February short leading data starts out decent We’ve had two pieces of forward looking data in the last week (in addition to the leading bits in the employment report). The first was the ISM manufacturing index: Contrary to my expectations, the most leading new orders component rebounded sharply, up to 58.2. This is closer to its “hot” readings of mid-2018 than to its tepid 51.3 in December. The second was motor vehicle sales. After housing, this is usually the second aspect of consumer spending to turn. While not great, it was OK: (H/t Calculated Risk). Motor vehicle sales tend to have long plateaus during expansions, before turning down in the 6 to 12 months before a recession. For me to think such a deterioration has started, I would need to see

Topics:

NewDealdemocrat considers the following as important: US/Global Economics

This could be interesting, too:

Joel Eissenberg writes How Tesla makes money

Angry Bear writes True pricing: effects on competition

Angry Bear writes The paradox of economic competition

Angry Bear writes USMAC Exempts Certain Items Coming out of Mexico and Canada

February short leading data starts out decent

We’ve had two pieces of forward looking data in the last week (in addition to the leading bits in the employment report).

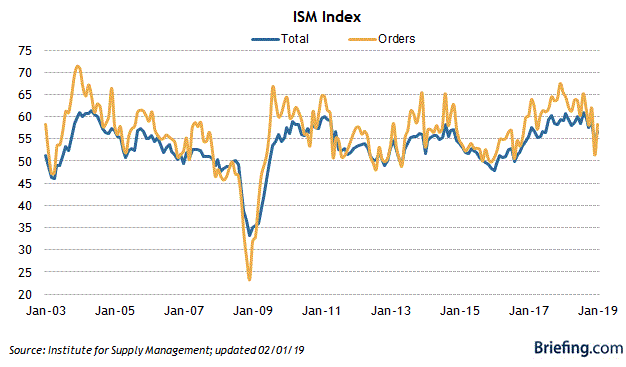

The first was the ISM manufacturing index:

Contrary to my expectations, the most leading new orders component rebounded sharply, up to 58.2. This is closer to its “hot” readings of mid-2018 than to its tepid 51.3 in December.

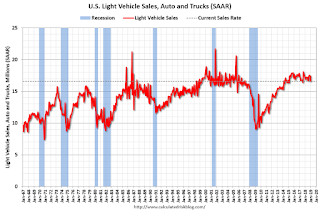

The second was motor vehicle sales. After housing, this is usually the second aspect of consumer spending to turn. While not great, it was OK:

Motor vehicle sales tend to have long plateaus during expansions, before turning down in the 6 to 12 months before a recession. For me to think such a deterioration has started, I would need to see more than one month of less than 16.5 units sold. In January, 16.6 units were sold on an annualized basis.

No signs of any imminent downturn in this data, even though both have backed off from their best readings.