More Q2 weakness: Highlights Consumers credit came in below expectations, up .2 B in June as consumers held back from adding to their credit-card debt and even paid off some of it following a spending spree in the previous month. Revolving credit, which includes credit cards and which posted the biggest increase since November in the previous month, fell %excerpt%.2 billion in June. Nonrevolving credit, which tracks both vehicle financing as well as student loans, rose a moderate .4 billion. The decline in revolving credit suggests the consumer is back to the prudent spending habits characteristic of most the months in the first half of the year. Getting It Right – Significant Underestimation Of Income “What is the use of producing data if you cannot get it right?

Topics:

WARREN MOSLER considers the following as important: Economic Releases

This could be interesting, too:

WARREN MOSLER writes Consumer sentiment, real retail sales, industrial production, wages

WARREN MOSLER writes New manufacturers orders, vehicle sales, unemployment claims, rents, oil prices

WARREN MOSLER writes Saudi price hike, private payrolls, new hires, corporate profits

WARREN MOSLER writes Pending home sales, Durable goods orders, oil rigs and production

More Q2 weakness:

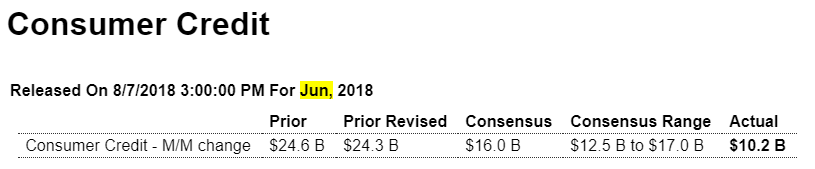

Highlights

Consumers credit came in below expectations, up $10.2 B in June as consumers held back from adding to their credit-card debt and even paid off some of it following a spending spree in the previous month. Revolving credit, which includes credit cards and which posted the biggest increase since November in the previous month, fell $0.2 billion in June. Nonrevolving credit, which tracks both vehicle financing as well as student loans, rose a moderate $10.4 billion. The decline in revolving credit suggests the consumer is back to the prudent spending habits characteristic of most the months in the first half of the year.

Getting It Right – Significant Underestimation Of Income

“What is the use of producing data if you cannot get it right? Would we be better off if data were published every five years when it would presumably be more accurate?

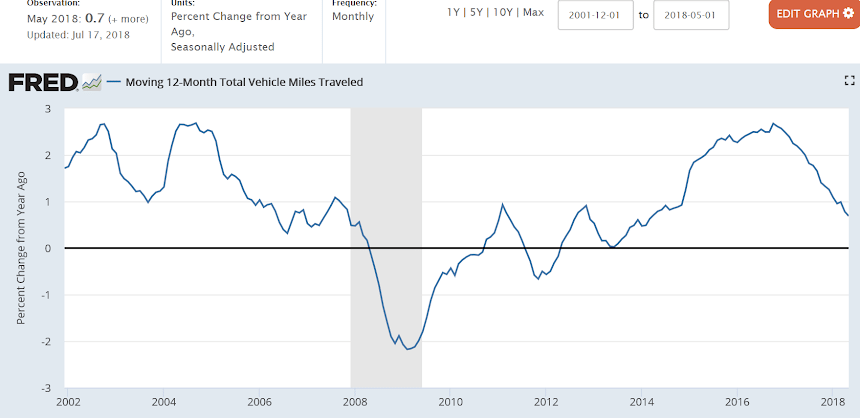

One very important takeaway from the new data is that the current economic expansion may have more room to run. For almost two years now we have been saying that consumers spending more than they were making in income was unsustainable. Turns out that they have been living more within their means than we thought and sustainability is less of a concern.”