The WASPIs are angry again. About the New State Pension, this time. Apparently it is unfair to women, especially those born in the 1950s.Paul Lewis, in the BBC's Money Box email (h/t Annie Shaw), lists six problems: 1. Women born 6 April 1951 to 5 April 1953 all reach state pension age before the new state pension begins. So they won’t get the new state pension while men of the same age – who will be 65 when it begins – will. That is sex discrimination and they want the choice to have new or old. 2. Women born 6 April 1953 to 5 April 1959 were told about their state pension age rise just a couple of years before they were 60 and their age was raised not once but twice. That didn’t happen to any men. 3. Women will generally do less well than men out of the new state pension. Even by the 2050s one in seven women won’t get the full amount because they don’t have 35 years’ contributions compared with one in ten men. It is also expected that more women than men will not get a pension at all because they won’t get the minimum ten years’ contributions. 4. The new state pension will not allow women to claim a pension on their husband’s contributions either while he is alive or after his death. If they have an inadequate pension of their own they will have to rely on means-tested pension credit which is itself being cut by up to £13 a week. 5.

Topics:

Frances Coppola considers the following as important: pensions

This could be interesting, too:

Nick Falvo writes Homelessness among older persons

Frances Coppola writes We need to talk about the state pension

Frances Coppola writes Statistics for state pension age campaigners

Frances Coppola writes Statistics for state pension age campaigners

Paul Lewis, in the BBC's Money Box email (h/t Annie Shaw), lists six problems:

1. Women born 6 April 1951 to 5 April 1953 all reach state pension age before the new state pension begins. So they won’t get the new state pension while men of the same age – who will be 65 when it begins – will. That is sex discrimination and they want the choice to have new or old.

2. Women born 6 April 1953 to 5 April 1959 were told about their state pension age rise just a couple of years before they were 60 and their age was raised not once but twice. That didn’t happen to any men.

3. Women will generally do less well than men out of the new state pension. Even by the 2050s one in seven women won’t get the full amount because they don’t have 35 years’ contributions compared with one in ten men. It is also expected that more women than men will not get a pension at all because they won’t get the minimum ten years’ contributions.

4. The new state pension will not allow women to claim a pension on their husband’s contributions either while he is alive or after his death. If they have an inadequate pension of their own they will have to rely on means-tested pension credit which is itself being cut by up to £13 a week.

5. Transitional rules cut back on the new State Pension for anyone who was not paying into SERPS and the State Second Pension which topped up the basic pension. As a result many will get little more than the old state pension in the first years of the new scheme. DWP figures show women are more likely to be affected than men.

Let's dissect each of these in turn.6. And finally the cold-towel-round-head rules which affect people who were in company schemes. Under these rules the DWP will no longer inflation-proof part of their company scheme through the state pension. This rule will probably affect men more than women.

Firstly, the claim that denying the new SP to women born April 1951-March 1953 is sex discrimination. This may be strictly correct, but it is a very dangerous argument. The reason why these women will not qualify for the new SP is that they will retire earlier than men of the same age. Putting it another way, the reason why men born April 1951-March 1953 will qualify for the new SP is that they will retire later than women of the same age. If denying the new SP to these women is sex discrimination, then forcing these men to retire later than women of the same age is surely also sex discrimination. If women of this age were granted their demand of a choice between old and new SP, then men of the same age should have the same choice - but they can't, because they retire too late. So men perhaps should demand compensation for the fact that they have to retire later than women of the same age and therefore can't remain on the old pension scheme even if it is better for them, which for a significant proportion of them it will be (see Telegraph chart below). If I were the WASPIs I would keep VERY quiet about this. The last thing that they want is to open the floodgates to claims from men, surely?

Secondly, this matter of late notice of pension age rises to women born between April 1954 and March 1959. This does not not really stack up as a new State Pension problem, but I will discuss it here anyway.

While I can understand that women might be angry that their pension age has been raised twice, it is incorrect to suggest that this is limited to women born in the 1950s. Women born from 1960 to 1974 have also had their pension age raised twice. Men have had it raised once, but then they were retiring later anyway. There are further rises to come - are we going to face complaints EVERY time the pension age is raised?

The fact is that no woman affected by the 1995 changes was formally notified of the increase in her pension age until 2009, and most - especially the younger ones - still have not been notified. That is every woman born between April 1951 and March 1974. The WASPI argue that women born 1954-59 should be compensated because they had less than the 10 years' notice that the government has now decided should be given for pension age changes. But women born 1960-65 have also had less than 10 years notice, and unless the DWP gets a move on with notifications, the rest will also have insufficient notice. If women born 1954-59 qualify for compensation on grounds of late notice, therefore, so do a good many younger women.

But I don't think this claim is legitimate. The fact is that until recently there has been NO specified notice period for changes to the pension age. The government is not bound to backdate its decisions. There is therefore no legal justification for rolling back the state pension age to 60 for any of these women on the grounds of late notice. If women were incorrectly told that they would retire at 60 on a state pension, they would potentially have a claim for negligence against whoever gave them that information - which could include employers and private pension providers. But if they just assumed they would retire at 60, and made no effort to check their entitlement, then it is difficult to see that they have any legal grounds for compensation. More importantly, compensating these women across the board would in effect create a six-year cliff edge for women born after April 1959, which would be grossly unfair. The whole point of the original transition period was to avoid this cliff edge.

Women born April 1953-March 1955 were affected by the sharper transition to the harmonised retirement age imposed in 2011: some of them may have a case for transitional relief if they are facing hardship. But their hardship really arises from the inadequacy of JSA and ESA. The money would be better spent on uprating these benefits, which have been subjected to harsh cuts and conditionality over the last few years. After all, if women in their early 60s who are sick, disabled or unemployed can't live on these benefits, neither can anyone else. And if they are left destitute because they don't qualify for any of them, that too is a problem also experienced by younger people and by men.

There is a sex discrimination issue here, too. Currently, a man born between April 1951 and March 1959 who loses his job has to claim JSA, even though he is close to retirement. But a woman of the same age apparently thinks it is an "indignity" that she should have to claim JSA instead of receiving a pension, and demands reinstatement of her pension rights. If granted, this would be sex discrimination against men. Again, the WASPIs really need to tread carefully around sex discrimination matters.

Thirdly, the contributions problem. Under the new SP, a full pension requires 35 years of contributions, and to claim a pension AT ALL requires 10 years. This in my view is a major scandal in the making. No way has any woman older than about 40 had sufficient notice to build up her contributions. The problem is certainly not limited to women born in the 1950s. Indeed, it is not limited to women at all: some men will also fail to qualify for a full pension under the new rules.

The DWP has graciously provided a means for those who have a shortfall, and reach pension age after 2017, to top up their contributions. But not everyone will have sufficient income to do this. As has happened all too often in recent years, changes in benefit entitlements (legally, the state pension is a benefit) hit the poorest the most.

It is distinctly unhelpful of the WASPIs to claim this as "their" problem when it is in fact a problem for a much larger number of people. This issue needs a completely different campaign. It would be a campaign I would wholeheartedly support. HMTs cost-cutting imperative has severely damaged the pension prospects for a lot of people. It is a disgrace.

Fourthly, the ending of the right to a spouse's pension. This was always bound to affect far more women than men. This does not only affect women born in the 1950s: many women born long after that will have expected to benefit from their husbands' pension rights. In combination with the contributions problem, this will result in a large number of women receiving less than full pensions. In principle it is a good idea - after all, many women don't have husbands whose pension rights they can claim, and it is unfair that married women should in effect have pension rights greater than those of their unmarried or divorced sisters. But the transition will be painful.

Is it unfair? Yes, because many women will not have time to build up contributions to compensate for the loss of their spouse's pension rights. Should there be transitional relief for women born in the 1950s? No. Transitional relief is needed for any woman who will have insufficient time or income to make up the contributions shortfall caused by this and the contributions increase - which will include a large number of women born in the 1960s. There will of course also be a small number of men affected by this change too. So this is not a WASPI problem. Again, it needs a completely different campaign.

Fifthly, the cutback of pension entitlement for those contracted out of SERPs and/or the State Second Pension. This affects people who paid lower NI contributions because they were members of contracted-out defined benefit workplace pension schemes. Because they paid lower NI contributions, the transitional arrangements for the new State Pension cut back their entitlement to the level they would have received under the old pension. However, they will of course receive corporate pensions in addition to their state pension - after all, that was why they were paying lower NI contributions in the first place.

Once again, this problem is not limited to women, let alone to those born in the 1950s. The fact that more women appear to be involved than men I suspect is due to higher female employment in the public sector, where contracted-out defined benefit pensions were more common and continued for longer than they did in the private sector.

However, really this is a non-problem. Under the old scheme, these people would have received less than people who had not been contracted out. There seems no reason at all why this reduction should be eliminated under the new scheme. After all, they will in total receive at least as much as the new state pension and probably more. So I would not support any campaign to compensate these people, men or women. (And before you ask, yes, I am one of them).

Finally, the ending of inflation-proofing for corporate pension holders. This was long overdue and a very sensible reform. But no doubt there will be complaints, principally from men. That makes a change.

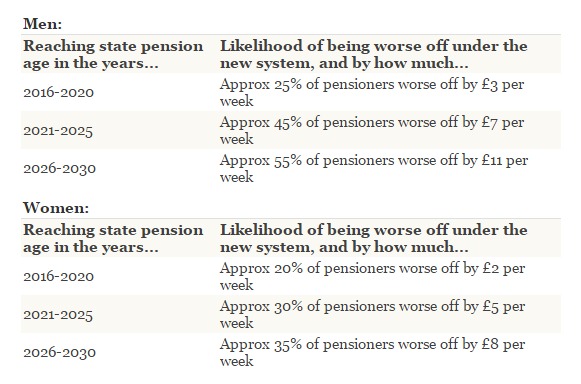

Paul's analysis suggests that women, particularly older ones, do worse out of the new SP than men. But I fear that his sympathy for the WASPI cause has blinded him to reality. The Telegraph, drawing on analysis from the DWP, paints a very different picture. Here is the Telegraph's handy table showing who are the biggest losers:

So although some groups of women are worse off under the new SP, the picture for men in general is very much worse. Moreover, it is clear that the biggest losers are younger people, both men and women. Men born 1961-65 fare particularly badly, with over half of them losing up to £11 a week: slightly older men also do quite badly. Women born in the 1950s fare better than anyone. Why is Paul focusing on them?By incorporating the problems that the new scheme causes for some older women into a campaign that is about a completely different matter, we risk missing the real issue. The new State Pension was a good idea in principle, but the way it is implemented in practice will cause hardship for a very large number of people for a long time to come. And it is all because of HMT penny-pinching, and a Chancellor who is making a political career out of hurting the poor and the vulnerable.

Related reading:

Impact of new SP on an individual's Pension Entitlement - first 15 years - DWP

Research shows most will be worst off under new Single Tier pension - Hymans Robertson

The angry WASPIs