It’s almost Cinco de Drinko weekend so hang in there for a few more hours. Or, if you’re reading this on Sunday, salud! In the meantime, here are three things I think I am thinking about: 1. Buffett buys….zzzzzzzzzz. So, Berkshire bought some Amazon stock recently. I am not gonna lie, this is a big snoozefest. The financial media always goes crazy when Buffett buys something new, but why is this news? Seriously? Berkshire stock hasn’t outperformed the S&P 500 in over 10 years. It’s just a great big index fund at this point. I’ve written about this in detail in the past and it’s not a failing of Buffett. Berkshire is just too damn big and as they’ve gotten bigger there’s been a steady downward trend in their per-share book value growth vs the S&P 500. At a market cap of 0B there’s

Topics:

Cullen Roche considers the following as important: Most Recent Stories

This could be interesting, too:

Cullen Roche writes Understanding the Modern Monetary System – Updated!

Cullen Roche writes We’re Moving!

Cullen Roche writes Has Housing Bottomed?

Cullen Roche writes The Economics of a United States Divorce

It’s almost Cinco de Drinko weekend so hang in there for a few more hours. Or, if you’re reading this on Sunday, salud! In the meantime, here are three things I think I am thinking about:

1. Buffett buys….zzzzzzzzzz. So, Berkshire bought some Amazon stock recently. I am not gonna lie, this is a big snoozefest. The financial media always goes crazy when Buffett buys something new, but why is this news? Seriously? Berkshire stock hasn’t outperformed the S&P 500 in over 10 years. It’s just a great big index fund at this point.

I’ve written about this in detail in the past and it’s not a failing of Buffett. Berkshire is just too damn big and as they’ve gotten bigger there’s been a steady downward trend in their per-share book value growth vs the S&P 500. At a market cap of $540B there’s just not that much they can do to differentiate themselves from the market. I mean, how many firms can they buy that are accretive alpha generating firms? The answer is not many. And even if they buy them they only look more and more like the broader market. So, I don’t know why people think this is news.

That said, and I know this would be wildly unpopular, I still think Berkshire should break up. It would be great to divide it into 10 different entities each managed by operators with niche expertise in specific areas. Then those Baby Buffett’s can see if they can grow into Big Boy Buffetts. Wouldn’t that be great to watch unfold?

2. The Jobs Report…zzzzzzzzzz. Man, another snoozefest of a job’s report today. Honestly, I don’t have much to say here. It’s just more of the muddle through I’ve been talking about for years. There still isn’t high risk of recession, but things also don’t look great. But one thing that’s amazing is how stable and steady this economy has become even if growth is low. As regulars know, I’ve called it the golden era of low and stable growth. Cycles are getting longer and more stable even though they’re lower growth.

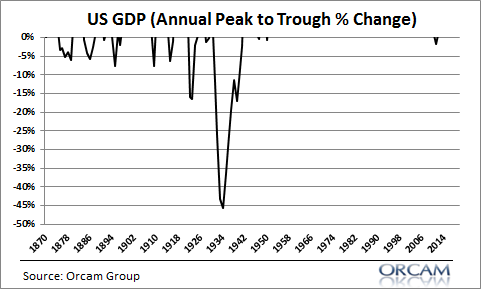

Speaking of which, here’s that amazing chart of peak to trough annual GDP growth – even with the financial crisis it’s amazing how much more stable the US economy has become in the last 50 years.

3. Chase Tweets…not zzzzzzzzzzzzz. So, Chase tweeted this the other day and people went ballistic:

I get it. Chase was not very fiscally responsible during the financial crisis so it’s kind of ironic that they’re saying something like this. But this is not really as offensive as people made it out to be. And what – is Chase never allowed to say anything about being fiscally responsible ever again? Isn’t it their job to promote fiscal responsibility even if they’ve failed to eat their own cooking at times? I don’t know. Sometimes it feels like the outrage machine is on overdrive these days and people just need to drink more margaritas and treat every day like Cinco de Drinko….¹

¹ – Please remember that past performance is not indicative of future results. Different types of alcohol involve varying degrees of risk, and there can be no assurance that the future performance of any alcohol, drinking strategy, or alcoholic product made reference to directly or indirectly in this article, will be profitable, equal any corresponding indicated historical performance level(s), or be suitable for you. Due to various factors, including changing market conditions, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this article serves as the receipt of, or as a substitute for, personalized alcohol advice from Pragmatic Capitalism.