As previously discussed, the numbers are showing that business is hiring more than output is increasing, which doesn’t seem to make sense to me. That is, it wouldn’t surprise me to see this reconciled by a drop in hiring, or a downward revision to employment in general. Productivity and CostsHighlightsFlat output and a rise in hours worked combined to sink fourth-quarter productivity to an annualized rate of minus 3.0 percent. The Econoday consensus was minus 1.8 percent with the low estimate at minus 2.6 percent. Weak output together with a moderate 1.3 percent rise in compensation lifted unit labor costs to a plus 4.5 percent rate which is just at the consensus for 4.4 percent.Lack of output, at only a plus 0.1 percent rate, is the weak baseline in this report. The rise in hours worked, at a sharp 3.3 percent rate, is the highest since fourth-quarter 2014 while, in a plus for profits but less for the inflation outlook, the rise in compensation is the lowest result since second-quarter 2014.Year-on-year data are more favorable with productivity at plus 0.3 percent, still very weak, and labor costs at a less severe plus 2.8 percent.The nation’s productivity has been soft for the last three years, posing questions for policy makers and underscoring the effects of full employment and limited investment in new technologies. More bad: Factory Orders U.S.

Topics:

WARREN MOSLER considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

As previously discussed, the numbers are showing that business is hiring more than output is increasing, which doesn’t seem to make sense to me.

That is, it wouldn’t surprise me to see this reconciled by a drop in hiring, or a downward revision to employment in general.

Productivity and Costs

Highlights

Flat output and a rise in hours worked combined to sink fourth-quarter productivity to an annualized rate of minus 3.0 percent. The Econoday consensus was minus 1.8 percent with the low estimate at minus 2.6 percent. Weak output together with a moderate 1.3 percent rise in compensation lifted unit labor costs to a plus 4.5 percent rate which is just at the consensus for 4.4 percent.Lack of output, at only a plus 0.1 percent rate, is the weak baseline in this report. The rise in hours worked, at a sharp 3.3 percent rate, is the highest since fourth-quarter 2014 while, in a plus for profits but less for the inflation outlook, the rise in compensation is the lowest result since second-quarter 2014.

Year-on-year data are more favorable with productivity at plus 0.3 percent, still very weak, and labor costs at a less severe plus 2.8 percent.

The nation’s productivity has been soft for the last three years, posing questions for policy makers and underscoring the effects of full employment and limited investment in new technologies.

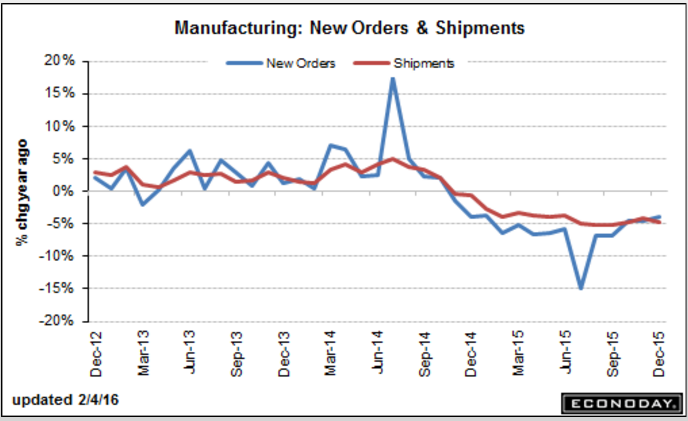

More bad:

Factory Orders

U.S. January Class 8 truck orders fell 48 percent on the year, preliminary data from freight transportation forecaster FTR showed, indicating that 2016 could be another weak year for truck makers.

FTR estimated that orders for the heavy trucks that move goods around America’s highways totaled 18,062 units in January. This follows on from a full-year decline in 2015 of nearly 25 percent to 284,000 units from 276,000.

“It is not looking to be a strong year,” for the market, FTR chief operating officer Jonathan Starks said in a statement.

Amid uncertainty over U.S. economic growth and a lackluster performance for retailers in the fourth quarter, trucking companies have been holding back on buying new models