This component is going nowhere: Still trying to catch up from the oil capex collapse of 2016 and covid collapse: Not good: This is an all time low as people scramble to get extra jobs to deal with higher prices,like paying rent, for example: Oil prices taking a breather with the announcements of releases from strategic petroleum reserves. Price direction, however, is instead set by Saudi OSP premiums to benchmarks which were just raised for the 3rd month and this time to record highs. This puts a relentless upward bias to prices until Saudi pricing changes, and will propel what’s call inflation as well. And the higher prices can also trigger a sharp recession: The Commodities Feed: Saudi OSP raised to record highs

Topics:

WARREN MOSLER considers the following as important: Economic Releases

This could be interesting, too:

WARREN MOSLER writes Consumer sentiment, real retail sales, industrial production, wages

WARREN MOSLER writes Saudi price hike, private payrolls, new hires, corporate profits

WARREN MOSLER writes Pending home sales, Durable goods orders, oil rigs and production

WARREN MOSLER writes Employment, optimism index, consumer credit, consumer price index

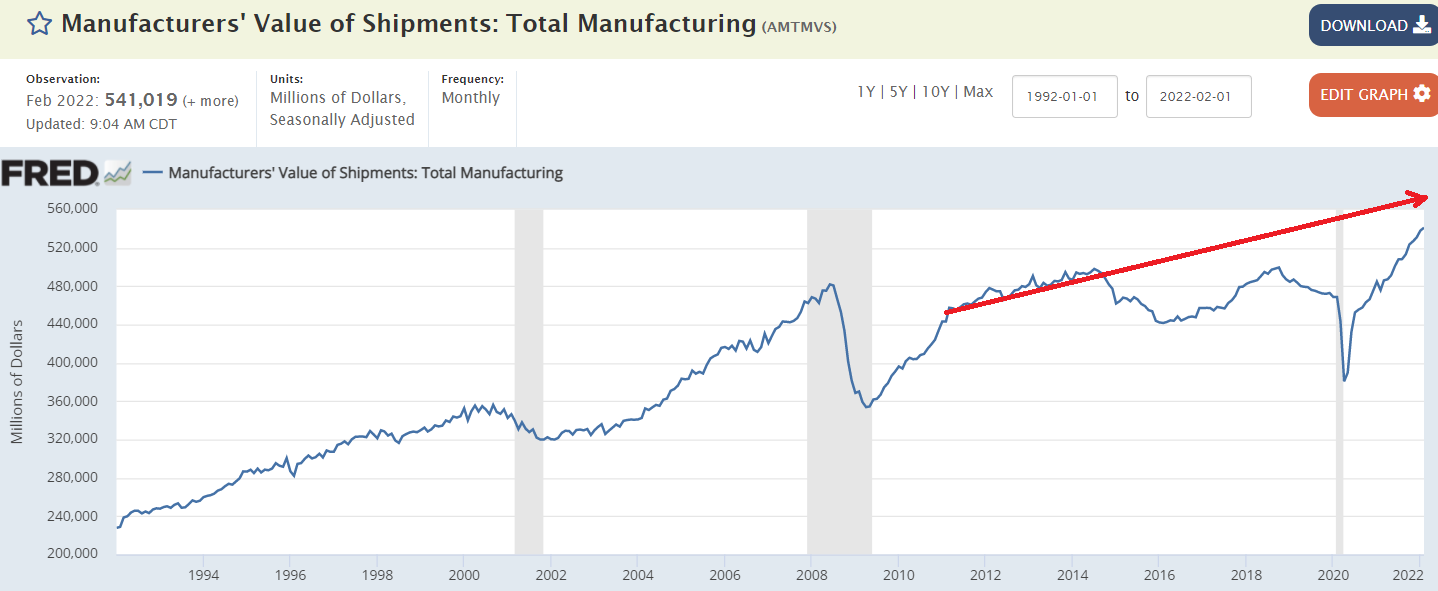

This component is going nowhere:

Still trying to catch up from the oil capex collapse of 2016 and covid collapse:

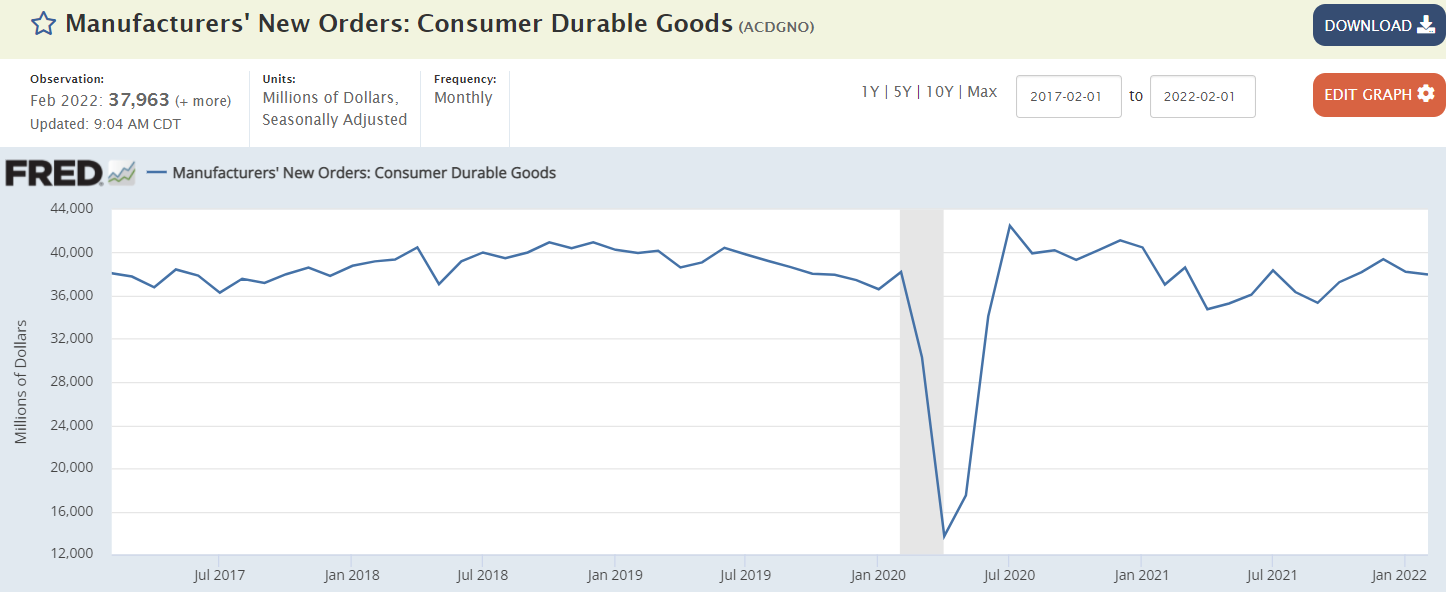

Not good:

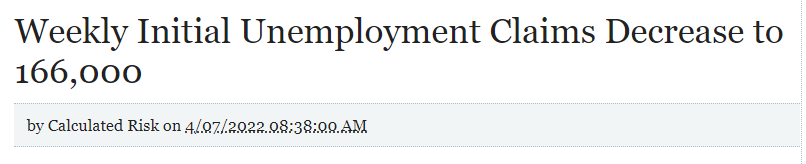

This is an all time low as people scramble to get extra jobs to deal with higher prices,

like paying rent, for example:

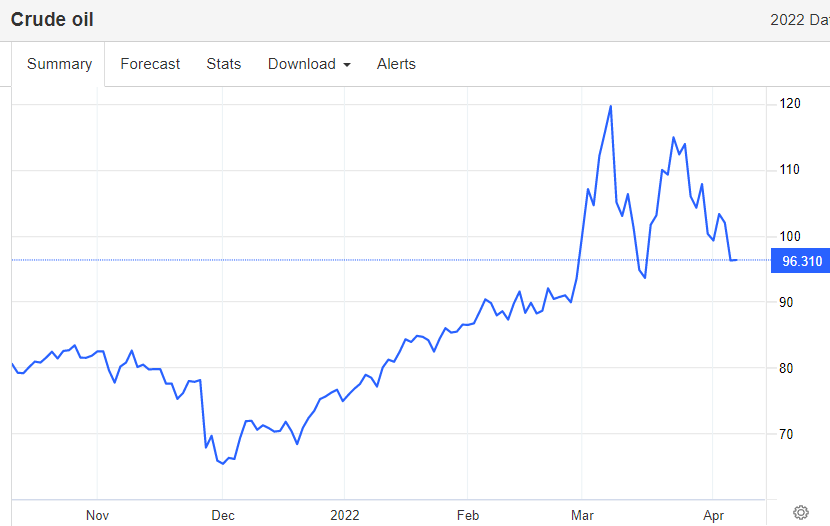

Oil prices taking a breather with the announcements of releases from strategic petroleum reserves.

Price direction, however, is instead set by Saudi OSP premiums to benchmarks which were just raised for the 3rd month and this time to record highs.

This puts a relentless upward bias to prices until Saudi pricing changes, and will propel what’s call inflation as well. And the higher prices can also trigger a sharp recession: