In my last post, I debunked the myth of the "reserve pool" of British workers. In this post, I discuss three more labour force myths that refuse to die: the myth of the "tide of unskilled immigration"the myth of the falling participation rate, and the myth of the "workless yoof". There’s also an update about my charity walk in the Lake District last Saturday, and a couple of pics. Read the post here. It’s free to read.

Read More »Articles by Frances Coppola

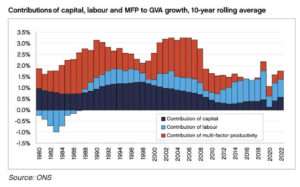

Why the Tories’ “put people to work” growth strategy has failed

June 4, 2024What do you do when your economy is in the doldrums and you need to kickstart growth?Why, you put more people to work, that’s what you do.This has been the Tories’ strategy since 2010. The sustained attack on welfare benefits has all been focused on “making work pay” – encouraging, and at the margin forcing, people with illnesses, disabilities and caring responsibilities into paid work. But there is another way of putting more people to work, and that is to import them. In a new report, the centre-right CPS thinktank says that importing people to kickstart growth has been the unspoken strategy of successive governments since 1997. And it argues that the strategy has manifestly failed. In my latest Substack piece, I examine the reasons the report advances for this failure, and conclude

Read More »Demons deserve our sympathy

May 14, 2024My latest Coppola Comment post reflects on what we mean by "demons". Are they really the evil spirits of myth? Or are they a metaphor for something else – something all too human, and for many people, all too familiar?I spent last Saturday singing Elgar’s Dream of Gerontius. There’s a famous “Demon’s Chorus” in this piece, which made me think… well, about the demons. I felt sorry for them. Seriously.

In the Dream of Gerontius, demons are an auditory representation of mindless evil and cruelty. The Soul doesn’t hear them until after death, but of course mindless evil and cruelty exist in life too, so they must have been present throughout its earthly life. Perhaps it encountered them a few times but didn’t realise what they were. Or perhaps it never went to places where demons hang out.

Trade lunacy is back

April 30, 2024It’s election season in the U.S., marred only by the minor complication of a criminal trial involving one of the candidates. Trump is on the campaign trail, and he is going big on trade policy. Or rather, trade lunacy.Here’s Gavin Bade at Politico attempting to explain Trump’s trade policy: Trump is considering a 10 percent universal import tariff, the former administration officials said, and one result of that policy could be to make the dollar weaker relative to other currencies. This is economic illiteracy of a kind I haven’t seen since the heady days of Brexit. Or – more accurately – since the last time one Robert Lightizer was the United States trade representative. He is, once again, setting Trump’s trade agenda. And he appears to be no better informed than he was last time.

Why

Read More »The West must no longer tolerate Israel’s human rights breaches

April 8, 2024My latest post at Substack examines the state of play in Gaza after six months of war. Fair to say, it is truly horrible. But more importantly, there is now overwhelming evidence that Israel has deliberately and systematically violated international humanitarian law. These violations could amount to genocide.On 28th March, the International Court of Justice decided that the situation in Gaza had significantly worsened since its original order in January imposing six "provisional measures" that Israel must take to prevent the situation worsening. The Court imposed, in additional to the original six, a further two measures, specifically requiring Israel to admit sufficient humanitarian aid to ward off famine and prevent its army interfering with the distribution of that aid. These measures

Read More »Is Gaza starving?

March 20, 2024“Over one million people in Gaza are starving,” proclaims a dramatic headline in the Wall Street Journal. Citing a new report from the International Food Security Phase Classification (IPC), a partnership of 15 international agencies and non-government organisations, the Journal goes on to say: More than a million people in the Gaza Strip, around half of the enclave’s population, are experiencing famine-like conditions, according to new estimates by food-insecurity experts who found evidence of widespread starvation and a sharp increase in child mortality in the war-ravaged enclave. I expected this figure to be disputed. Both sides in this conflict inflate (or deflate) statistics when it suits them, and each side accuses the other of manipulating the numbers. So Israel’s supporters would

Read More »We need to talk about the state pension

March 20, 2024My post-Budget article for the Radix thinktank considers the future of the State Pension in the light of the Chancellor’s changes to National Insurance. The headline news in the Budget was a 2p cut in the main rate of National Insurance contributions for employed and self-employed people. This was the second such cut, the first being in the Autumn statement. And the Chancellor expressed an intention to go much further. He trailed the idea of abolishing personal National Insurance completely. These changes will have far-reaching implications for the state pension… To read the rest of the post, click here. Related reading:The Fund that isn’t a fund

Read More »The tragedy of Gaza

February 20, 2024Dear friends, I said I wouldn’t post any more on this site. But Elon Musk doesn’t like me posting Substack links on Twitter. And Substack itself is a mess. The home page looks amateurish, and new posts don’t even appear on it until they’ve amassed enough views to push down previous posts. It’s an absurd way of organising a site. So I have decided in future to post links to my Substack posts here. Hopefully this will mean you can find them more easily, both on Google and Twitter. Some of my Substack posts have paywalls, but you will have the option to subscribe or opt for a free trial. Here’s the introduction to my latest Substack post, The Tragedy of Gaza. Click the link to read all of it. It is free to read.The Palestinian economy is enduring a fiscal crisis and the economic outlook is

Read More »Sunset

May 10, 2023Dear friends, this is my last post on this site. Coppola Comment has moved to Substack. You can find the new site here. Why the move? Well, Blogger has become increasingly difficult to use. The code generator is buggy and I constantly have to mess around with the HTML to make posts look half decent. I don’t have the time for this nonsense. I just need a nice straightforward CMS that doesn’t make my life difficult. Also, those of you who subscribed by email will know that for some time now you have not been receiving email notifications. This is because Google turned off Feedburner. Google helpfully said I could download the email list and do notifications myself using something like mailchimp, but I don’t have the time for this, either. I want a platform that manages my subscribers and

Read More »A fractional reserve crisis

April 16, 2023This is a slightly amended version of a keynote speech I gave on 14th April 2023 at the University of Ghent, for the Workshop on Fintech 2023.

The crisis that has engulfed crypto in the last year is a crisis of fractional reserve banking. Silvergate Bank and Signature Bank NY were fractional reserve banks. So too were Celsius Network, Voyager, BlockFi, Babel Finance and FTX. And still standing are the crypto fractional reserve banks Coinbase, Gemini, Binance, Nexo, MakerDAO, Tether, Circle, and, I would argue, every one of the DeFi staking pools. All of these are doing some variety of fractional reserve banking. Custodia Bank and Kraken Finance claim to be full-reserve banks – but 100% reserve backing for deposits is both hard to prove and not a guarantee of safety.

What do I mean by

Read More »What really happened to Signature Bank NY?

March 29, 2023As the world reeled in shock at the sudden collapse of Silicon Valley Bank (SVB), another bank quietly went under. On Sunday 12th March, the U.S. Treasury, Federal Reserve and FDIC announced that all SVB depositors, whether insured or not, would have access to their funds from Monday. And then they added:

We are also announcing a similar systemic risk exception for Signature Bank, New York, which was closed today by its state chartering authority.Signature Bank NY’s state chartering authority was the New York State Department of Financial Services (NY DFS). It posted this on its website:

On Sunday, March 12, 2023, the New York State Department of Financial Services (DFS) took possession of Signature Bank in order to protect depositors. All depositors will be made whole.

DFS has

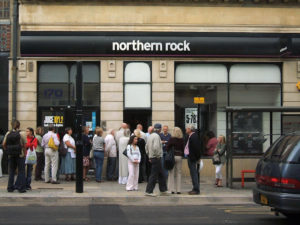

The Peston effect

March 16, 2023The last week or so has seen some of the worst bank communications since 2007, when the Bank of England started a bank run by leaking news of Northern Rock’s emergency liquidity request to the journalist Robert Peston. Then as now, awful communications have frightened the horses, triggered stampedes and caused banks to fail. Three banks in particular have shown an extraordinary insensitivity to popular fears: Silicon Valley Bank, Credit Suisse, and Wells Fargo. Two of these have paid a heavy price for their management’s inept handling of vital communications. But the third seems to have got away with it – this time. Next time, it might not be so lucky. Exhibit 1: Silicon Valley Bank (SVB)In the wake of Silvergate Bank’s failure, Silicon Valley Bank decided to restructure its balance

Read More »Silvergate Bank – a post mortem

March 9, 2023Silvergate Bank died yesterday. Its parent, Silvergate Capital Corporation, posted an obituary notice (click for larger image):Silvergate Bank bled to death after announcing significant delay to its 10-K full-year accounts and warning that it might not be able to continue as a going concern. We will never know whether it could have recovered from the bank run after the failure of FTX. The bank run after the announcement was far, far worse. The exit of its major crypto customers sealed Silvergate’s fate. But the agent of death was a government agency. On 7th March, Bloomberg reported that Silvergate Bank had been in talks with FDIC about a potential resolution "since last week". Many of us had expected FDIC to go into the bank last Friday with a view to resolving it over the weekend. We

Read More »Lessons from the disaster engulfing Silvergate Capital

March 7, 2023This is the story of a bank that put all its eggs into an emerging digital basket, believing that providing non-interest-bearing deposit and payment services to crypto exchanges and platforms would be a nice little earner, while completely failing to understand the extraordinary risks involved with such a venture. On 1st March, Silvergate Capital Corporation announced that filing of its audited full-year accounts would be significantly delayed, and warned that its financial position had materially changed for the worse since the publication of its provisional results on January 17th, when it reported a full-year loss of nearly $1bn.

The stock price promptly tanked, falling 60% during the day: Platforms, exchanges and other banks halted or re-routed transactions on Silvergate’s SEN

Read More »WASPI Campaign’s legal action is morally wrong

February 28, 2023I haven’t written a post about WASPI for a very long time. I felt I had said everything I wanted to say, and it had become evident that the WASPI campaign and its offshoots had neither the widespread support nor the legal arguments that they claimed. Labour’s proposed £58bn payment to WASPI women contributed to its disastrous defeat at the 2019 General Election. And in 2020, the hardline Back to 60 group’s bid to overturn their state pension age rises failed in the Court of Appeal. The Government had no intention of compensating WASPI women for their lost pensions, and there was neither legal nor political means to force it to do so. The campaign seemed, in short, dead in the water.

But it seems it isn’t, quite. Some years ago, WASPI campaign received legal advice that a challenge to

Read More »Proof of reserves is proof of nothing

February 16, 2023Proof of reserves is all the rage on crypto platforms. The idea is that if the platform can prove to its customers’ satisfaction that their deposits are fully matched by equivalent assets on the platform, their deposits are safe. And if the mechanism they use to prove this uses crypto technology, that’s even better. Crypto tech solutions have surely got to be much more reliable than traditional financial accounts and audits – after all, FTX passed a U.S. GAAP audit. No, they aren’t. Proof of reserves as done by exchanges like Binance does not prove that customer deposits are safe. It is smoke and mirrors to fool prospective punters into relinquishing their money, just like claims that exchanges and platforms are "audited" or have "insurance". There are no audits in the crypto world,

Read More »Binance and its stablecoins

February 13, 2023Yesterday, the SEC issued a Wells notice to the stablecoin issuer Paxos, warning it that the SEC intended to take legal action against it for issuing an unregistered security. The security in question is the fully-reserved stablecoin BUSD (Binance USD), which Paxos issues expressly for use on the Binance crypto exchange. The Wells notice doesn’t apply to Paxos’s other fully-reserved stablecoin, USDP, which it issues for use on its own platform.

A few hours later, the New York Department of Financial Services (NY DFS) ordered Paxos to stop minting BUSD. In a consumer alert published on its website, the NY DFS said there were "several unresolved issues related to Paxos’ oversight of its relationship with Binance in regard to Paxos-issued BUSD." It didn’t specify what these issues were,

Read More »The fatal flaws of Celsius Network

February 8, 2023Celsius Network was never a real business. It did not have a viable business model. Really, it was a momentum trading scheme that relied on the premise that crypto prices would always rise. And when they didn’t, it resorted to fake valuations and market manipulation to escape insolvency. It was fraudulent from the start. This is the conclusion I’ve reached after studying the U.S. Examiner’s final report (yes, I’ve read all 476 pages of it) and Celsius’s audited reports and accounts up to 31st December 2020. There are no more recent audited accounts. It was due to file its 2021 accounts by 31st December 2022, but it did not do so. The accounts are now significantly overdue. I doubt if they will ever be filed. The U.S. Examiner’s report reveals deep and long-lasting insolvency, concealed

Read More »Hollow Promises

January 23, 2023Today, I bring you the sad tale of a crypto lender that promised safety and high returns to its depositors, but whose promises have proved to be as hollow as its name. Donut Inc., a self-proclaimed DeFi" lender, has a "Proof of Reserves" section on its website. This is supposed to reassure customers that their deposits are matched one for one by the platform’s liquid assets. I am firmly of the opinion that "Proof of Reserves" statements prove nothing without a corresponding statement of liabilities, since deposits aren’t the only form of liability, and encumbered assets can’t back deposits. But in this case, the "Proof of Reserves" is worse than useless. It is actually fiction. And it conceals a truly dreadful situation for Donut’s customers. As of today, this is what the "Proof of

Read More »Snake oil sellers in the stablecoin world

December 11, 2022It’s been evident for some years now that those selling risky crypto products to risk-averse investors like to have federal branding on their snake oil. Tether claimed to have 100% actual dollar backing for its stablecoin. Various exchanges and platforms claimed that customer deposits were FDIC insured. The New York Attorney General showed that Tether didn’t have 100% dollar backing or anything like it. And now the FDIC has sent cease & desist orders to FTX, Voyager and several other crypto companies, it has become dangerous even to mention FDIC insurance in marketing material. But that doesn’t meant they’ve given up on the quest for a credible claim to Federal backing. The new Holy Grail is gaining access to Federal Reserve funding without becoming a licensed bank. Accordingt to

Read More »The entire crypto ecosystem is a ponzi

November 26, 2022The crypto ecosystem has grown massively in the last three years. Many of those participating in it have made life-changing amounts of money – on paper, or perhaps more accurately on computer. But the problem with paper gains is that they tend to evaporate like the morning mist when the market turns. The crypto market turned towards the end of 2021 and is now firmly in bear territory. Bitcoin has fallen from above $60,000 in November 2021 to barely $16,000 now. For anyone who bought Bitcoin near the top, that is a mammoth real loss. And even though it is not a real loss for people who bought Bitcoin in the bear market of 2018 and have HODLed for years, it is still a mammoth paper loss. No-one likes to see an unrealised financial gain wiped out by the markets before they can claim

Read More »The FTX-Alameda nexus

November 10, 2022How did it all go so wrong, so quickly? Less than a month ago, Sam Bankman-Fried was the golden boy of crypto, with a net worth in the $billions, and his exchange FTX was valued at $32bn. Now, FTX has a gaping hole in its balance sheet, thousands of people have lost their money, and Sam is facing personal bankruptcy and, potentially, fraud charges. The short answer is – it didn’t. The hole in FTX’s balance sheet has existed for a long time. We don’t know exactly how long, but the size of the estimates (ranging from $6-$10 billion) suggests several months if not years. Sam has been trading while insolvent. He’s not the only crypto oligarch to do so: Celsius’s Mashinsky also traded while insolvent for an extended period of time. Trading while insolvent is illegal, of course. But in

Read More »When populism fails

October 18, 2022At the Battle of Ideas last Saturday, a panel on "populism" spent an hour and a half discussing everything except economics. Sherelle Jacobs of the Telegraph called for the Tory party to replace what she called a "twisted morality of sacrifice and dependency" with the "Judaeo-Christian" values of thrift and personal responsibility. And when a brave audience member asked "shouldn’t we be discussing economics?" Tom Slater of Spiked brushed him off and carried on talking about cultural issues. Economics be damned, populism is all about morality and culture. But important though morality and culture are, it is economics that really matters. Rudiger Dornbusch’s work on macroeconomic populism shows that populism eventually fails because the economics don’t work. And when it does, the people who

Read More »What was the real reason for the Bank of England’s gilt market intervention?

September 30, 2022Why did the Bank of England intervene in the gilt market this week? The answer that has been doing the rounds is that it was protecting the solvency of pension funds. But this doesn’t make sense to me. The Bank doesn’t have any mandate to prevent pension funds going bust. And anyway, the type of pension fund that got into trouble isn’t at meaningful risk of insolvency. There was never any risk to people’s pensions. I don’t think the Bank was concerned about pension funds at all. I think it had a totally different type of financial institution in its sights. Let’s recap the sequence of events from a market perspective. This was, on the face of it, a classic market freeze. Pension funds sold assets, mainly long-dated gilts, to raise cash to meet margin calls on interest rate swaps (of which

Read More »Celsius is heading for absolute zero

August 16, 2022Yesterday, the failed crypto lender Celsius filed a monthy cash flow forecast and a statement of its assets and liabilities held in the form of cryptocurrency and stablecoins. They showed that the lender is deeply underwater and will run out of money within two months. Today, Celsius presented an update regarding its chapter 11 bankruptcy plans. Reading this, you’d think it was a different company. Liquidation isn’t on the agenda. No, they are talking about "reorganization" and and seeking debtor-in-possession (DIP) financing: DIP financing is a specialist form of finance for companies in chapter 11 bankruptcy to enable a company to continue operating. It usually takes the form of term loans. DIP loans are secured on the company’s remaining assets and are typically senior over all other

Read More »Why Coinbase’s balance sheet has massively inflated

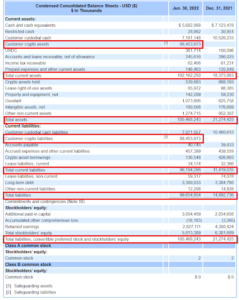

August 15, 2022Coinbase recently filed its interim financial report. It makes pretty grim reading. A quarterly net loss of over $1bn, net cash drain of £4.6bn in 6 months, fair value losses of over 600k… To be sure, Coinbase is not on its knees yet. It still has $12bn of its own and customers’ cash (both are on its balance sheet), and a whopping asset base. In fact its assets have increased – a lot. As have its liabilities. Coinbase’s balance sheet is five times bigger than it was in December 2021. Here’s Coinbase’s balance sheet, as reported in its 10-Q filing. I’ve outlined the relevant items in red: There’s a new asset called "customer crypto assets" worth some $88.45 bn, matched by a new liability called "crypto asset liabilities". This asset and its associated liability are by far the biggest

Read More »The ones who stay in Omelas

August 12, 2022Ursula Le Guin’s short story "The Ones Who Walk Away From Omelas" contains a terrible moral conundrum. Many people have agonised over it: to my knowledge, no-one has solved it. Attempts that I have seen all in some way change the framing of the story, whether by justifying blood sacrifice, insisting that there must be a better way, or creating a better alternative. But if you change the framing, you have not solved the problem. You have avoided it.As I read through Le Guin’s story to the end, I recognised the moral conundrum. It is similar to the one I posed in this piece. In Le Guin’s story, as in mine, the facts don’t matter. It is what people believe that matters.In Le Guin’s story, millions of people believe their happiness and that of everyone they love – indeed, their very existence

Read More »Where has all the money gone?

July 28, 2022The collapse of Terra in May sent shock waves round the crypto world, triggering domino-like collapses of crypto companies. One of those companies was the investment fund Three Arrows Capital. At the time, everyone thought 3AC was a conservatively-managed investment company that was simply the unfortunate victim of an unforeseen event. If anyone was to blame for 3AC’s collapse, it was Do Kwon. How wrong they were. Since 3AC was ordered into liquidation by a British Virgin Islands court, more and more creditors have emerged from the woodwork claiming they are owed money. The liquidators have filed emergency motions to freeze 3AC’s assets because there is evidence that funds are being moved out of reach. And 3AC’s co-founders, Su Zhu and Kyle Davies, have done a runner, though Bloomberg

Read More »Why Celsius Network’s depositors won’t get their money back

July 14, 2022The crypto lender Celsius has filed for Chapter 11 bankruptcy. This should come as a surprise to absolutely no-one, though the grief and pain on Twitter and Reddit suggests that quite a few "Celsians" didn’t want to believe what was staring them in the face. Celsius suspended withdrawals nearly a month ago. So far, every crypto lender that has suspended withdrawals has turned out to be insolvent. There was no reason to suppose that Celsius would be different. Celsius’s bankruptcy filing says the company has assets of $1 – 10 bn and a similar quantity of liabilities: This doesn’t tell us much about the extent of the company’s insolvency. But rumours have been circulating of a $2bn hole in its balance sheet. In May, according to Coindesk, the company said it had $12bn of what Celsius calls

Read More »Shipwrecked

July 14, 2022Two days after I published my last post, the ship went down. Voyager Digital filed for Chapter 11 bankruptcy protection. The bankruptcy filing revealed the extent of its indebtedness. Tragically, most of its creditors are customers, some of whom hold claims worth millions of dollars. But its largest creditor is Alameda Research, to whom it owes $75m. This is the maximum that Voyager could draw down from Alameda’s credit line in a 30-day period. So it appears that Alameda did not pull its credit line as I thought. Rather, Voyager maxed it out – but still ran out of money. Voyager’s desperate shortage of cash is the proximate reason for its bankruptcy. But for its customers, the hole in its balance sheet is the bigger problem. Voyager admits that it cannot repay all, or even most, deposits

Read More »

_reporters_swarming-300x200.png)

-300x200.jpg)

-300x221.jpg)