So, Stephen Moore is no longer being considered for the Fed. As I explained in detail this is a good thing. Moore was nowhere near qualified and had a long track record of misunderstanding basic things about the Fed. So good for Trump for recognizing this and dropping the nomination. Now what? Someone asked me an interesting question on Twitter: “Who would you nominate?” I (half jokingly) answered FRED PCEPILFE. That refers to the Fred data set for core personal consumption expenditures, the Fed’s preferred measure of inflation. I wasn’t really kidding though. I think the Fed operates with too much discretion in setting policy. I would prefer that they implement some sort of systematic approach that takes the guesswork and board meetings out of the equation.

Topics:

Cullen Roche considers the following as important: Most Recent Stories

This could be interesting, too:

Cullen Roche writes Understanding the Modern Monetary System – Updated!

Cullen Roche writes We’re Moving!

Cullen Roche writes Has Housing Bottomed?

Cullen Roche writes The Economics of a United States Divorce

So, Stephen Moore is no longer being considered for the Fed. As I explained in detail this is a good thing. Moore was nowhere near qualified and had a long track record of misunderstanding basic things about the Fed. So good for Trump for recognizing this and dropping the nomination. Now what?

Someone asked me an interesting question on Twitter:

“Who would you nominate?”

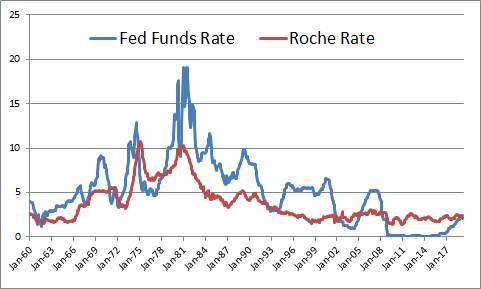

I (half jokingly) answered FRED PCEPILFE. That refers to the Fred data set for core personal consumption expenditures, the Fed’s preferred measure of inflation. I wasn’t really kidding though. I think the Fed operates with too much discretion in setting policy. I would prefer that they implement some sort of systematic approach that takes the guesswork and board meetings out of the equation. For instance, you could set a very simple rule for the Fed Funds Rate where it was equal to the rate of PCEPILFE plus 0.5%. Here’s how that rule would have looked over the last 20 years vs the actual FFR:

This would achieve a whole bunch of good things in my view:

- It would remove the discretionary human element involved in rate changes and replace it with a purely systematic approach.

- It would create a more predictable and stable form of monetary policy as opposed to the constant guessing game we have now.

But this would be bigger than just an interest rate rule change. I would broaden it so that no new Fed governors are nominated. There would still be a Federal Reserve Chairman/woman, but there would be no need for a Board of Governors. Instead, the Fed Chair would act more as a head regulator and overseer of the Federal Reserve System.

Importantly, there would be no such thing as things like QE and other discretionary policies as there would be no Board of Governors to dictate these discretionary changes. So, the balance sheet would naturally unwind and interest rates would just change systematically. No more Fed meetings, no more interest rate tinkering, no more QE, etc. Just a systematic rules based approach to interest rates and a Fed Chairperson to oversee the payments system.

So, who should be the next Fed nominee? How about FRED PCEPILFE?¹

NB – Think about this fairly. If the robots are going to start taking everyone’s jobs then shouldn’t we spread the love and make sure that they also take some of these beloved government jobs? It seems only fair.

¹ – I am not this naive. I am very aware of the fact that Donald Trump is hard at work watching Fox News deciding whether to pick Neil Cavuto, Lou Dobbs or whoever is the economic pundit that most fancies his favor.