Here are some things I think I am thinking about. 1) Has Mr. Market Finally Lost His Mind? It seems that everyone is losing their mind over politics so I’ve been rather amazed that the financial market has held it together this long. That changed a bit in October as the MSCI All World Stock Index took a 12% dive. Now, what’s interesting about the stock market downturn is that the wheels have been in motion here for almost all of 2018. The MSCI All World Index, the only true measure of “the stock market”, peaked in January. While US stocks continued higher the total world has done rather poorly all year long. So this isn’t really all that new if you’ve been paying attention. But has the market lost its mind and will it get crazier? Well, no one knows for sure, but there’s a strong

Topics:

Cullen Roche considers the following as important: Most Recent Stories

This could be interesting, too:

Cullen Roche writes Understanding the Modern Monetary System – Updated!

Cullen Roche writes We’re Moving!

Cullen Roche writes Has Housing Bottomed?

Cullen Roche writes The Economics of a United States Divorce

Here are some things I think I am thinking about.

1) Has Mr. Market Finally Lost His Mind? It seems that everyone is losing their mind over politics so I’ve been rather amazed that the financial market has held it together this long. That changed a bit in October as the MSCI All World Stock Index took a 12% dive.

Now, what’s interesting about the stock market downturn is that the wheels have been in motion here for almost all of 2018. The MSCI All World Index, the only true measure of “the stock market”, peaked in January. While US stocks continued higher the total world has done rather poorly all year long. So this isn’t really all that new if you’ve been paying attention.

But has the market lost its mind and will it get crazier? Well, no one knows for sure, but there’s a strong argument to be made that the market had lost its mind for 8 years. After all, bear markets are born in bull markets. The way I like to see things, the stock market is an instrument that pays about 7-8% per year in nominal terms and can’t mathematically pay out much more than that over the very long-term. That is, after all, approximately the rate of corporate profits. So, when you go through these long periods of multiple expansion and 10%+ returns you have to wonder – “when is Mr. Market going to give back some of that excess return?” Said differently, a little smoothing in stock market returns in the coming years isn’t really a bad thing. It’s actually Mr. Market adjusting for what had been a period of very high unsustainable returns.

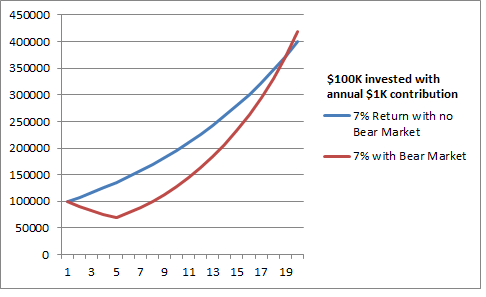

2) Wait a Second, Should we be Begging for a Bear Market? Speaking of bear markets – I posted this chart on Twitter and some people lost their minds over it. What it’s showing is somewhat theoretical, but also practical. Basically, when the stock market falls it generally results in multiple compression and higher expected future returns. So, let’s say you have two investors who earn a 7% annualized return over time, but one investor experiences a big bear market and continues to invest through the bear market when multiples compress. Strangely, that investor does better in the long-term because they invest more money into a higher return generating asset class during the bear market while the other investor invests into an expensive but steady market.

In fairness, we’re assuming that the bear market bounces back with higher expected future returns, but you get the basic point. In essence, for the long-term investor they should be begging for a bear market where they can invest more money at more attractive prices. This is especially true of the young, low income generating investor who will be able to invest more of a higher future income into the market into a potential bear market.

The flip side of this is that most of us aren’t super long-term investors. Most of us are something middle-of-the-road. So, maybe all those people who lost their minds on Twitter over this have a good point. And that’s what makes all of this so hard – we need to think more long-term, but our liabilities are mostly short-term. The key is finding that right balance where you can maintain a strategy that is intelligently long-term, but not irrationally long-term.

3) The Wall Street Math Hustle. I won’t say much about this article other than it’s fantastic and you should read it. It gets into a lot of the stuff I talk about here regularly – how chasing market beating returns is bad; how paying high fees is bad; how most of what Wall Street sells is the illusion of sophistication and the guarantee of high fees in exchange for the hope of market beating returns. You’ll love this piece, especially if you’re into bashing nerdy financial types.¹

I don’t like bashing my own industry, but I believe there’s a better way to offer financial advice and investment management without the high fees and salesmanship about market beating returns.

¹ Wait a second here – I am a nerdy financial type…uh oh.