Real retail sales update for April 2018 It’s a slow start of the week, so let’s catch up on one of my favorite indicators, real retail sales, which were reported last week. First of all, adjusted for population, real retail sales have peaked a year or more in advance of each of the last two recessions. That hasn’t happened yet, as the long term rising trend is intact, even if sales have backed off their wintertime highs. If they go longer than 6 months without making a new high, then it would be a signal for caution. But we’re not there yet. Also, in the short term consumption leads hiring, so let’s update that comparison (these are YoY% changes): This suggests that there should not be any significant weakness in the job market in the next few

Topics:

NewDealdemocrat considers the following as important: US/Global Economics

This could be interesting, too:

Joel Eissenberg writes How Tesla makes money

Angry Bear writes True pricing: effects on competition

Angry Bear writes The paradox of economic competition

Angry Bear writes USMAC Exempts Certain Items Coming out of Mexico and Canada

Real retail sales update for April 2018

It’s a slow start of the week, so let’s catch up on one of my favorite indicators, real retail sales, which were reported last week.

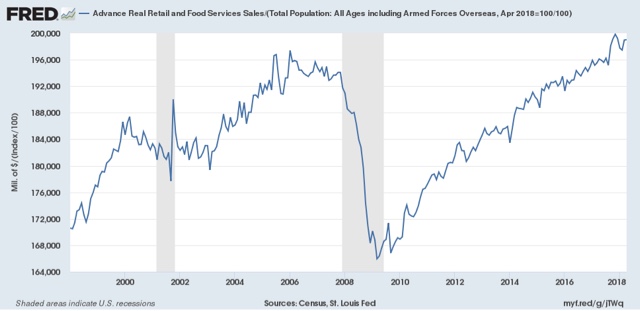

First of all, adjusted for population, real retail sales have peaked a year or more in advance of each of the last two recessions. That hasn’t happened yet, as the long term rising trend is intact, even if sales have backed off their wintertime highs.

If they go longer than 6 months without making a new high, then it would be a signal for caution. But we’re not there yet.

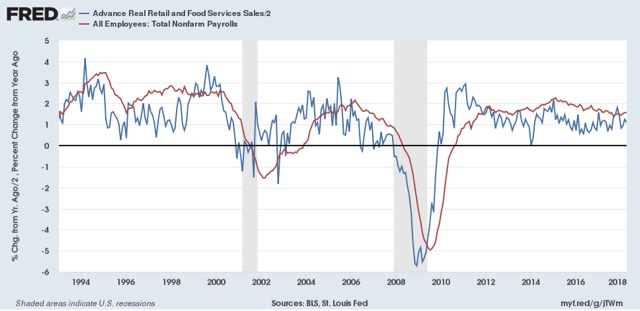

Also, in the short term consumption leads hiring, so let’s update that comparison (these are YoY% changes):

This suggests that there should not be any significant weakness in the job market in the next few months.

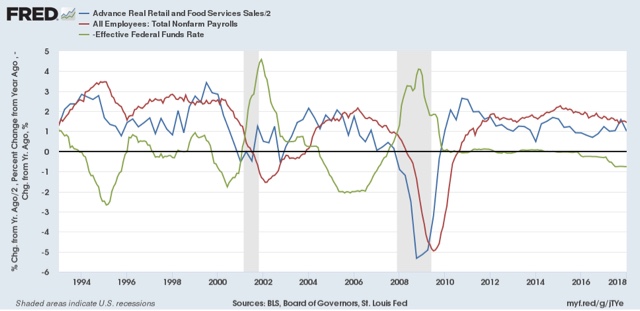

Finally, since I’ve recently noted that the YoY change in the Fed funds rate has a good track record of forecasting the YoY% change in jobs 12-24 months out, let’s add that (green) into the mix:

I don’t think we’ll see a significant downturn in jobs until real retail sales growth decelerates to about half its current YoY rate.