Not long ago they blamed cold weather, now it was the warm weather. And this time not a word about the consumer not spending his gas savings…;) Holiday sales fall short of forecasts: NRF Jan 15 (CNBC) — The National Retail Federation said Friday that holiday sales increased 3 percent to 6.1 billion in November and December, falling short of the trade group’s forecast for 3.7 percent growth, as unseasonably warm weather and low prices weighed on results.The news came shortly after the Commerce Department said retail sales posted an unexpected drop in December, falling 0.1 percent from the previous month. Compared with the prior year, December sales rose 2.2 percent, to 8.1 billion, according to the government data.During the October to December period, total sales rose 1.8 versus the prior year, according to the department. Total sales for all of 2015 increased 2.1 percent, representing their weakest result since 2009, Reuters said.“Make no mistake about it, this was a tough holiday season for the industry,” said NRF President Matthew Shay. “Weather, inventory challenges, advances in consumer technology and the deep discounts that started earlier in the season and that have carried into January presented stiff headwinds.”“Despite these factors, the industry rallied, consumers responded and sales still grew at a healthy rate.

Topics:

WARREN MOSLER considers the following as important: GDP

This could be interesting, too:

Angry Bear writes GDP Grows 2.3 Percent

NewDealdemocrat writes Real GDP for Q3 nicely positive, but long leading components mediocre to negative for the second quarter in a row

Mike Norman writes Atlanta Fed reduces Q2 GDP forecast once again, as I said they would

Frances Coppola writes Why the Tories’ “put people to work” growth strategy has failed

Not long ago they blamed cold weather, now it was the warm weather.

And this time not a word about the consumer not spending his gas savings…

;)

Holiday sales fall short of forecasts: NRF

Jan 15 (CNBC) — The National Retail Federation said Friday that holiday sales increased 3 percent to $626.1 billion in November and December, falling short of the trade group’s forecast for 3.7 percent growth, as unseasonably warm weather and low prices weighed on results.

The news came shortly after the Commerce Department said retail sales posted an unexpected drop in December, falling 0.1 percent from the previous month. Compared with the prior year, December sales rose 2.2 percent, to $448.1 billion, according to the government data.

During the October to December period, total sales rose 1.8 versus the prior year, according to the department. Total sales for all of 2015 increased 2.1 percent, representing their weakest result since 2009, Reuters said.

“Make no mistake about it, this was a tough holiday season for the industry,” said NRF President Matthew Shay. “Weather, inventory challenges, advances in consumer technology and the deep discounts that started earlier in the season and that have carried into January presented stiff headwinds.”

“Despite these factors, the industry rallied, consumers responded and sales still grew at a healthy rate.”

How the industry generated this growth, however, remained a top concern among analysts. They cautioned that profitability will likely take a hit when retailers start rolling out their fourth-quarter earnings results in coming weeks, thanks to aggressive discounts.

“Knowing that the topline growth was fueled by promotions tells us that the real number for us to focus on is … the individual bottom-line results for retailers, because that’s where we’re going to see the real profitability numbers,” said Steve Barr, PwC’s U.S. retail and consumer leader.

Industry forecasts had called for modest sales growth this holiday season, as low gas prices and a stronger economy battled against muted wage gains and higher rent and health-care costs. Retailers that cater to middle-income shoppers faced even more headwinds, including price deflation and a shift in consumer spending toward dining out or travel.

As a result, the National Retail Federation predicted retail sales excluding autos, gas and restaurants would increase 3.7 percent in November and December, compared with the prior year’s 4.1 percent growth.

In the same vein, consulting firm AlixPartners forecast holiday sales (excluding motor vehicles, food services and dining, and gas stations) would rise 2.8 to 3.4 percent during the final two months of the year, compared with 4.4 percent growth in 2014.

And Deloitte, whose prediction covers the November through January period (but excludes motor vehicles and gasoline) predicted a 3.5 to 4 percent increase. That would mark a slowdown from its recorded 5.2 percent gain the prior year.

As the season progressed, however, analysts grew more pessimistic that sales would meet these forecasts. Despite retailers’ best efforts to get shoppers into their stores earlier, November got off to a slow start. Then, over the critical Black Friday weekend, ShopperTrak data indicated that sales fell an estimated 10.4 percent.

What’s more, unseasonably warm weather through December took a huge bite out of retailers’ traffic and sales, with Planalytics calculating a $572 million sales loss for specialty apparel stores during the final two months. That figure does not even take into account department stores, which also rely heavily on apparel. In its holiday sales release,Macy’s blamed 80 percent of its 4.7 percent same-store sales decline on cold-weather goods.

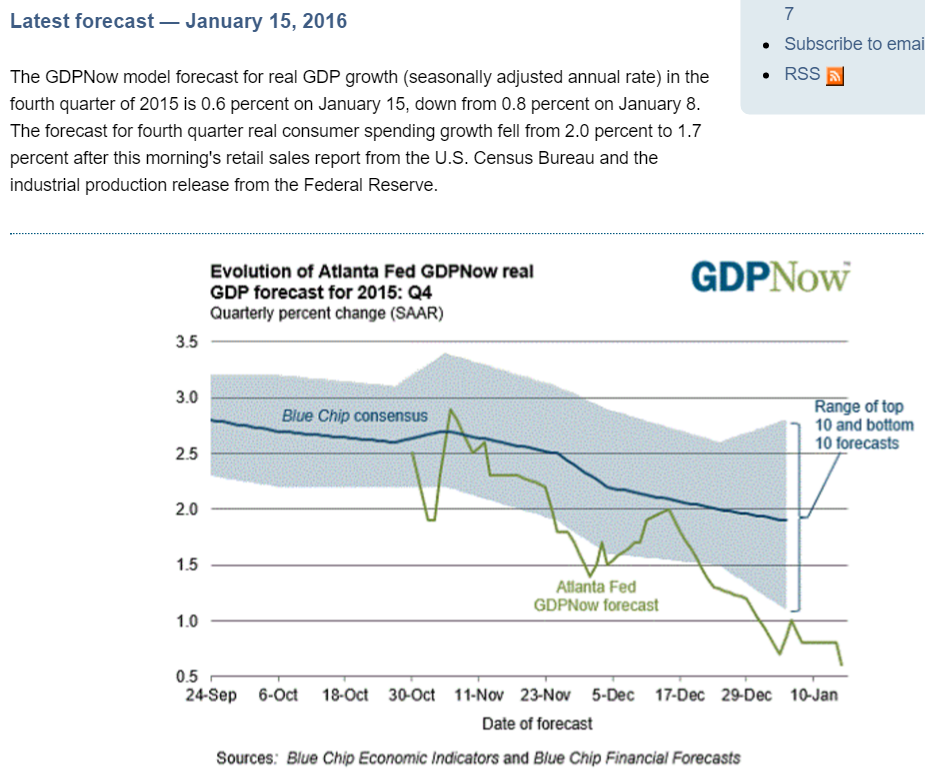

Down again, now forecasting only .6% GDP growth for Q4: