Looks like the Fed hiked during a recession. Should make for interesting Congressional testimony… Maybe the hundreds of $ millions they spend on economic research isn’t enough???;) Sales remain at recession levels: Retail SalesHighlightsRetail sales proved disappointing in December, down 0.1 percent in a headline that is not skewed by vehicles or even that much by gasoline. Ex-auto sales also fell 0.1 percent while the core ex-auto ex-gas reading came in unchanged which is well below both expectations as well as low-end expectations. The Beige Book yesterday warned us about weak apparel sales which in this report fell a very steep 0.9 percent, in a decline that likely reflects more than just import-price contraction. The general merchandise category, which is very large, fell 1.0 percent in the month. Electronics & appliances also show contraction.December winds up what was a not-so-great year for the nation’s retailers. Total sales rose only 2.1 percent in the year, the smallest gain since 2009 and well down from 3.9 percent in 2014. Excluding motor vehicles, sales rose 0.9 percent, far lower than 2014’s 3.1 percent.There are, however, some positives in the report including another strong gain for restaurants, up 0.8 percent, and also another gain for furniture & home furnishings, up 0.9 percent in strength that confirms ongoing improvement in the housing sector.

Topics:

WARREN MOSLER considers the following as important: FED, GDP

This could be interesting, too:

Angry Bear writes GDP Grows 2.3 Percent

NewDealdemocrat writes Real GDP for Q3 nicely positive, but long leading components mediocre to negative for the second quarter in a row

Mike Norman writes Atlanta Fed reduces Q2 GDP forecast once again, as I said they would

Frances Coppola writes Why the Tories’ “put people to work” growth strategy has failed

Looks like the Fed hiked during a recession.

Should make for interesting Congressional testimony…

Maybe the hundreds of $ millions they spend on economic research isn’t enough???

;)

Sales remain at recession levels:

Retail Sales

Highlights

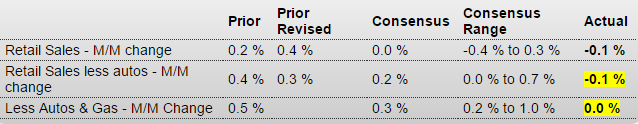

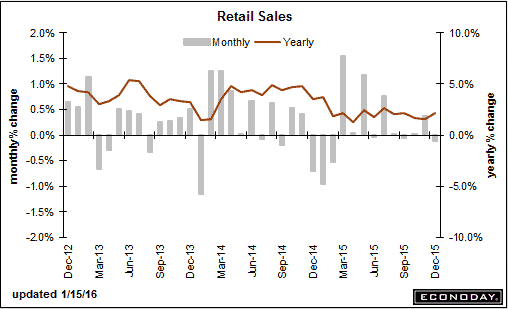

Retail sales proved disappointing in December, down 0.1 percent in a headline that is not skewed by vehicles or even that much by gasoline. Ex-auto sales also fell 0.1 percent while the core ex-auto ex-gas reading came in unchanged which is well below both expectations as well as low-end expectations. The Beige Book yesterday warned us about weak apparel sales which in this report fell a very steep 0.9 percent, in a decline that likely reflects more than just import-price contraction. The general merchandise category, which is very large, fell 1.0 percent in the month. Electronics & appliances also show contraction.December winds up what was a not-so-great year for the nation’s retailers. Total sales rose only 2.1 percent in the year, the smallest gain since 2009 and well down from 3.9 percent in 2014. Excluding motor vehicles, sales rose 0.9 percent, far lower than 2014’s 3.1 percent.

There are, however, some positives in the report including another strong gain for restaurants, up 0.8 percent, and also another gain for furniture & home furnishings, up 0.9 percent in strength that confirms ongoing improvement in the housing sector. But sales at non-store retailers rose only 0.3 percent for a second straight month which are moderate gains that do not confirm anecdotal reports of unusual holiday strength for online shopping.

Upward revisions do take some of the sting out of the December report but not much. November total sales are revised 2 tenths higher to plus 0.4 percent and reflects a sharp upward revision to vehicle sales to plus 0.5 percent. But vehicle sales couldn’t muster any strength in December, coming in unchanged. And sales at gasoline stations extended their long run of contraction that reflects falling oil prices, down 1.1 percent in December.

There’s plenty of jobs for consumers and gas prices are low — but so are wages. The consumer started to slow down at year end and that was before the new trouble in China. Today’s data will pull down expectations for fourth-quarter growth.

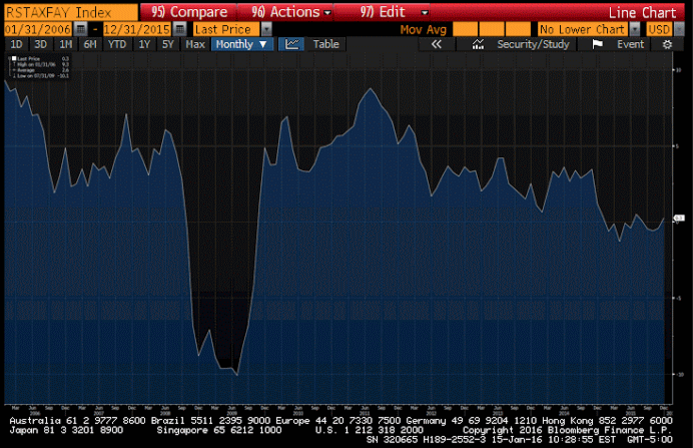

Retail Sales ‘control group’ (retail sales excluding food, auto dealers, building materials, and gas stations)

More recession evidence, and maybe worse…

Empire State Mfg Survey

Highlights

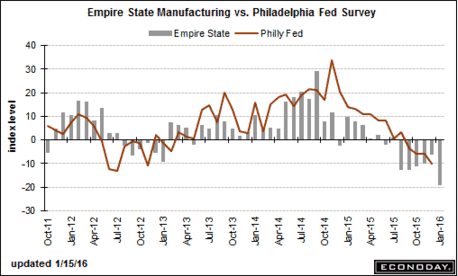

The contraction in factory activity in the New York manufacturing region, which began way back in August, unfortunately is picking up a lot of steam this month, at minus 19.37 for the January headline which is the lowest reading since April 2009. New orders, at minus 23.54, are contracting for an eighth straight month and at the sharpest pace since March 2009. Unfilled orders, at minus 11.00, are in an even deeper string of contraction. Employment, at minus 13.00, is down for a sixth straight month as is the workweek, at minus 6.00. And there’s a crumbling going on in the 6-month outlook which, at 9.51 is still in the positive column but shows the least optimism since way back in March 2009. This report is grim and offers an initial look at January’s factory activity which, based on these results, appears to be getting hit by global concerns.

More recession evidence, or worse…

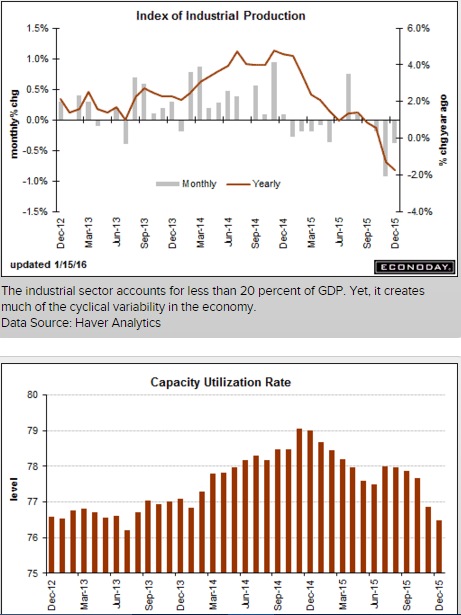

Industrial Production

Highlights

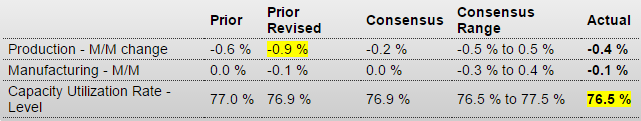

December was not a good month for the industrial economy as industrial production fell a sharper-than-expected 0.4 percent. Utility output, down 2.0 percent, declined for a third straight month reflecting unseasonably warm temperatures. Mining, reflecting low commodity prices and contraction in energy extraction, has also been week, down 0.8 percent for a fourth straight decline. Turning to manufacturing, which is the most important component in this report, production fell 0.1 percent for a second straight month (November revised downward from an initial no-change reading).Details on manufacturing include a second straight contraction for vehicles, down 1.7 percent following November’s 1.5 percent decline. Weakness here, along with weakness in the motor vehicle component of this morning’s retail sales report, will raise talk that the auto sector, which had been one of the highlights of the 2015 economy, may slow down in 2016, at least the early part of the year. Construction supplies are a positive, up 0.6 percent for the second strong showing in three months and confirming strength underway in data for construction spending.

Capacity utilization fell 4 tenths from a downwardly revised November to 76.5 percent. A low utilization rate, which is running roughly 4 percentage points below its long-term average, holds down the cost of goods.

Year-on-year rates confirm weakness, down 1.8 percent overall with utilities down 6.9 percent and mining down 11.2 percent. Manufacturing is in the plus column but it’s nothing spectacular, at plus 0.8 percent.

Making matters worse is a downward revision to November, now at minus 0.9 percent vs an initial decline of 0.6 percent. Looking at the annualized rate for the fourth quarter, industrial production fell 3.4 percent though manufacturing did increase but not much, up 0.5 percent. Weather factors are skewing utility output but otherwise, readings are fundamentally soft and reflect the downturn in global demand made more severe for U.S. producers by strength in the dollar.

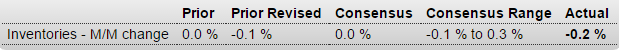

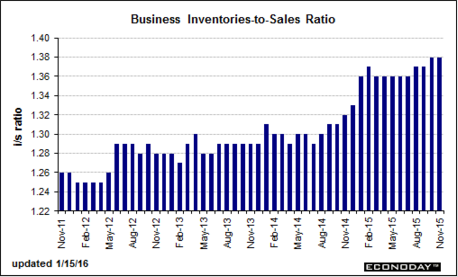

Inventories down some but sales down same so relative to sales inventories remain way high, another recession indication:

Business Inventories

Highlights

Inventories are contracting, the result of defensive draws in the wholesale and manufacturing sectors. Business inventories fell 0.2 percent in November following a decline in October of 0.1 percent. Wholesale inventories fell 0.3 percent for a second straight month with manufacturing down 0.3 percent following October’s 0.2 percent draw. Retail, up 0.2 and 0.1 percent in November and October, was the only sector adding inventories and today’s weak results for December retail sales may point to an unwanted build for December.Relative to sales, which also fell 0.2 percent and were down 0.3 percent in October, total inventories are stable, at a ratio of 1.38. This report is indicative of economic weakness and will not be building expectations for fourth-quarter growth let alone the outlook for first-quarter growth.

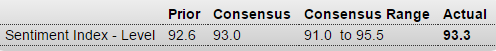

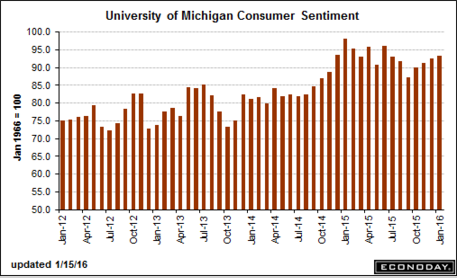

This was up a tad so they have something to report on the news. But even here the current conditions took a dive. And, as previously discussed, this is one man one vote, not one dollar one vote, and total spending has been decelerating:

Consumer Sentiment

Highlights

The first indication of the China effect on U.S. consumers looks positive but ultimately is mixed. January’s flash consumer sentiment index did rise 7 tenths from final December to 93.3 but current conditions, the component that picks up the immediate impact of special factors, fell 3.0 points to 105.1. Should volatility in markets begin to ease and confidence in China improve, this reading could pop back as quickly as month end.Lifting the mid-month index is a rise in the expectations component, up 3.0 points 85.7. Behind this gain is strength in the jobs market and perhaps even falling oil prices as 1-year inflation expectations are down a sizable 2 tenths to 2.4 percent. This is offset in part by a 1 tenth rise in 5-year expectations to 2.7 percent.

The resilience in long-term optimism is a plus for the U.S. economy though the eroding in short-term inflation expectations will not be encouraging to Federal Reserve policy makers who have launched a rate-hike sequence for an economy still struggling against deflation. The Dow is moving off opening lows in early reaction to this report.