May personal spending returns to typical late cycle pattern The consumer continues to do okay. That is the message from personal income and spending as reported for May this morning. First of all, let’s compare the YoY% growth in real personal spending (blue) with real retail sales (red): For the last 50 years, during all business cycles but one, retail sales rose faster than, and ran ahead of, spending during the first part of the cycle, and declined below spending in the latter part of the cycle, so much so that the comparison is a good mid-cycle indicator. The crossover point occurred in 2014 during this cycle, so it is an excellent bet that we are in late cycle. But wait! Real retail sales have recently been rising again YoY, and last month

Topics:

NewDealdemocrat considers the following as important: US/Global Economics

This could be interesting, too:

Joel Eissenberg writes How Tesla makes money

Angry Bear writes True pricing: effects on competition

Angry Bear writes The paradox of economic competition

Angry Bear writes USMAC Exempts Certain Items Coming out of Mexico and Canada

May personal spending returns to typical late cycle pattern

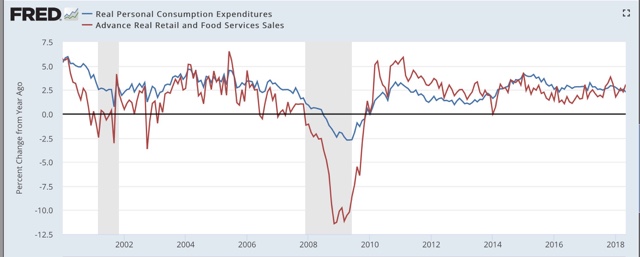

First of all, let’s compare the YoY% growth in real personal spending (blue) with real retail sales (red):

For the last 50 years, during all business cycles but one, retail sales rose faster than, and ran ahead of, spending during the first part of the cycle, and declined below spending in the latter part of the cycle, so much so that the comparison is a good mid-cycle indicator. The crossover point occurred in 2014 during this cycle, so it is an excellent bet that we are in late cycle.

But wait! Real retail sales have recently been rising again YoY, and last month surpassed spending. Have we reset? I very much doubt it.

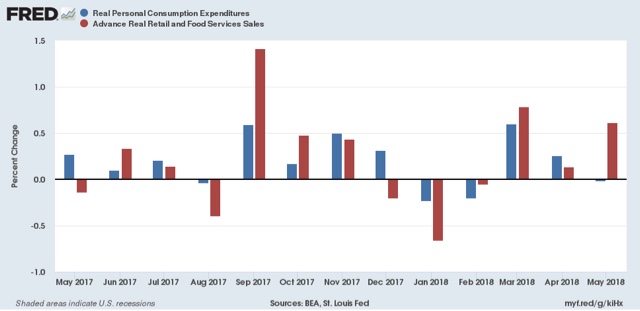

First of all, let’s compare the two metrics m/m since the beginning of 2017:

In general, the growth occurred late last year after the hurricanes and California wildfires, and was likely in response to those events. This year so far, real spending has averaged only +0.1% per month, and most of that in March — which may be related to the recent withholding tax cuts. Retail sales for May look like something of an outlier. So the likelihood is the recent YoY uptick is transitory.

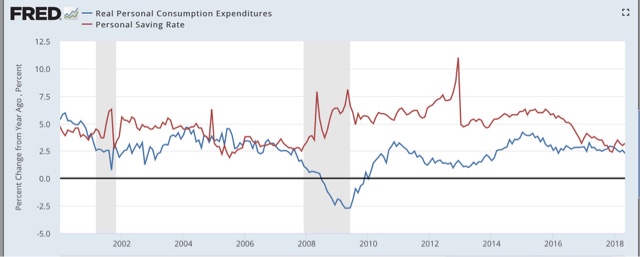

Also, let’s again compare spending (blue) with the personal saving rate (red):

A steep decline in the savings rate also tends to be something that happens in mid- to later-cycle. Note the big decline in 2004-05, and again in 2016.

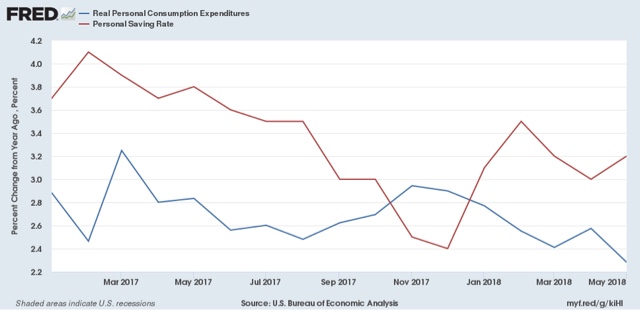

When we zoom in on the last 18 months, we see that the bump higher in spending last autumn was coincident with a dip in the savings rate:

Now both have returned to their previous rates. My suspicion is that this will continue until the last 6 months or so before the next recession, when YoY spending will decelerate, and the savings rate may begin to increase, as has been the case historically.