Share the post "Dear Hedge Funds: Index Funds Didn’t Eat Your Returns" Indexing strategies have been the fastest growing segment of the asset management world in the last 15 years due to low fees, tax efficiency, diviersification and the failure of higher fee active managers to justify their higher fees. As this trend plays out we’re hearing more and more stories about how this trend is bad for investors and how we need these old high fee active managers to better manage the asset space. The latest story about the inevitable day of reckoning due to index funds comes from hedge fund manager Bill Ackman. Ackman’s flagship hedge fund has failed to outperform the S&P 500 by a wide margin in the last few years and his 2015 annual letter blamed index funds for some of the troubles. How much of this is true though? Let’s explore some of Ackman’s comments in more detail. First, we should note that much of the confusion in this debate stems around the mythical distinction between “active” and “passive” investing. As I’ve noted many times before, the market is comprised entirely of active participants whose level of activity ranges from silly (high fee day trading, for instance) to intelligent (your typical Boglehead type of approach often referred to as “passive indexing”).

Topics:

Cullen Roche considers the following as important: Most Recent Stories, Myth Busting

This could be interesting, too:

Cullen Roche writes Understanding the Modern Monetary System – Updated!

Cullen Roche writes We’re Moving!

Cullen Roche writes Has Housing Bottomed?

Cullen Roche writes The Economics of a United States Divorce

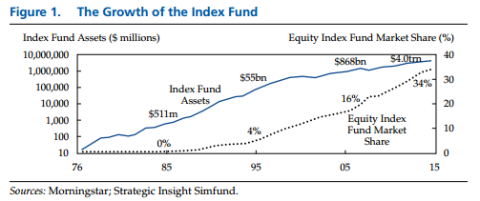

Indexing strategies have been the fastest growing segment of the asset management world in the last 15 years due to low fees, tax efficiency, diviersification and the failure of higher fee active managers to justify their higher fees. As this trend plays out we’re hearing more and more stories about how this trend is bad for investors and how we need these old high fee active managers to better manage the asset space.

The latest story about the inevitable day of reckoning due to index funds comes from hedge fund manager Bill Ackman. Ackman’s flagship hedge fund has failed to outperform the S&P 500 by a wide margin in the last few years and his 2015 annual letter blamed index funds for some of the troubles. How much of this is true though? Let’s explore some of Ackman’s comments in more detail.

First, we should note that much of the confusion in this debate stems around the mythical distinction between “active” and “passive” investing. As I’ve noted many times before, the market is comprised entirely of active participants whose level of activity ranges from silly (high fee day trading, for instance) to intelligent (your typical Boglehead type of approach often referred to as “passive indexing”). Since “the market” is comprised of ONE portfolio of all outstanding global financial assets and all market participants deviate from this globally cap weighted portfolio then the distinction between active (those who try to beat the market) and passive (those who try to capture the market return) is far murkier than most would have you believe.

This distinction is important to understand because the rise of less active investors creates greater opportunities for more active managers. This is due to the fact that a “passive” product requires active management. For every passive investor who doesn’t want to waste time and money buying every stock in a stock index fund there is a more active manager or market maker ensuring that that product trades at the net asset value that that less active investor desires. Indeed, passive investors pay active investors in various forms (spreads, market data fees, arbitrage, etc) for owning their less active product. Some active managers like high frequency trading firms and other market makers have made gobs of money during the rise of index funds thanks largely to the efficient way in which they make the indexing process operate. There is no clear distinction between active and passive investing because passive investing necessarily requires an active manager just like a market requires both a buyer and a seller. But let’s move on to some of Ackman’s claims.

Are index funds causing high valuations? Ackman says that index funds are causing unusually high valuations in some stock indices:

“As more and more capital flows to index funds – and certain index funds such as those tracking the S&P 500 receive disproportionate amounts of investor capital – the valuation of the indexed constituent companies increases. While some investors consider the valuation of the index components when allocating to specific index funds, many and perhaps most do not. We would expect that many if not most investors picked an index fund when they signed up for their 401(k) plans and never looked back.”

Index funds are a growing segment of the world, but this thinking implies that index funds are now the marginal price setter of “the market”. This might be becoming increasingly true, but as of 2015 index funds were still a relatively small piece of all asset managers at just 34%. Bear in mind, much of this money is simply “index funds” inside of active strategies (see the rise of the many tactical asset allocation ETFs, for instance). The annual turnover of the 100 largest ETFs is 864% which shows that ETFs are far more “active” than most people think.

(Source: John Bogle, The Index Mutual Fund: 40 Years of Growth, Change, and Challenge¹)

More importantly, even if index funds are influencing valuations then this should create more opportunities for more active managers. After all, if Ackman thinks that the US markets are overvalued and that the tide is essentially lifting all boats then one has to wonder why he has any exposure to US markets in the first place. The purpose of a more “active” strategy is to find slices of the market that won’t expose investors to systemic risk. This is what the higher fees are supposed to justify, after all. If the more active investor can’t expose those uncorrelated corners of “the market” then one has to wonder what purpose the manager is serving in the first place.

Further, Ackman’s comments about US stocks and index funds are a fallacy of composition. After all, the rise of index funds is a global phenomenon and many global markets (like emerging markets) have become quite attractive in relative value terms over the last 10 years when compared to US stocks.² Savvy managers should be able to exploit the attractive valuations in parts of the world where valuations have declined substantially, but despite the supposed upward pressure from indexing, many of these foreign markets have appeared more like value traps than anything else.

Do Index Funds Create a Lack of Governance? Ackman asserts that the growth in indexing will lead to less shareholder involvement in corporate management. He says:

“While index fund managers are, of course, fiduciaries for their investors, the job of overseeing the governance of the tens of thousands of companies for which they are major shareholders is an incredibly burdensome and almost impossible job.”

The reason indexing has become so prominent is because there is tremendous evidence proving that “the market” allocates capital better than more active high fee managers. The rise of indexing is consistent with the view that “the market” does not believe people like Bill Ackman know more about a corporation than the people who run that corporation. I find it rather odd that so many hedge fund managers believe they know more about corporations than the people who have spent their lives running and building those corporations.

Further, the data above showing index funds as a % of total assets in index funds shows that index funds don’t “control” corporate America. They are, at best, still a minority participant. And more importantly, the rise of short-termism has coincided perfectly with the growth in activist hedge funds because most of these funds have time horizons that are much shorter than corporations would prefer. An asset manager literally cannot think long-term like a corporation because they are judged by their annual returns. Hedge funds will never have a truly long-term time horizon. They will necessarily do what is in the best interests of the short-term because they must impose their short-term needs on firms. Perhaps this isn’t true of Ackman’s firm, but it is certainly true of active managers in general.

Is Indexing Turning the USA in Japan? Ackman’s most outrageous claim is that indexing might turn America into Japan:

If the index fund trend continues, and it looks likely to do so, what happens when index funds control Corporate America? Courts have often deemed shareholders to be in control of a corporation with as little as 20% of the ownership of a company. At current rates of asset inflows, it will not be long before index funds effectively control Corporate America and the corporations of many foreign countries. The Japanese system of cross corporate ownership, the keiretsu, has been blamed for decades of Japanese corporate underperformance and economic malaise. Large passive ownership of Corporate America by index funds risks a similar outcome without the counterbalancing force of large active investors and improvements in the governance oversight implemented by passive index fund managers.

If index funds control corporate America then more of these high fee active managers will stop pretending that they know more about corporations than the great entrepreneurs who built those businesses. But more importantly, the stock market is not the economy. Japan’s economy is not suffering because there is a dearth of activist managers to help guide Japanese corporations to success (as if hedge fund managers create the productive output that make corporations great in the first place). The Japanese economy is suffering primarily because they have an insurmountable demographic problem. The Japanification of the US stock market is one of the great red herrings used by high fee active managers trying to scare the world into believing the rest of us can’t survive without their existence.

Indexing isn’t eating hedge fund returns. As I noted recently, it’s high fees that are eating hedge fund returns. In fact, if you look at Ackman’s own shareholder letter you’ll notice that one of the biggest things eating returns are the high fees. The gross return of 37.3% over the last three years was cut nearly in half due to fees which reduce it to just 22.2%! Index funds aren’t eating the returns from hedge funds. It’s the high fees that are eating the returns from hedge funds. Ackman and other hedge funds would do better by their shareholders if they reduced their fees rather than blaming low fee index funds for their inability to identify pockets of the market that will generate better returns.

Sources:

¹ – John Bogle, The Index Mutual Fund: 40 Years of Growth, Change, and Challenge

² – Rob Arnott, King of the Mountain: Finding Short-term Efficacy in the Shiller PE Ratio