Deficit growing despite tariffs. Could be J curve effect: Highlights A slight 0.1 percent decline in exports and a slight 0.2 percent gain in imports made for a sizable 1.7 percent deepening in the nation’s trade deficit in October to .5 billion which is just outside Econoday’s consensus range. The deficit with China was very deep, at .1 billion in October vs .2 billion in September for a year-to-date deficit of 0.8 billion that is 23 percent deeper than this time last year. This is important data for ongoing trade talks between the U.S. and China. October’s deficit with the EU, at billion, also deepened as did the deficit with Japan at .2 billion. The deficit with Mexico, at .2 billion, eased slightly while the deficit with Canada, at .9 billion,

Topics:

WARREN MOSLER considers the following as important: Economic Releases

This could be interesting, too:

WARREN MOSLER writes Consumer sentiment, real retail sales, industrial production, wages

WARREN MOSLER writes New manufacturers orders, vehicle sales, unemployment claims, rents, oil prices

WARREN MOSLER writes Saudi price hike, private payrolls, new hires, corporate profits

WARREN MOSLER writes Pending home sales, Durable goods orders, oil rigs and production

Deficit growing despite tariffs. Could be J curve effect:

Highlights

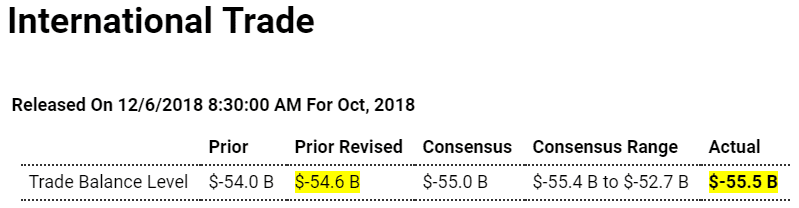

A slight 0.1 percent decline in exports and a slight 0.2 percent gain in imports made for a sizable 1.7 percent deepening in the nation’s trade deficit in October to $55.5 billion which is just outside Econoday’s consensus range.

The deficit with China was very deep, at $43.1 billion in October vs $40.2 billion in September for a year-to-date deficit of $420.8 billion that is 23 percent deeper than this time last year. This is important data for ongoing trade talks between the U.S. and China.

October’s deficit with the EU, at $17 billion, also deepened as did the deficit with Japan at $6.2 billion. The deficit with Mexico, at $7.2 billion, eased slightly while the deficit with Canada, at $1.9 billion, widened slightly. Note that country balances, unlike other data in this report, are not adjusted for calendar or seasonal effects.

Exports, in possible tariff effects, show another sizable drop in foods, feeds & beverages, to $10.3 billion vs September’s $11.0 billion. Exports of civilian aircraft were also weak, at $4.9 billion vs September’s $5.2 billion. Services exports, an area of strength for the U.S., edged higher in the month to $69.6 billion.

Foods, feeds & beverages on the import side rose slightly to $12.3 billion with imports of consumer goods, which are a special sore spot in the U.S. trade picture, rising $2.0 billion to $57.4 billion. Imports of services rose modestly to $47.0 billion.

October’s $55.5 billion headline deficit compares with a monthly average in the third-quarter of $52.8 billion and unfortunately marks a very weak opening for fourth-quarter net exports.

Tariffs taking their toll:

Highlights

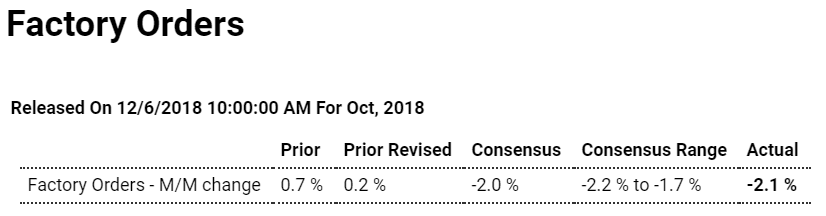

Held down by downturns in the defense goods and also civilian aircraft, factory orders sank 2.1 percent in October. The split between the report’s two main components shows a modest 0.3 percent increase for nondurable goods — the new data in today’s report where the gain is tied to printing and petroleum — and a 4.3 percent drop for durable orders vs 4.4 percent in last week’s advance report for this component.

Orders for defense goods have fallen 16.4 and 16.2 percent the last two reports but follow a giant 48.8 percent surge in August that was tied to aircraft. Orders for civilian aircraft in October and September have fallen 22.2 and 19.1 percent but here too follows an outsized gain in August, of 63.7 percent.

Core capital goods (nondefense ex-aircraft) are mostly weak in today’s report, with orders unchanged following declines of 0.6 and 0.2 percent in the prior two months. But core shipments, which are direct inputs into fourth-quarter GDP, did rise 0.3 percent for a respectable opening to fourth-quarter business investment.

Areas of strength in October include sharp order gains for fabrications, computers & electronics, and also electrical equipment. Other readings include a marginal 0.1 percent rise in factory inventories which will offset very strong October builds for retailers and wholesalers and will limit October’s contribution to GDP inventory. Both total shipments and also total unfilled orders posted soft 0.1 percent declines.

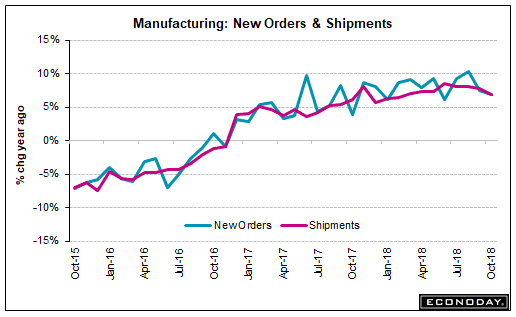

Monthly swings in aircraft can badly cloud results this report which focuses attention on the smoother reading of year-on-year change. This remains solidly positive at a 6.9 percent gain for total orders which, however, is down from 7.5 percent in September and a 4-year high of 10.3 percent in August. But a little slowing at year-end won’t dim manufacturing’s central contribution to the strength of the 2018 economy.

Still flat to down, much like housing:

Highlights

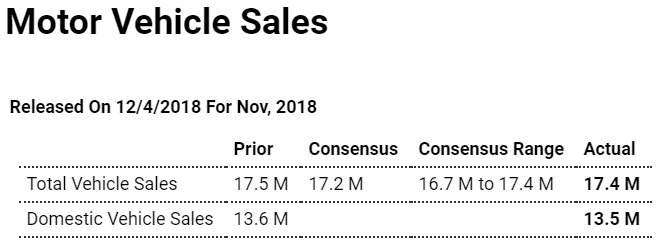

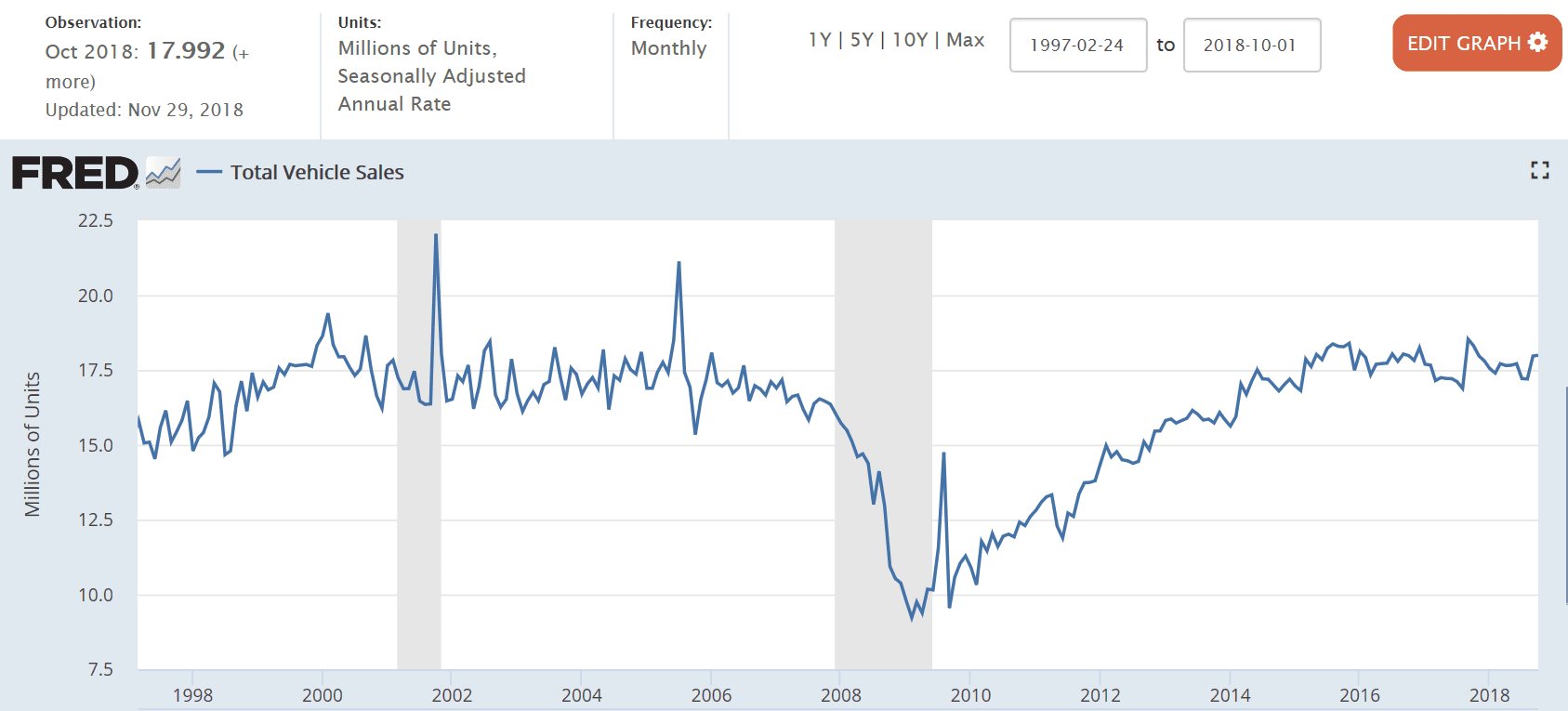

Unit vehicle sales in November came in on the high end of expectations but, at a 17.4 million annualized rate, still fell just short of October’s 17.5 million rate. The results do not point to a back-to-back monthly gain for motor vehicles which make up about 1/5 of total retail sales and which in October ended two months of declines. Yet November did come in at a very healthy rate with strength concentrated in light trucks which typically have high sticker prices and which help dollar totals of the retail sales report.

The IHS Markit Germany Composite PMI stood at 52.3 in November 2018, compared to a preliminary reading of 52.2 and October’s final 53.4. The latest reading pointed to the weakest pace of expansion in the private sector in nearly four years amid slower growth in service sector and a slight rise in manufacturing output that was the weakest for over five-and-a-half years. New orders rose the least since the start of 2015, with export orders falling for the third straight month, and job creation slowed. On the price front, output charge inflation eased to an 11-month low. Looking ahead, business confidence towards the outlook remained close to the lowest in almost four years. Composite Pmi in Germany is reported by Markit Economics.