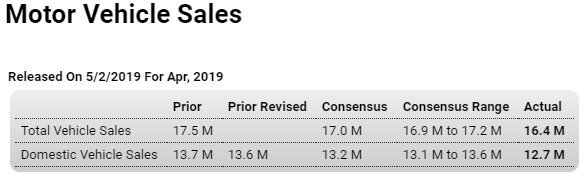

Continues to decelerate: Highlights Jerome Powell may have cited March auto sales as an economic plus in yesterday’s FOMC press conference, but April sales couldn’t keep up the pace. Unit vehicle sales managed only a 16.4 million annual rate in April which was far below March’s 17.5 million rate and well below Econoday’s consensus range. The setback returns the sales pace to the disappointing mid-16 million range of January and February that was a ratcheting down from the fourth-quarter pace in the mid-17 million range. Sales of domestic-made vehicles came in at a 12.7 million rate in April, also below the consensus range. Today’s results point to trouble for the motor vehicle component of the April retail sales report and, though unit sales data are a clouded mix of

Topics:

WARREN MOSLER considers the following as important: Economic Releases

This could be interesting, too:

WARREN MOSLER writes Consumer sentiment, real retail sales, industrial production, wages

WARREN MOSLER writes New manufacturers orders, vehicle sales, unemployment claims, rents, oil prices

WARREN MOSLER writes Saudi price hike, private payrolls, new hires, corporate profits

WARREN MOSLER writes Pending home sales, Durable goods orders, oil rigs and production

Continues to decelerate:

Highlights

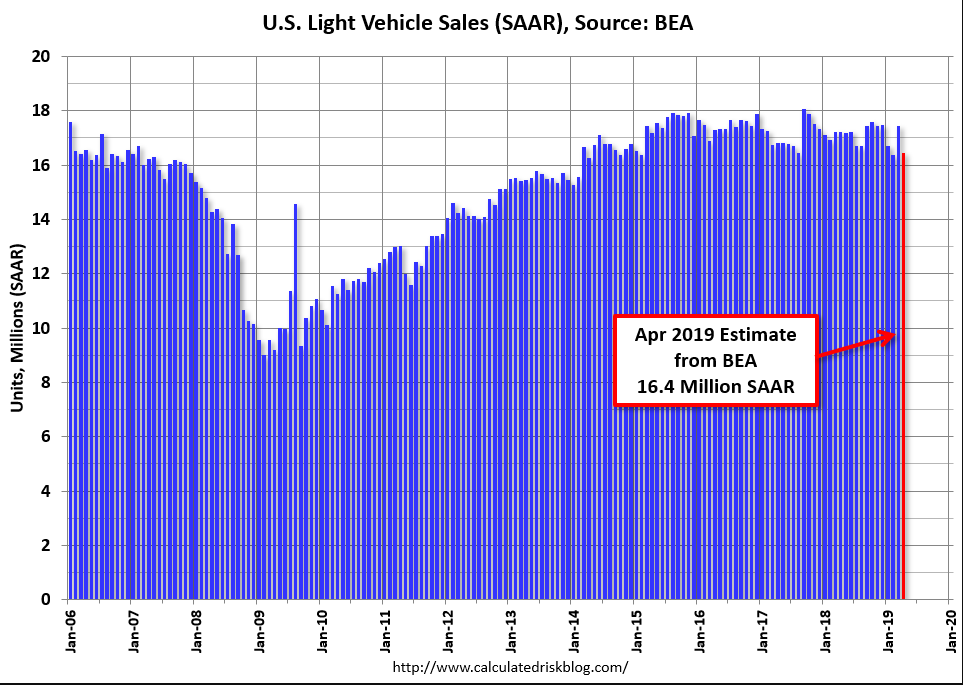

Jerome Powell may have cited March auto sales as an economic plus in yesterday’s FOMC press conference, but April sales couldn’t keep up the pace. Unit vehicle sales managed only a 16.4 million annual rate in April which was far below March’s 17.5 million rate and well below Econoday’s consensus range. The setback returns the sales pace to the disappointing mid-16 million range of January and February that was a ratcheting down from the fourth-quarter pace in the mid-17 million range.

Sales of domestic-made vehicles came in at a 12.7 million rate in April, also below the consensus range. Today’s results point to trouble for the motor vehicle component of the April retail sales report and, though unit sales data are a clouded mix of business and consumer sales, nevertheless hint strongly at an inauspicious second-quarter opening for consumer spending in general.

Deep in negative territory as trade wars continue: