Summary:

I wasn't going to write another post about the WASPI campaign, but things have become so unpleasant and confused that I have no choice. This post is my final and definitive statement on where I stand on the women's state pension debate.My view of the women's state pension age problemI described the women's state pension age problem in some detail in a previous post, so I shall only outline it here, along with my view on each part of this complex problem.Recent changes to women's state pension age are these:

The 1995 Pensions Act raised women's state pension age (SPA) from 60 to 65, the same as men's. To give women time to prepare, the transition did not start for 15 years, and it then raised the age over the course of 10 years, from 2010 to 2020. The effect was that women born prior to 6 April 1950 would remain eligible for the state pension on their 60th birthday, but women born later than that would see their eligibility gradually delayed. NO woman born after February 1951 would retire at 60, and all women born on or after 6 April 1955 would retire on their 65th birthdays.

The 2008 Pensions Act added a year to both men's and women's SPA. The rise was to run concurrently with the 1995 transition. As a result, most 1950s women - including those subject to the 1995 transition - suffered an additional rise in their pension age.

Topics:

Frances Coppola considers the following as important:

basic income,

pensions

This could be interesting, too:

Frances Coppola writes We need to talk about the state pension

Michael Stephens writes Podcast on Gender Budgeting

Michael Stephens writes Podcast on Gender Budgeting

Frances Coppola writes Statistics for state pension age campaigners

I wasn't going to write another post about the WASPI campaign, but things have become so unpleasant and confused that I have no choice. This post is my final and definitive statement on where I stand on the women's state pension debate.

My view of the women's state pension age problem

I described the women's state pension age problem in some detail in a previous post, so I shall only outline it here, along with my view on each part of this complex problem.

Recent changes to women's state pension age are these:

- The 1995 Pensions Act raised women's state pension age (SPA) from 60 to 65, the same as men's. To give women time to prepare, the transition did not start for 15 years, and it then raised the age over the course of 10 years, from 2010 to 2020. The effect was that women born prior to 6 April 1950 would remain eligible for the state pension on their 60th birthday, but women born later than that would see their eligibility gradually delayed. NO woman born after February 1951 would retire at 60, and all women born on or after 6 April 1955 would retire on their 65th birthdays.

- The 2008 Pensions Act added a year to both men's and women's SPA. The rise was to run concurrently with the 1995 transition. As a result, most 1950s women - including those subject to the 1995 transition - suffered an additional rise in their pension age.

- In 2011 - after the 1995 transition had already started - the government, under pressure from the EU, brought forward completion of the 1995 transition by two years in order to complete the transition to the extra year by 2020. This created sharp increases in the SPA for women born 1953-4. In response to campaigning, this second SPA rise was limited to a maximum of 18 months. However, coming on top of the 1995 and 2008 changes, it did result in very large total SPA rises at short notice for some women.

My considered view on all of this is as follows.

Firstly, I regard the 1995 transition as fair and generous. I see no reason whatsoever to overturn it. I also, on balance, regard the 2008 change as reasonable, though the Government could have taken longer to implement it.

However, the 2011 change is a different matter. Shortening a fair and long-established transition process after it had started was unfair, and the concession was inadequate. As a result of this, some women face difficult financial circumstances for which I think relief should be offered.

Solving the 2011 problem

For me, the case for transitional relief for some women facing hardship due to the 2011 change is overwhelming, and I have been trying to think of ways of providing targeted relief for these women. I do not think that reinstating their previous state pension age or offering compensation in lieu of state pension will be remotely acceptable to the present government, since this would be expensive, a major loss of face, and potentially open the floodgates to other claims for compensation due to ill-thought-out and badly executed government policies (ATOS testing, anyone?). So I believe a more practical approach would be look at specific adjustments to working age benefits to help these ladies, such as relaxing JSA and ESA jobsearch conditionality for over-60s. I know it isn't what they really want, but I genuinely think this would have a better chance of success. In the end, if their need is for money, does it really matter whether it comes in the form of a pension or a working-age benefit?

I admit that I have another agenda too. Enhancements to working age benefits for over-60s would drive a wedge into the government's policies on working age benefits, which are causing major hardship and distress for a lot of people, including men born in the 1950s who of course were never able to claim state pension from 60. I was horrified to hear recently of a 60-year-old man sanctioned for 6 weeks for missing job centre appointments when his wife died, and another man sanctioned for failing to attend an appointment after suffering a heart attack while waiting for that appointment. Ending this misery for over-60s of both sexes would be a job well done.

But to take this route, the women affected would have to accept that they are not pensioners. They are working-age women whose problem is lack of work and/or lack of sufficient savings to enable them to retire earlier than their SPA. This is very different from the WASPI approach, which is to define them as pensioners who have been "robbed", and demand restitution.

Nonetheless, on the unfairness of the 2011 change I am broadly in agreement with WASPI. I simply disagree about the solution.

The WASPI demand: a much bigger issue

But the WASPI campaign does not limit itself to seeking transitional relief for women facing hardship due to the 2011 change. It has a much more far-reaching agenda.

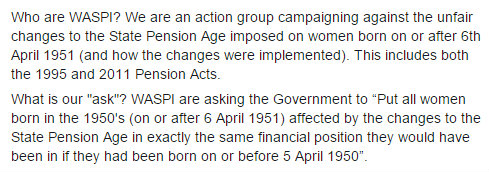

The WASPI demand, as expressed on their Facebook page, is as follows (for the avoidance of confusion, this is a genuine screen print from their Facebook home page):

I interpret the first paragraph as meaning that not only the implementation of the pension changes, but the CHANGES THEMSELVES, were unfair. And not only the 2011 change, but the 1995 and 2008 changes too. This causes me a serious problem. I do not regard the 1995 and 2008 changes as unfair. In my view, equalisation with men is fair. So too is raising SPA as people live longer. As I shall explain below, it is the working young who pay state pensions. We have a responsibility to them.

I interpret the second paragraph as demanding financial compensation for all women born between 6 April 1951 and 31 December 1959 for loss of their right to a state pension at 60. For these women to be restored to the financial position that they would have been in if they had been able to claim the state pension at 60 (as women born on or before April 1950 did), the amount paid to them must be the difference between the total state pension they would have received if they retired at 60 and the total state pension they will now receive. That is up to 6 years of state pension payments for each woman, paid as a lump sum.

This amounts to restoring a state pension age of 60 for all women born in the 1950s and delaying the equalisation of men's and women's pension ages for a further 10 years. I have been told by WASPI representatives that this is not the intention. They say they are in favour of equalisation of men's and women's pension ages. But I can't see how this demand can be interpreted in any other way. I have asked repeatedly for clarification, but so far have received none.

The late notice problem

WASPI representatives say they are only seeking general compensation because the DWP failed to give 1950s women sufficient individual notice of the changes. The DWP did not start to notify 1950s women of their new SPA until 2009, and the bulk of the letters were sent 2012-13. Some of the letters apparently failed to arrive because awful record-keeping by DWP and HMRC meant addresses were wrong. It was, in short, a dog's breakfast.

I would be the first to agree that the DWP's communication in this, as in so many other matters, has been abysmal. The DWP is utterly incompetent, and I have repeatedly criticised it. However, inadequate notice due to incompetence does not of itself create grounds for compensation. If there is no material loss, then a simple apology would suffice. As I shall explain, I am unconvinced that the case for general compensation has been made.

Firstly, I accept that the notice given by the DWP was inadequate, but this problem is not limited to women in the 1950s. Younger women have not been notified either - including those born in the 1960s. It is not clear to me why a woman born on 31st December 1959 should receive compensation for late notice, but a woman born on 1st January 1960 should not. One day's difference in a birth date cannot possibly turn totally inadequate notice into adequate notice, especially over a holiday period. In setting such an arbitrary end date for compensation, WASPI creates a cliff edge for women born in the 1960s which could - if 1950s women obtain full restitution as WASPI demands - be as much as 6 years. This is grossly unfair to them. It is a greater injustice than the injustice WASPI seeks to rectify.

But far more importantly, what financial difference would more notice have made to 1950s women? They say it would give them more time to "plan". But it is not clear to me what plans they would have made. Again, I have asked for explanation, but received none.

Whether more notice would have made a material difference to 1950s women's financial position seems to depend entirely on their personal circumstances. For women on such low incomes that they couldn't save, more notice would have made no difference at all: after all, if the problem is no spare cash, giving more time to accumulate spare cash isn't a solution. So more notice would not have helped the poorest women. An earlier state pension is not a solution to women's pay inequality: since many of these women don't qualify for a full state pension due to insufficient NI contributions, all it does is enable them to live for longer on a lower pension than a man or a better-off woman. I wonder how much of the support for the WASPI demand from women who say they are on very low incomes - and the anger they express at their state pension delay - comes from an unspoken belief that the state pension is some kind of reward for a lifetime of drudgery? If this is right, I feel terribly sorry for them. No-one should have to spend their entire life doing work they hate. But this is a perverse view of the state pension. It is not justification for granting it earlier.

More notice would have given women on higher incomes time to save more to cover the gap between their corporate pension age and their new state pension age - assuming they intended still to retire at 60. But since the whole point of equalising men's and women's pension ages is to keep women working for longer, why should topping up these women's savings so they can stop work early be a priority?

And if course if a woman gave up (or lost) her job expecting SP at 60, she is now unemployed and facing the brutal JSA and ESA regimes. These are the angriest and most frightened ladies, and with reason. I have huge sympathy for them. But I've already said, here and elsewhere, that these benefits regimes desperately need adjusting. They are far too harsh, not just for ladies in their 60s but for everyone. So we should adjust them, not compensate these women while neglecting men and younger people. Similarly, women who are carers should claim carer's allowance, another benefit that desperately needs reform - for a 35 hour week it pays £62.10, which is far below the current minimum wage let alone the new Living Wage. The hardships faced by WASPI women are an opportunity to fix the benefits system. I'm really disappointed that WASPI ignores this and chooses instead to pursue an impossible goal.

But aren't these women entitled to their pensions?

There seems to be a prevalent view that 1950s women are "entitled" to retirement at 60 (or equivalent financial compensation). The entitlement arguments seem to run like this: 1) they've paid in to a state pension all their lives, they should now be able to draw it out 2) when they started work they were promised retirement at 60, government should honour that promise.

But there are real problems with both of these arguments.

The first argument is simply wrong. People don't "pay in" to an NI fund that is invested on their behalf. There are no "pension pots" made up of individual NI contributions. UK s

tate pensions are unfunded. That means current NI receipts from working people pay current pensions and contributory benefits. And no, this is not because pension pots were "raided" by Brown/Blair/Major/Thatcher (take your pick). The UK state pension has always been unfunded. What are called the "NI Funds" are in reality just clearinghouses, and their surplus is the accumulated difference between NI receipts and payments from the funds.

The NI funds built up a surplus when wages were rising, the UK working population was rising and payments to pensioners and benefit claimants were not keeping pace: that surplus is invested in UK government debt, which is the safest form of investment for UK residents. But now that wages are stagnant, the UK working population is stable, the pensioner population is growing due to people living longer and pension payments are being uprated, the NI funds are running deficits and their accumulated surplus is fast diminishing. This is simply due to demographic shifts, poor economic performance and policy decisions regarding pension and benefit payments. It is a known hazard of "pay-as-you-go" pension schemes, especially those where the funding is shared with contributory benefit schemes.

Now, turning to this idea that people are "entitled" to state pension at the age promised when they started work. The problem with this from the WASPI point of view is that it equally applies to younger women. After all, women born 1960-79 also had a retirement age of 60 at the start of their working lives. Once again, this argument founders on the arbitrary WASPI end date.

But more seriously, this argument is wrong too. There is no "promise" of state pension at a particular age, or indeed for a particular amount. All NI contributions buy is the right to a pension of some amount at some age. Both of those can be changed by Act of Parliament - just as entitlement to other NI-funded benefits such as JSA can be changed. So government is not bound to honour either the retirement age or the pension amount in force at the start of an individual's working life. And as far as I am aware (though I believe WASPI is obtaining a legal opinion on this), it has no obligation to give any particular notice of changes. There certainly isn't a "rule" that 10 years' notice of changes must be given, though this government has said that future governments will give such notice.

So the "entitlement" argument doesn't stack up either.

Moral considerations

The story of the equalisation of men and women is one of enabling women to take responsibility for their own financial affairs, rather than being dependent on men. This must surely include keeping up with legislative changes that affect them. Many women DID know about the 1995 change - indeed according to a 2004 DWP research paper, 72% of 1950s women knew the SPA was rising. And people have been able to check their SPA with the DWP since 2001. Unions, trade representatives and HR departments of larger employers also would have been able to advise.

In view of all this, I find a claim for compensation for 1950s women on grounds that they didn't know, hard to swallow. Apart from the fact that most of them actually did know, this rewards women who did not take responsibility. It is a form of moral hazard. I realise that there are all manner of reasons why a woman might not manage her finances well, and I do not wish to judge: but if women are to be truly equal with men, they must accept the same responsibilities as men. Saying "I was too busy with job, childcare and housework to pay attention to current affairs" is to reject the equality for which women have fought so hard, incomplete though it is as yet. And expecting SPA to be the same as corporate pension age - and therefore not checking SPA until the last minute - is just folly. Sisters, we have to do better than this.

I'm also seriously concerned about the cost of such compensation. I do not like this government's penny-pinching attitude, but the reality is that this is the government we have for the next 4 years and possibly longer. Given this, I am unable in conscience to support paying "compensation" to well-off women knowing that the cost of this will inevitably be born by the poor, sick, disabled and unemployed in the form of higher taxes and deeper cuts to working age benefits and essential services. I regard general compensation for 1950s women as morally suspect when the working poor are being hit so hard. I would much rather see targeted relief to women in difficulties than across the board compensation.

The moral issues run well into the future, too. If it is to be sustainable, we must change the way we regard the state pension. The state pension was originally envisaged as an insurance scheme: everyone paid in, but the majority never claimed because they died before reaching their SPA. Now, the majority of people claim SP: 91% of women live to 65 and 86% of men. And they claim it for a long time, too, A woman retiring at 60 can expect to live - on average - for at least another 20 years. In an attempt to keep a lid on rising costs, George Osborne recently limited the proportion of someone's life that they could expect to spend claiming state pension: "UP TO one third", he said, explaining that the SPA would continue to rise in line with life expectancy. But "chinese whispers" - including among WASPI ladies - promptly transformed this into "SHOULD spend up to one third". This is how unreasonable entitlements are born. How much of their incomes will future working people have to pay in tax and NI, if this becomes a general expectation that government must "honour"? For how long will they be willing to do this, knowing that when it is their turn, they will get much less? What is the responsibility of older people towards future generations? This needs serious discussion. The unborn, and the young children of today, have not agreed to the "entitlements" and "promises" claimed by older people. They have no voice. Who will speak for them?

A better way

For all the above reasons, I cannot support what I understand to be WASPI's main aim, which is for all 1950s women to receive financial compensation for the loss of state pension from 60.

I do, however, support targeted relief for women facing hardship, especially (but not necessarily limited to) those affected by the 2011 change. And I would like to see constructive debate about how the needs of these women can realistically be met in the current climate.

I do not know if WASPI will take me seriously. But I have now stated my position clearly and unambiguously. I am not hostile: but I will not support their campaign as it stands. It is the moral arguments against it that I find overwhelming. We cannot fight injustice with injustice, and promote equality by perpetuating inequality. There has to be a better way.

And indeed there is. This problem would be entirely solved by a

universal basic income coupled with a sensible progressive tax system. Can't we stop fighting over scraps, and campaign together for a really radical reform that would benefit everyone?

Over to you, WASPI.

Related reading:When will I get my state pension? - Henry Tapper

The Basic Income Guarantee: what stands in its way? - Tom Streithorst

State pension age increases for women born in 1950s - House of Commons

State pension age background - House of Commons

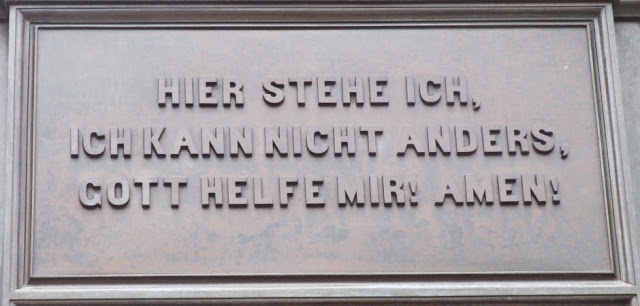

Image: Martin Luther's words at the Diet of Worms, courtesy of reformedanglicans. The full text of Luther's answer, and the historical circumstances, can be found by clicking the link. Please do. It is interesting - and relevant for anyone who takes a moral stand on a current political issue.