Rolling over: Also rolling over, and inline with the drop in retail sales: U.S. auto sales are falling as vehicle prices climb, indicating that buyers at the lower end are getting squeezed out of the new car market, according to a new industry forecast. First-quarter auto sales are expected to drop by nearly 2.5 percent from a year earlier, to 4 million units, according to J.D. Power and LMC Automotive. Retail sales, which exclude sales to rental car companies and other commercial businesses, are expected to drop by about 5 percent to 2.9 million units. It’s the first time first-quarter retail sales are projected to fall short of 3 million units in six years, said Thomas King, senior vice president of J.D. Power’s data and analytics division.

Topics:

WARREN MOSLER considers the following as important: Economic Releases

This could be interesting, too:

WARREN MOSLER writes Consumer sentiment, real retail sales, industrial production, wages

WARREN MOSLER writes New manufacturers orders, vehicle sales, unemployment claims, rents, oil prices

WARREN MOSLER writes Saudi price hike, private payrolls, new hires, corporate profits

WARREN MOSLER writes Pending home sales, Durable goods orders, oil rigs and production

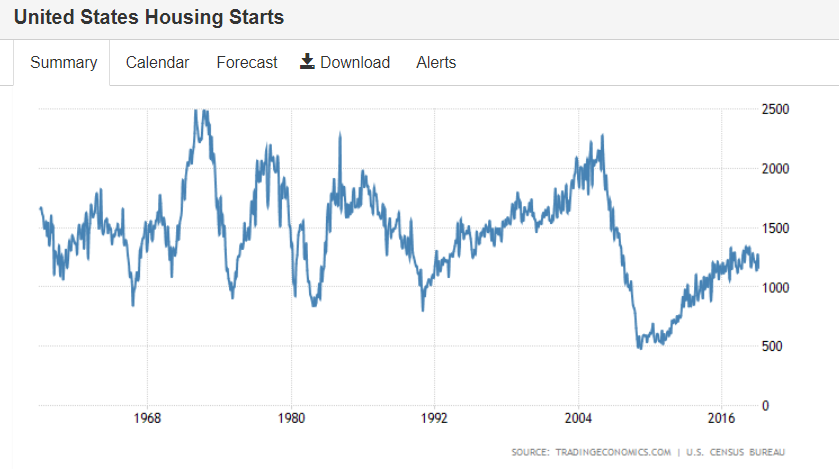

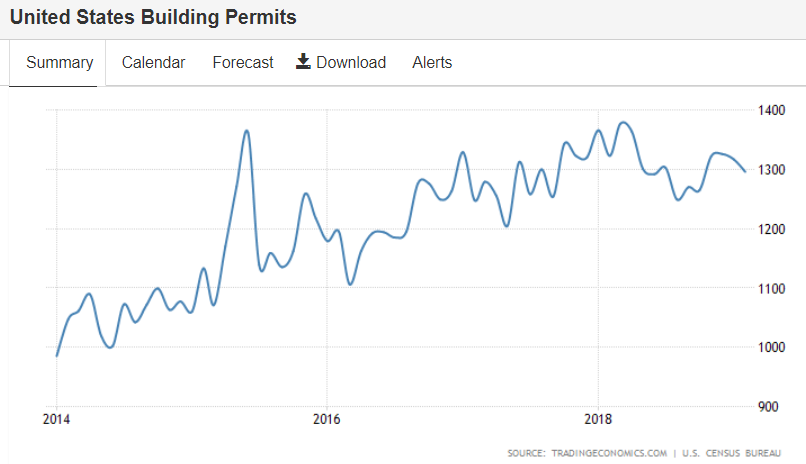

Rolling over:

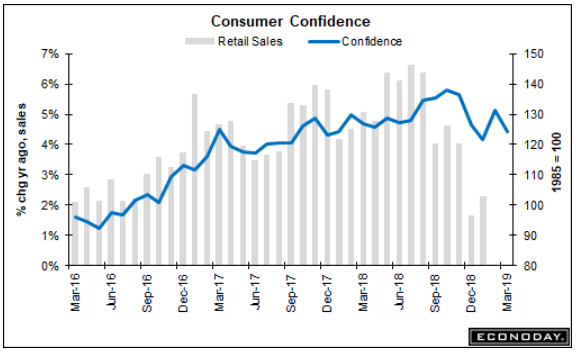

Also rolling over, and inline with the drop in retail sales:

U.S. auto sales are falling as vehicle prices climb, indicating that buyers at the lower end are getting squeezed out of the new car market, according to a new industry forecast.

First-quarter auto sales are expected to drop by nearly 2.5 percent from a year earlier, to 4 million units, according to J.D. Power and LMC Automotive.

Retail sales, which exclude sales to rental car companies and other commercial businesses, are expected to drop by about 5 percent to 2.9 million units. It’s the first time first-quarter retail sales are projected to fall short of 3 million units in six years, said Thomas King, senior vice president of J.D. Power’s data and analytics division.