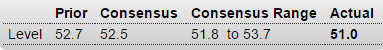

This is volatile so best to go by the 3 mo moving average, as shown on the chart: Chicago Fed National Activity IndexHighlightsDoubts over the outlook may be building but January was a solid month for the economy as the national activity index rose to plus 0.28 from a revised minus 0.34 in December. The gain lifts the 3-month average to minus 0.15 from minus 0.30. It was a jump in industrial production that led January’s charge, lifting the production component which contributed 0.27 to the headline after pulling it down by 0.38 in December. Gains in vehicle production were a highlight of the industrial production report which also got a boost from a weather-related swing higher for utility output. Employment also added to January’s headline but less so from December’s outstanding strength, to plus 0.12 from plus 0.16. Sales/orders/inventories were little changed at minus 0.03 with personal consumption & housing unchanged at minus 0.08. The readings in this report, though in general favorable, are mixed with the current month pointing to above-trend historical growth but not the 3-month average which points to below average growth. So it reads like euro based portfolios have been shifting assets to other currencies etc.

Topics:

WARREN MOSLER considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

This is volatile so best to go by the 3 mo moving average, as shown on the chart:

Chicago Fed National Activity Index

Highlights

Doubts over the outlook may be building but January was a solid month for the economy as the national activity index rose to plus 0.28 from a revised minus 0.34 in December. The gain lifts the 3-month average to minus 0.15 from minus 0.30. It was a jump in industrial production that led January’s charge, lifting the production component which contributed 0.27 to the headline after pulling it down by 0.38 in December. Gains in vehicle production were a highlight of the industrial production report which also got a boost from a weather-related swing higher for utility output. Employment also added to January’s headline but less so from December’s outstanding strength, to plus 0.12 from plus 0.16. Sales/orders/inventories were little changed at minus 0.03 with personal consumption & housing unchanged at minus 0.08. The readings in this report, though in general favorable, are mixed with the current month pointing to above-trend historical growth but not the 3-month average which points to below average growth.

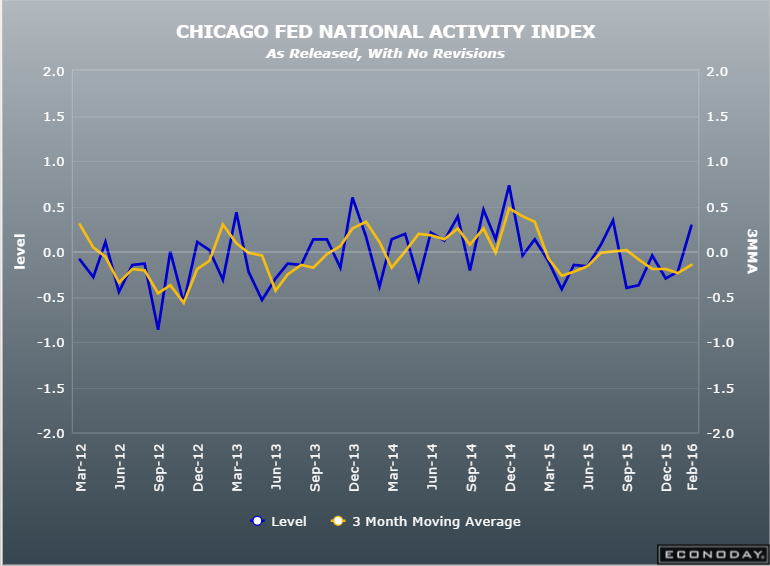

So it reads like euro based portfolios have been shifting assets to other currencies etc. as previously discussed, even as their liabilities remain in euro:

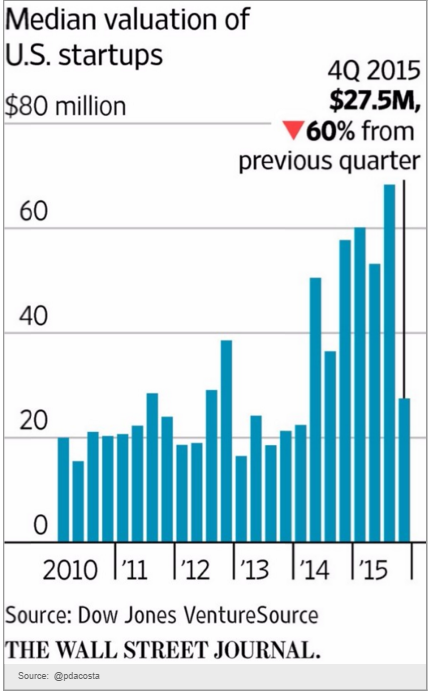

Startups can be a meaningful source of ‘borrowing to spend’ which offsets ‘savings desires’ however most recently it’s going the wrong way:

Black Knight Financial Services’ First Look at January Mortgage Data: Delinquencies Up Sharply; Prepayment Rate Drops

– Delinquency rate up 6.6 percent in January; back above 5 percent nationally for the first time in 11 months

– Prepayment rate (historically a good indicator of refinance activity) dropped 29 percent to its lowest level since February 2014

– Foreclosure sales (completions) up nearly 16 percent following holiday moratoriums

– Active foreclosure inventory continues to decline; down 26 percent from last year

According to Black Knight’s First Look report for January, the percent of loans delinquent increased 6.6% in January compared to December, and declined 7.1% year-over-year.

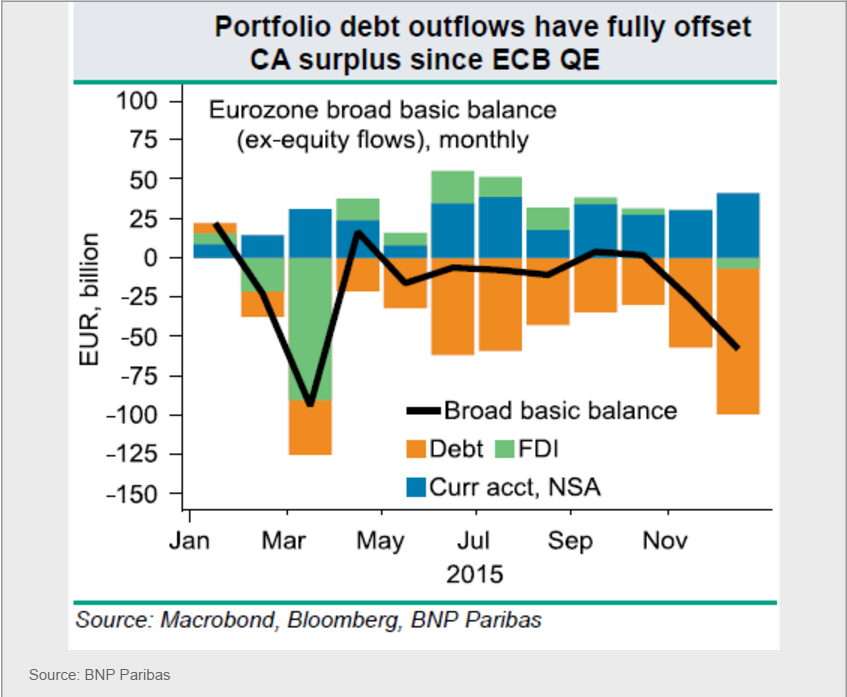

Worse than expected again. And this is the one that’s be overstating things:

PMI Manufacturing Index Flash