A bit of an uptick but still trending lower: Sales going sideways on an inflation adjusted basis: This sector seems to be doing ok: Not keeping up with inflation so probably not causing it: Lowest income earners (no college) have been catching up some, but also lagging inflation:

Read More »New manufacturers orders, vehicle sales, unemployment claims, rents, oil prices

This component is going nowhere: Still trying to catch up from the oil capex collapse of 2016 and covid collapse: Not good: This is an all time low as people scramble to get extra jobs to deal with higher prices,like paying rent, for example: Oil prices taking a breather with the announcements of releases from strategic petroleum reserves. Price direction, however, is instead set by Saudi OSP premiums to benchmarks which were just raised for the 3rd month and this time to...

Read More »Saudi price hike, private payrolls, new hires, corporate profits

This could easily drive oil up past $200/barrel and trigger a serious recession. This survey/forecast is higher than precovid. The full employment report comes out Friday: Gross new hires have been trending lower: Corporate profits jumped after the covid dip and have recently flattened:

Read More »Pending home sales, Durable goods orders, oil rigs and production

Recovered to trend but only because this chart isn’t adjusted for inflation: Nor does the narrative that consumers have gone crazy buying goods seem to be holding up:Not a lot of growth here:

Read More »Employment, optimism index, consumer credit, consumer price index

Slowly returning to the pre covid trend: Still below the pre covid trend line:

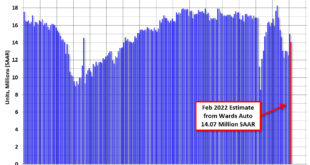

Read More »Car sales, ISM Services, Atlanta Fed, energy recession chart

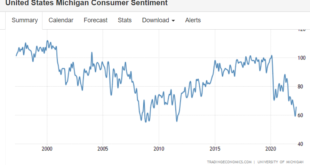

Low and slipping: GDP tracking at 0:

Read More »Income expectations, NY manufacturing, industrial production, retail sales

Post war slowdown continues: Below the 2018 highs, but still growing from the covid dip: Adjusted for inflation, the slope is downward:

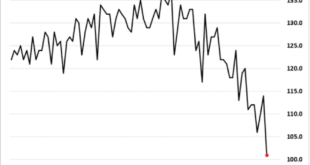

Read More »Optimism indexes, mtg purchase applications

Post was slump continues: Mortgage applications and housing in general remains far weaker than it was when rates were far higher and the population was a lot lower as well:

Read More »Employment, oil

Still slowly working its way back to the pre covid trend: New rigs continue to come online, but it won’t interfere with Saudi/Russian price setting until sufficient production comes online to reduce Saudi sales. And right now sales are going up, indicating that demand for oil at the Saudi’s prices is increasing, as the Saudis set price and let their refiners buy all they want at their posted prices: As previously discussed, Saudi OSP’s (official selling price spreads vs...

Read More »Private payrolls, durable goods orders, ISM services, Atlanta Fed

Fading, and this series is not inflation adjusted: Still high but falling fast: Still at only .1% GDP growth for Q1:

Read More » Heterodox

Heterodox