Warning – hard money types are going to lose their minds over this article. I apologize in advance. It’s impossible to talk about interest rates without running into people who think the Fed has “manipulated” interest rates lower than they otherwise would be. As if the bond market has become nothing more than one huge completely manipulated Federal Reserve market. This is a really intuitively appealing argument and it’s not even completely wrong, but I want to add some important...

Read More »Everything Wrong with the “Money Printer Go Brrrr” Meme

You’ve probably seen some version of the following meme in the last few years. In case you haven’t it’s generally used to infer that Jerome Powell is printing money and hyperinflation is coming. I love a good meme and few things make me happier than hilarious nonsense on the internet. So I feel bad debunking this meme because it’s kind of funny and memes are mostly harmless, but this is one of those memes used by people who want you to believe something that isn’t right. Anyhow let’s get...

Read More »The Scarcity of Money Myth

I’m here to ruin some long running narratives. I apologize in advance. Money is not scarce. It never has been and it never will be. More importantly, scarcity of money is not a strength.¹ It is a weakness. Sound weird? Yeah, I bet. Let me explain. Back in college I was kind of obsessed with commodities and commodity money. I’d been reading a lot of Austrian econ and all that stuff. But then I came across the endogenous money theories and I learned over time that money is not a physical...

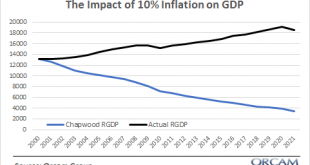

Read More »Is Inflation Really 10%?

One of the long running themes on this website is low inflation and debunking narratives about how very high inflation might be around the corner. I like to work from a first principles understanding, looking at things for what they are and trying to be as objective as possible. Overall, my predictions about low inflation and low interest rates over the last 10 years have been mostly spot-on. Sure, in the last year I’ve been predicting rising inflation due to the huge stimulus measures,...

Read More »Government Bond Markets Aren’t “Free” Markets

This is one of those posts that is operational in nature, but will sound political to some people. Before you send me a mean email please try not to politicize the issue.¹ I hope this is helpful. Here’s a question I got from Twitter: “Cullen, why not let government bond markets be free and not manipulated?” I see this one a lot and it’s based on a misunderstanding of “free markets” and how they relate to the government. So let’s dive in. First, currencies are essentially imposed on us. So...

Read More »The Dangerous Myth of ‘Taxpayer Money’ Raúl Carrillo and Jesse Myerson

Ends with a political rant, but the part about "taxpayer money" being public money in reality is correct.SplinterThe Dangerous Myth of 'Taxpayer Money'Raúl Carrillo, practicing attorney and a director of The Modern Money Network and Jesse Myerson, an Indiana-based community organizer with Hoosier Action

Read More »Stop Saying MMT Describes Reality – It Doesn’t

I had a good laugh at this Tweet from Jo Michell (who is a very good economist by the way). It seems to be from a UK blog advocating for MMT: Now, I may not be an expert on sexual intercourse, but I am an expert about money creation and so that qualifies me to tell you that, based on this comment, this guy doesn’t know what sexual intercourse is. The simple fact is that MMT does not, definitively does not, describe the existing reality of the monetary system. Let me explain. First, MMT...

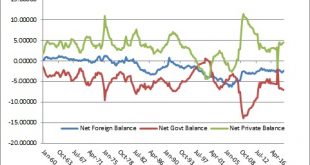

Read More »Let’s Talk About Sectoral Balances

I am a big fan of looking at things through the lens of the sectoral balances. For instance, I sometimes post this chart on this website which depicts the government’s balance vs the non-government. (This is a stupid chart without a lot more context) It’s a decent (though incomplete) depiction of the private sector’s balance versus the government’s position and it’s helpful to understand because, mainly, if you believe the private sector is too heavily indebted, then the government’s...

Read More »EVERYONE Funds Their Spending

One of the most confused (and confusing) elements of endogenous money is the idea of “funding”. Endogenous money is not a new theory, but it is not well understood even to this day. Even many supposed endogenous money theorists, like the MMT people, misunderstand it and as MMT has gained some popularity I am seeing increasing misinterpretations. So let’s dive in and see if I can’t explain this more succinctly and clearly. Endogenous money is the fact that anyone can expand their balance...

Read More »Let’s Stop Talking About “Paying Off the National Debt”

When we talk about personal finance we often talk about paying off our debts to become financially free. But this is a fallacy of composition. While some households can pay off their debts, the economy actually relies on expanding debt (and assets) to have liquidity and growth. After all, debt isn’t necessarily bad. Yes, there are bad types of debt (like credit card debt which almost always have a negative long-term return), but there are also good types of debt (for instance, when someone...

Read More » Heterodox

Heterodox