed by the statements of the Fed's Quarles on Friday here: The figure illustrates that the Fed's securities holdings are projected to decline about 0 billion this year and another 0 billion next year as Treasury and agency securities continue to roll off gradually from the Fed's portfolio. So 0B at an annual rate is about B/month which is faster than what they have been doing since they started to reduce in October which has been about B/month.

Topics:

Mike Norman considers the following as important:

This could be interesting, too:

Mike sent this chart out to his subscribers this week; bringing attention to a recent acceleration in the rate at which the Fed seems to be reducing Reserve Balances: This would seem to be confirmed by the statements of the Fed's Quarles on Friday here: The figure illustrates that the Fed's securities holdings are projected to decline about 0 billion this year and another 0 billion next year as Treasury and agency securities continue to roll off gradually from the Fed's portfolio. So 0B at an annual rate is about B/month which is faster than what they have been doing since they started to reduce in October which has been about B/month.

Topics:

Mike Norman considers the following as important:

This could be interesting, too:

Robert Vienneau writes Austrian Capital Theory And Triple-Switching In The Corn-Tractor Model

Mike Norman writes The Accursed Tariffs — NeilW

Mike Norman writes IRS has agreed to share migrants’ tax information with ICE

Mike Norman writes Trump’s “Liberation Day”: Another PR Gag, or Global Reorientation Turning Point? — Simplicius

Mike sent this chart out to his subscribers this week; bringing attention to a recent acceleration in the rate at which the Fed seems to be reducing Reserve Balances:

This would seem to be confirmed by the statements of the Fed's Quarles on Friday here:

The figure illustrates that the Fed's securities holdings are projected to decline about $400 billion this year and another $460 billion next year as Treasury and agency securities continue to roll off gradually from the Fed's portfolio.

So $400B at an annual rate is about $33B/month which is faster than what they have been doing since they started to reduce in October which has been about $12B/month.