Share the post "Indexing Doesn’t Win When It’s Implemented Via a High Fee Advisor" I’m a big advocate of indexing strategies because they’re low fee, tax efficient and diversified approaches to allocating one’s savings. But I see a worrisome trend in the asset management business – high fee advisors endorsing low fee indexing and selling it as something different from “active” management. We should be very clear here – these high fee advisors are not much different than their high fee active brethren. The asset management business has experienced a huge shift in the last 10 years. Trillions in fund flows have moved from high fee mutual funds into low fee ETFs and index funds. The evidence behind low cost indexing has become virtually irrefutable at this point. You don’t get what you pay for.¹ In fact, in many cases you get what you don’t pay for. Unfortunately, as fund fees have declined the average management fee at the advisor level has remained relatively high. Over the last 10 years we’ve seen a huge shift in the way asset management firms generate revenue. As mutual funds grew in popularity in the 90’s many of these firms used to charge commissions or advisory fees (usually in excess of 1%) and the fund company charged you an expense ratio on top of that (also 1% or more).

Topics:

Cullen Roche considers the following as important: Most Recent Stories

This could be interesting, too:

Cullen Roche writes Understanding the Modern Monetary System – Updated!

Cullen Roche writes We’re Moving!

Cullen Roche writes Has Housing Bottomed?

Cullen Roche writes The Economics of a United States Divorce

I’m a big advocate of indexing strategies because they’re low fee, tax efficient and diversified approaches to allocating one’s savings. But I see a worrisome trend in the asset management business – high fee advisors endorsing low fee indexing and selling it as something different from “active” management. We should be very clear here – these high fee advisors are not much different than their high fee active brethren.

The asset management business has experienced a huge shift in the last 10 years. Trillions in fund flows have moved from high fee mutual funds into low fee ETFs and index funds. The evidence behind low cost indexing has become virtually irrefutable at this point. You don’t get what you pay for.¹ In fact, in many cases you get what you don’t pay for. Unfortunately, as fund fees have declined the average management fee at the advisor level has remained relatively high.

Over the last 10 years we’ve seen a huge shift in the way asset management firms generate revenue. As mutual funds grew in popularity in the 90’s many of these firms used to charge commissions or advisory fees (usually in excess of 1%) and the fund company charged you an expense ratio on top of that (also 1% or more). Most investors in a mutual fund housed at a big brokerage house were seeing 2% or more of their total return sucked out in fees. Investors in a closet index fund housed at a discount broker were still seeing a 1%+ drag on their returns.

As the indexing revolution has swept over these firms the high fee closet indexing mutual funds have been increasingly swapped out for the low fee index funds. But the high fees are still there. They’re just lower high fees than the outrageous 2%+ fees that were once there. Unfortunately, what we’re seeing across the business today often involves an advisor who charges the same 1%+ fee that the mutual fund charged, but they’re selling it within the “low fee indexing” pitch. So, what you actually end up owning is a low fee indexing strategy wrapped inside of a high fee asset management service. In other words, you end up with a fee structure no different than the investor who owns the high fee mutual fund in their own discount brokerage account.

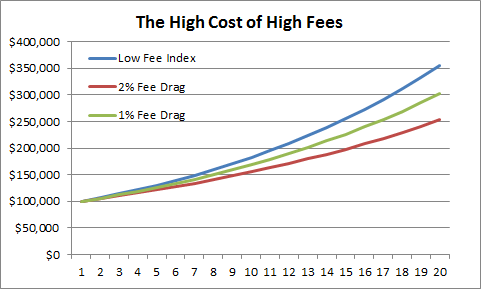

The chart above shows the impact of a diversified portfolio with an average annual return of 7% in a low fee index relative to the same portfolio with a 1% and 2% fee drag. Over the course of 20 years your $100,000 investment is a full 40% lower after the 2% fee drag and 18% lower with the 1% drag. In other words, over a 20 year period you’re handing over upwards of $100,000 for a service that is now being done by truly low fee advisors like my firm, Vanguard, Schwab and the Robo advisor firms. To be blunt, this 1% fee structure is an antiquated fee structure and it won’t continue. To be even more blunt – investors should be revolting against it given their options.

We can’t control the returns we’ll earn in the financial markets. But we can control the taxes and fees we pay in those accounts. As the investment landscape shifts and you review your 2016 finances don’t find yourself in a backwards service paying high fees for something that is now being done by a multitude of firms in a truly low fee structure.

¹ – Shopping for Alpha – you get what you don’t pay for, Vanguard