Okay, so you all know I am all about operational reality. And although the financial markets and the economy aren’t exactly like the physical world there are certain operational and fundamental aspects to it all. So, I was intrigued by this Tweet by Ron Paul and the lop-sided responses: Okay, so Ron Paul has a certain type of follower, but let’s go through this because it’s good practice. Federal Reserve Notes – Good ‘ol cash. Nothing gives you greater optionality. Heck, you can even buy drugs with it if that’s your thing. But cash is the worst thing to hold for the long-term because it is designed not to earn any interest and that means that it is guaranteed to erode purchasing power every year. Cash can basically be thought of as an asset that gives you unparalleled near-term

Topics:

Cullen Roche considers the following as important: Most Recent Stories

This could be interesting, too:

Cullen Roche writes Understanding the Modern Monetary System – Updated!

Cullen Roche writes We’re Moving!

Cullen Roche writes Has Housing Bottomed?

Cullen Roche writes The Economics of a United States Divorce

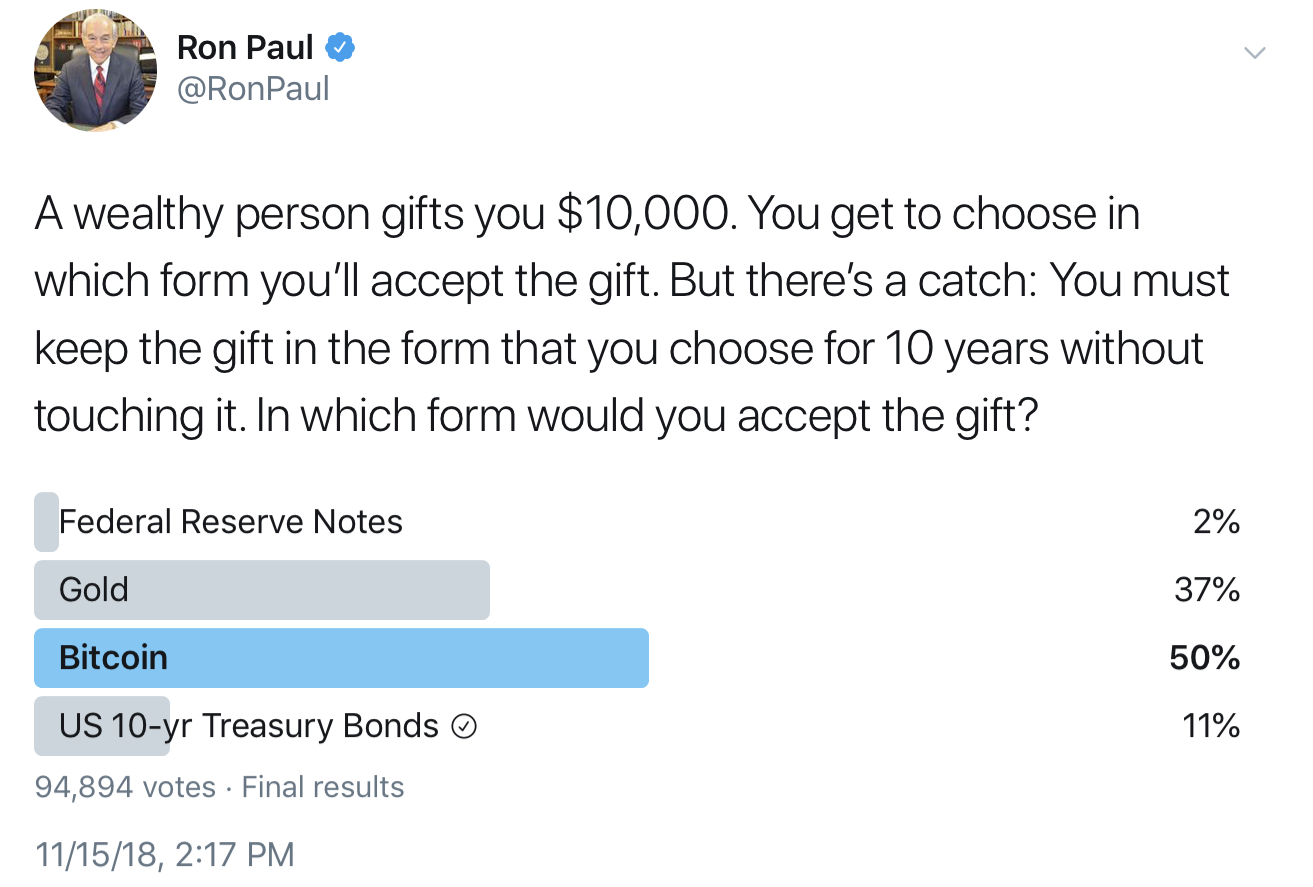

Okay, so you all know I am all about operational reality. And although the financial markets and the economy aren’t exactly like the physical world there are certain operational and fundamental aspects to it all. So, I was intrigued by this Tweet by Ron Paul and the lop-sided responses:

Okay, so Ron Paul has a certain type of follower, but let’s go through this because it’s good practice.

Federal Reserve Notes – Good ‘ol cash. Nothing gives you greater optionality. Heck, you can even buy drugs with it if that’s your thing. But cash is the worst thing to hold for the long-term because it is designed not to earn any interest and that means that it is guaranteed to erode purchasing power every year. Cash can basically be thought of as an asset that gives you unparalleled near-term purchasing optionality, but gives you that optionality with the cost of losing the rate of inflation every year. So, definitely not something you want to hold onto for 10 years….

Gold – Ah, there’s gold in them thar hills! Yeah, we all know someone who has a love affair with gold. It’s pretty, has real economic utility, has a long history of being a reliable medium of exchange and has tended to maintain purchasing power.

The obvious problem with gold is that it has no cash flows. Ie, there is no fundamental reason why gold should rise in value other than its basic economic value as a commodity. That’s why I’ve always said gold is a basic commodity with a “faith put”. Ie, lots of people believe gold has certain monetary or inflation protecting qualities, but those are beliefs, not fundamental to gold itself.

So, is gold a good 10 year bet? If you believe its utility as a commodity is going to surge or that it will continue to be viewed as a good inflation hedge (and that inflation is about to surge) then yes, but there’s really no fundamental reason why gold should outpace a broad basket of commodities over the long-term. And commodities, at the end of the day, ARE the cost of inflation.

Bitcoin – Not sure what to say about Bitcoin that won’t get me in trouble with a whole slew of people. Bitcoin is a decentralized payment system. It’s digital cash. In fact, pegging Bitcoin to the USD would make it A LOT more useful because then it wouldn’t be so volatile and it would be a lot easier to settle intra-day payments with it. That is, after all, the biggest flaw in Bitcoin. It’s useful as a decentralized payment system, but it’s too volatile to be a reliable payment system.

Of course, its value has surged and crashed and surged and crashed because no one really knows whether it will be useful for anything in the long-term, but there’s no intrinsic reason why Bitcoin should have any value. Ie, no one has any idea whether Bitcoin should be worth $0 or $1,000,000. It’s a total gamble, especially over a 10 year period. Unlike gold, which has real economic utility as a commodity, there’s no necessary economic utility for Bitcoin. It’s easily replaced, non-essential and little more than a legacy asset within the broader crypto space. So, if you can afford to lose $10K it might be worth a flyer on a greater fool bet, but there’s no reason why Bitcoin can’t continue to crash lower and lower as people realize it’s just a flawed payment system with little intrinsic value.

10 Year T-Bonds – Bonds? Are you crazy man? Everyone knows interest rates are low and that that means bonds are a terrible option because rising rates means falling bond prices. Well, no. Not true at all. If you buy a 10 year T-Bond today you will earn about 3% every single year for the next 10 years. The US government pays those interest payments by taxing the most productive underlying private sector in the world. So you have a nearly guaranteed 3% return over 10 years. Not bad!

So, if you’re running a risk adjusted analysis here there’s really only one sensible option. It’s the one issued by a AAA rated entity that is currently paying higher than the rate of inflation. The one that just 11% of people in this poll think is a smart pick is, fundamentally, the only logical choice assuming you had to pick just one….

NB – Do it. I know you want to tear me apart in the comments or on Twitter. Let me have it. I literally asked for it. Also, have a great weekend.