Tracking Trump’s trade wars: inventories and intermodal traffic Here’s something I thought I would start to track: looking for evidence of the effects of Trump’s trade wars on manufacturing and distribution. Producers and distributors aren’t simply going to sit back and wait to absorb new tariff expenses: we should expect them to engage in as much “front-running” as possible, importing the goods and commodities likely to be affected by the tariffs early, and building up inventories that can be sold at the lower, pre-tariff prices. Once the tariffs kick in, the front-running would end, leading to a reversal of the pattern. Two places we would expect that front-running to show up are in manufacturers and wholesalers inventories, and in the intermodal units

Topics:

NewDealdemocrat considers the following as important: Taxes/regulation, US/Global Economics

This could be interesting, too:

Joel Eissenberg writes How Tesla makes money

Angry Bear writes True pricing: effects on competition

Angry Bear writes The paradox of economic competition

Angry Bear writes USMAC Exempts Certain Items Coming out of Mexico and Canada

Tracking Trump’s trade wars: inventories and intermodal traffic

Producers and distributors aren’t simply going to sit back and wait to absorb new tariff expenses: we should expect them to engage in as much “front-running” as possible, importing the goods and commodities likely to be affected by the tariffs early, and building up inventories that can be sold at the lower, pre-tariff prices. Once the tariffs kick in, the front-running would end, leading to a reversal of the pattern.

Two places we would expect that front-running to show up are in manufacturers and wholesalers inventories, and in the intermodal units that are typically used for cross-ocean shipping. Let’s take them in order.

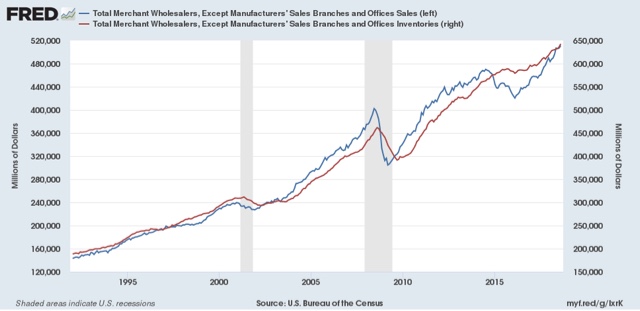

First, as a general rule sales lead inventories. Sales peak first going into recessions, and bottom first coming out. It is likely the very fact that sales turn that is the signal for producers to add or subtract from inventories. Here’s that relationship for wholesalers over the past 25+ years:

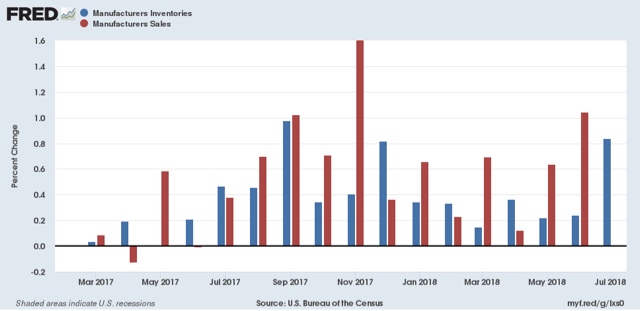

Front-running would differ from that, because we would continue to see increased sales, but we would see an even bigger increase in inventories. Here are the monthly percentage changes in sales (red) and inventories (blue) for manufacturers over the past several years:

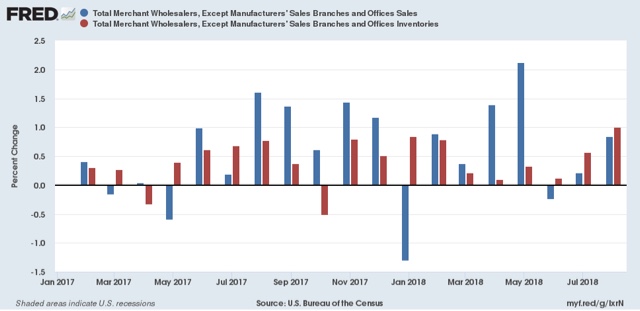

And here, with the red and blue reversed (sorry!) for wholesalers:

For manufacturers, only the very last month fits the patterns, and could easily represent catching up from the big inventory drawdown the month before. But for wholesalers, the last three months fit the pattern. as sales increase, but inventories increase more.

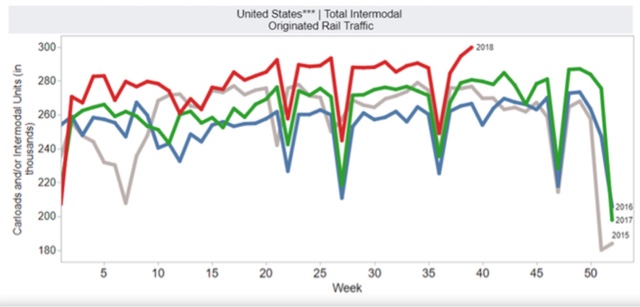

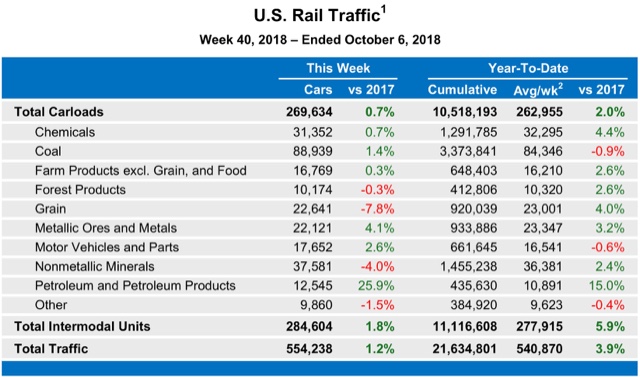

Secondly, a good way to track intermodal traffic is via the weekly railroad report, which breaks traffic down into intermodal units and non-intermodal carloads. Here’s what intermodal traffic over the last several years looks like:

We have seen big YoY gains in intermodal traffic in the last 6 months, but not particularly more than the YoY gains from 2016 to 2017 – except possibly in the last 2 weeks of September.

And here is the data for the latest week, just out today. We have suddenly gone from 10% YoY gains in both intermodal and carloads to gains of less than 2%:

I’ll continue to keep track of this, to see how Trump’s trade wars impact the economy in as close to real time as realistically possible.