A bold forecast: there will be no autumn surge in housing this year The big issue this year in housing is whether increased mortgage rates and higher prices have merely resulted in a deceleration in the increase in new housing sales and construction, or whether housing is actually rolling over. As I’ve written several times in the last month, there is accumulating evidence that it is actually the latter: housing has at very least plateaued. The acid test will be what happens in the next four months. Here’s why. (As an aside, as I recently learned from reading a biography of Mark Twain, who hid out during the Civil War in Nevada and California, the “acid test” is a real thing. Real gold does not dissolve in acid, but “fool’s gold” a/k/a iron pyrite,

Topics:

NewDealdemocrat considers the following as important: Taxes/regulation, US/Global Economics

This could be interesting, too:

Joel Eissenberg writes How Tesla makes money

Angry Bear writes True pricing: effects on competition

Angry Bear writes The paradox of economic competition

Angry Bear writes USMAC Exempts Certain Items Coming out of Mexico and Canada

A bold forecast: there will be no autumn surge in housing this year

As I’ve written several times in the last month, there is accumulating evidence that it is actually the latter: housing has at very least plateaued. The acid test will be what happens in the next four months. Here’s why.

(As an aside, as I recently learned from reading a biography of Mark Twain, who hid out during the Civil War in Nevada and California, the “acid test” is a real thing. Real gold does not dissolve in acid, but “fool’s gold” a/k/a iron pyrite, does. So there.)

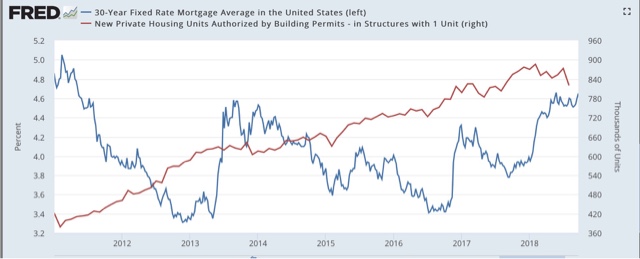

Let’s start by going back seven years, which is the last time mortgage rates were higher than they are now, and before house prices bottomed. Here’s what mortgage rates (blue, left scale) and the least volatile housing metric, single family housing permits (red, right scale), look like:

Note a few things:

- mortgage rates declined nearly 2%, from 5% to 3.3%, from 2011 through mid-2013.

- during that big decline, single family permits rose over 60%.

- during the “taper tantrum” of 2013, mortgage rates rose back to 4.6%

- permits stalled for a year after the tantrum, and established a new, less steep trend line that was broken to the downside by this week’s August housing permits report.

- after mid-2013, mortgage rates established three meaningful intermediate lows: in early 2015, mid-2016 (due to “Brexit”), and mid-2017.

- each of these three intermediate lows in mortgage rates coincided with a temporary acceleration of the growth in housing permits

- mortgage rates have just made a new 7 year high, reaching 4.87% this week.

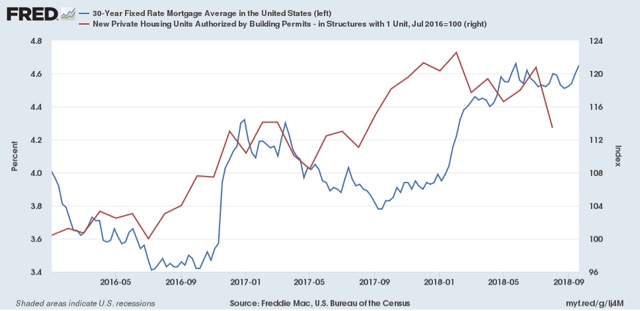

Now let’s zoom in on the last 2 years. This second graph is the same data as the one above, except I have normed single family permits to 100 as of July 2016:

Note that permits rose 13% between July and December 2016, and rose another 9.7% between August and December of last year. Both of these surges took place during the temporary declines in mortgage rates, and stopped when rates ratcheted higher.

In other words, despite jumps in mortgage rates in late 2013 and early 2017, the trendline in permits only decelerated compared with its longer term trend. Aside from this month’s permits report, they never actually rolled over.

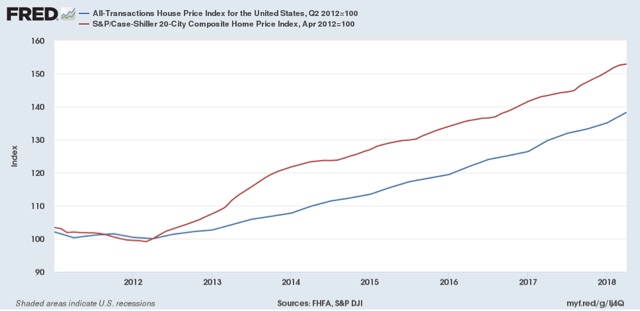

The difference this year is that there has been no decline in interest rates: in fact, since March, mortgage rates have actually headed slightly higher. Further, depending on the measure, house prices, as shown in the graph below, are roughly 40% to 50% higher than they were at their bottom in 2011 — far in excess of household income growth:

So, here is my bold forecast: unless mortgage rates decline below 4.5% in the next few months, there will be no autumn surge in permits such as there was in the last two years. Similarly, at very least no meaningful new high will be established in single family permits (more than 2% above February’s number), and more likely than not, there will be no new high at all.

And since the Fed seems bent on raising interest rates next week, unless there is to be a yield curve inversion, mortgage rates are quite unlikely to decline below 4.5%. They may even go higher.