The recent rise in initial jobless claims: signal or noise? Yesterday initial jobless claims for the prior week were reported at 234,000, a six month high. That’s 32,000 above the recent one week low. The four week moving average rose to 223,250, more than 15,000 higher than its recent low: Is it cause for concern? After all, the long leading indicators have been neutral for half a year, and in the last several weeks their more volatile high frequency version turned negative, so it is reasonable to expect short leading indicators to start to follow suit. To cut to the chase, while it is certainly possible that it is the beginning of something worse, we aren’t anywhere near the point where we can rule out it simply being noise (although it certainly

Topics:

NewDealdemocrat considers the following as important: US/Global Economics

This could be interesting, too:

Joel Eissenberg writes How Tesla makes money

Angry Bear writes True pricing: effects on competition

Angry Bear writes The paradox of economic competition

Angry Bear writes USMAC Exempts Certain Items Coming out of Mexico and Canada

The recent rise in initial jobless claims: signal or noise?

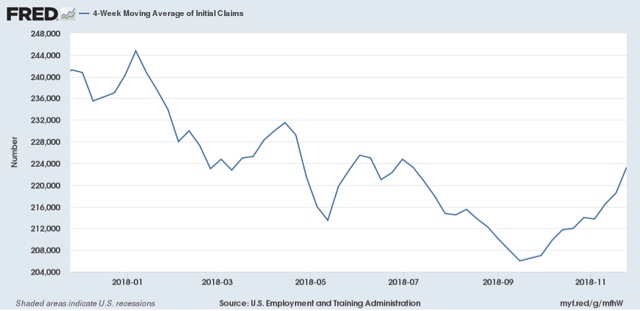

Yesterday initial jobless claims for the prior week were reported at 234,000, a six month high. That’s 32,000 above the recent one week low. The four week moving average rose to 223,250, more than 15,000 higher than its recent low:

Is it cause for concern? After all, the long leading indicators have been neutral for half a year, and in the last several weeks their more volatile high frequency version turned negative, so it is reasonable to expect short leading indicators to start to follow suit.

To cut to the chase, while it is certainly possible that it is the beginning of something worse, we aren’t anywhere near the point where we can rule out it simply being noise (although it certainly suggests that the monthly unemployment rate isn’t going to decline any further in the next few jobs reports, since initial claims lead the unemployment rate by several months). I’ve arrived at a formulation for distilling signal from noise, which will be the subject of a longer post, but consider this an introductory sketch.

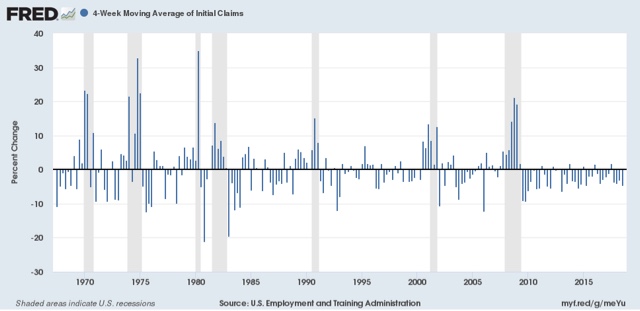

While I won’t go into all the details here, the simple fact is that there is almost always one or two periods a year where the four week moving average of jobless claims rises between 5% and 10%. About once every other year for the past 50+ years, it rises over 10%. Typically (not always!) it has risen by 15% or more over its low before a recession has begun. And a longer term moving average of initial claims YoY has, with one exception, turned higher before a recession has begun.

As of yesterday, the four week moving average is only 8.4% above its September low of 206,000, so we are still well within the range of normal fluctuations during an expansion.

Another way to look at this is the quarter over quarter percent change in the average of weekly initial claims:

You can see that, even in the middle of expansions, increases of 5% are not uncommon.

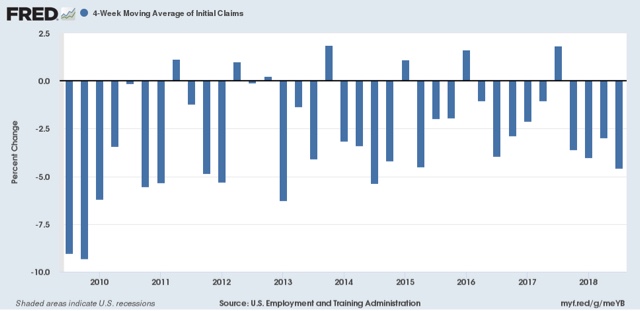

Here’s the close-up of this expansion:

For the first 8 weeks, this quarter is running between 4% and 5% higher than last quarter.

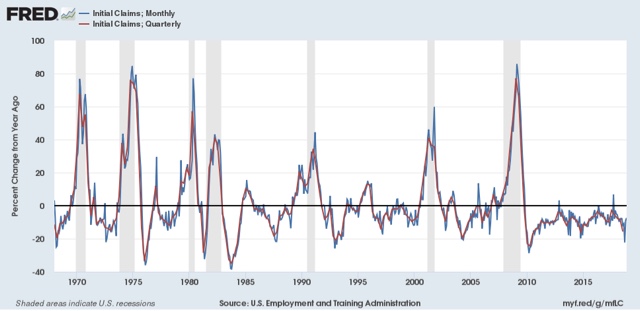

A second way to parse signal from noise is to look at readings YoY. With the sole exception of 1981, when the Fed was drastically raising rates, the number has always been higher YoY by the time a recession begins:

As shown above, this is true whether we measure on a monthly (blue) or quarterly (red) average. The monthly YoY average signals first, but results in many more false positives. The 13 week moving average gives one or two months less warning, but is much less likely to give a false positive.

As of yesterday, initial claims are -7.5% lower YoY, so are nowhere near cause for concern.

I’ll lay out a more detailed explanation of what it would take for me to hoist a yellow or red flag, or “neutral” or “negative” reading on initial claims, in the next week or two, but for now, suffice it to say that since I am anticipating a slowdown next year, I am not anticipating initial claims making any significant new low compared with September, but on the other hand, it would take an increase in the four week moving average to nearly 240,000 for a yellow caution flag to be triggered.