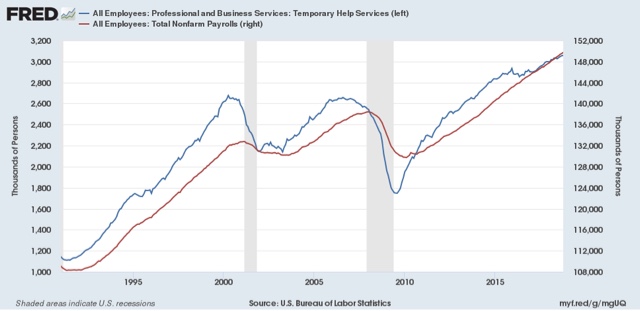

Why this Friday I’ll pay particular attention to the temporary jobs number With the long leading indicators outside of corporate profits and ease of credit having turned neutral to negative, at least for now, my attention is turning more and more to the short leading indicators. And one of those — temporary employment — is of particular importance to the overall employment situation. It is reported as part of the overall monthly jobs report, and I will be paying particular attention to it when the November jobs report is issued this Friday. Since the BLS started to report the series in 1991, temporary employment has tended to peak roughly 6 to 9 months before overall employment, and to bottom roughly 3 months in advance: Here is the same

Topics:

NewDealdemocrat considers the following as important: US/Global Economics

This could be interesting, too:

Joel Eissenberg writes How Tesla makes money

Angry Bear writes True pricing: effects on competition

Angry Bear writes The paradox of economic competition

Angry Bear writes USMAC Exempts Certain Items Coming out of Mexico and Canada

Why this Friday I’ll pay particular attention to the temporary jobs number

Since the BLS started to report the series in 1991, temporary employment has tended to peak roughly 6 to 9 months before overall employment, and to bottom roughly 3 months in advance:

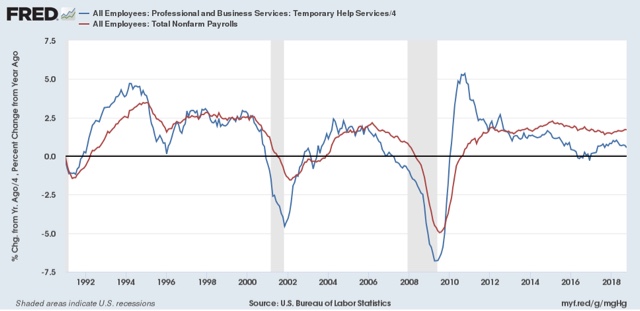

Here is the same information graphed as the YoY% change (note I’ve divided temp growth by 4 for purposes of scale):

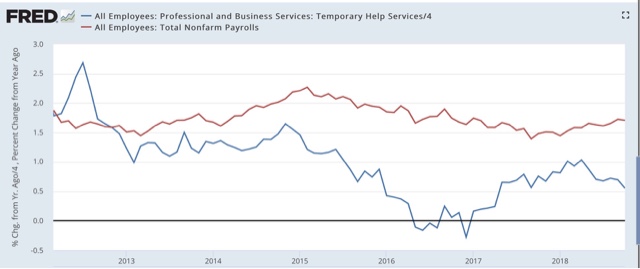

and here is a close-up since 2012. The lead and lag times have certainly been variable, but they are nevertheless clear:

The simple takeaway from the above is that temporary employment is still growing, which is positive for the jobs market in the coming months. BUT, while it hasn’t turned negative, that growth began to decelerate one year ago, and has slowed substantially in the last six months, causing YoY growth to be cut in half.

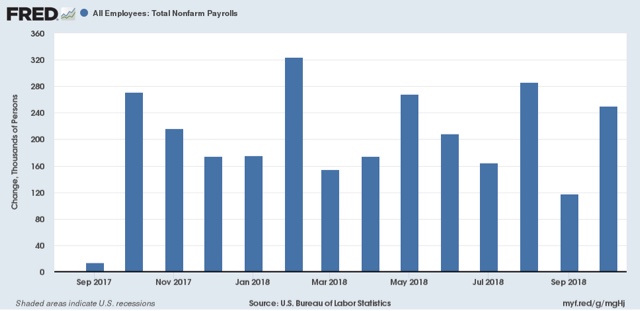

As a result, I am expecting the slowdown in growth to begin showing up in the overall employment numbers. Here’s what the monthly numbers look like since a little over a year ago:

Over the three months beginning last November, monthly jobs growth averaged a little under 190,000. While the monthly numbers a way too volatile, a slowdown to under 175,000 job gains per month in the next few months looks reasonable.

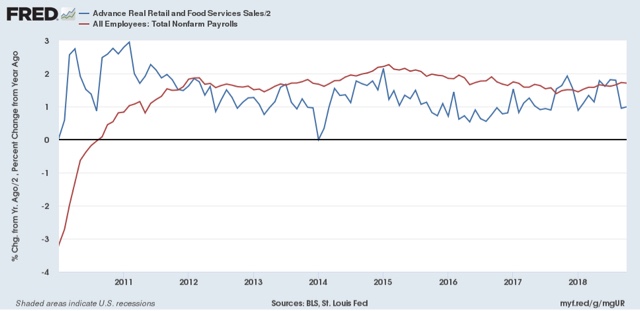

For completeness’ sake, I’ve also frequently noted that real retail sales, while very noisy m/m, has a good track record of leading employment by several months. Here’s the YoY% look at that since 2010:

This has also moderated as September 2017’s +1.7% monthly gain has disappeared from the YoY comparisons. It’s too soon to know for sure if real retail sales are confirming the recent slowdown in temp hiring.

In any event, on Friday I’m going to pay particular attention to the temp hiring number, and if that slowdown continues, I’ll start highlighting it in my monthly post on the jobs report.