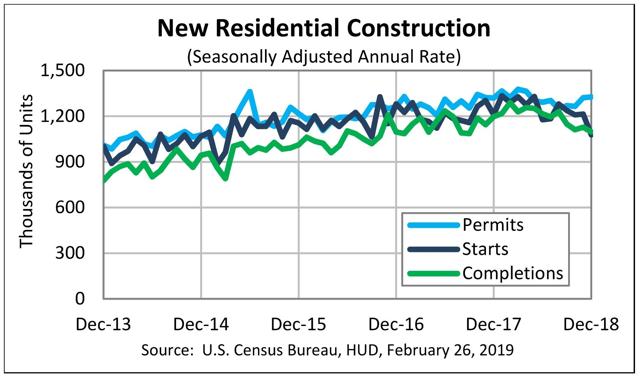

December housing permits and starts mixed, support slowdown scenario This morning we finally got December housing permits and starts. Remember that starts are more volatile than permits, and single family permits are the least volatile of all. Here’s what the overall data looks like: While starts and completions laid an egg, permits actually went up a little bit. In particular, for housing to be outright recessionary, I would want to see single family housing permits down -10% from peak at minimum. This morning’s data has them down only about -6.5% off peak, just slightly above their worst showing of 2018. In other words, this morning’s report says slowdown rather than recession to me. On a side note, the talking heads on CNBC were bemoaning

Topics:

NewDealdemocrat considers the following as important: US/Global Economics

This could be interesting, too:

Joel Eissenberg writes How Tesla makes money

Angry Bear writes True pricing: effects on competition

Angry Bear writes The paradox of economic competition

Angry Bear writes USMAC Exempts Certain Items Coming out of Mexico and Canada

December housing permits and starts mixed, support slowdown scenario

Here’s what the overall data looks like:

While starts and completions laid an egg, permits actually went up a little bit.

In particular, for housing to be outright recessionary, I would want to see single family housing permits down -10% from peak at minimum. This morning’s data has them down only about -6.5% off peak, just slightly above their worst showing of 2018.

In other words, this morning’s report says slowdown rather than recession to me.

On a side note, the talking heads on CNBC were bemoaning that lower mortgage rates hadn’t led to an substantial increase in housing starts. But as I’ve pointed out many times, permits and starts follow interest rates with about a 3 to 6 month lag. In other words, consistent with a bottom in housing construction this spring.

I’ll have more to say probably tomorrow at Seeking Alpha. When the post goes up, I’ll link to it here.