It’s all going the wrong way now, with fewer proactively spending more than their incomes to ‘offset’ those desiring to spend less than their incomes. That is, as previously discussed, the private sector tends to be highly pro cyclical: Online lenders see cash crunch By Jon MarinoFeb 19 (CNBC) — A cash crunch is impeding the online lending industry’s growth as the cost of borrowing grows, funds become increasingly scarce and ratings agencies maintain a cautious outlook toward the space.Next, start-ups that have grown into unicorns originating billions of dollars’ worth of loans may find themselves doing less lending or, conversely, putting more of their loans onto their own books.The asset-backed securities market is slowing and issued a meager billion in January — the lowest total since at least 2012, according to Dealogic data — and generated a paltry billion in ABS loans in February. In terms of deal volume, ABS deals in 2016 have also dropped to lows the market has not seen for years.

Topics:

WARREN MOSLER considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

It’s all going the wrong way now, with fewer proactively spending more than their incomes to ‘offset’ those desiring to spend less than their incomes. That is, as previously discussed, the private sector tends to be highly pro cyclical:

Online lenders see cash crunch

By Jon Marino

Feb 19 (CNBC) — A cash crunch is impeding the online lending industry’s growth as the cost of borrowing grows, funds become increasingly scarce and ratings agencies maintain a cautious outlook toward the space.

Next, start-ups that have grown into unicorns originating billions of dollars’ worth of loans may find themselves doing less lending or, conversely, putting more of their loans onto their own books.

The asset-backed securities market is slowing and issued a meager $40 billion in January — the lowest total since at least 2012, according to Dealogic data — and generated a paltry $10 billion in ABS loans in February. In terms of deal volume, ABS deals in 2016 have also dropped to lows the market has not seen for years.

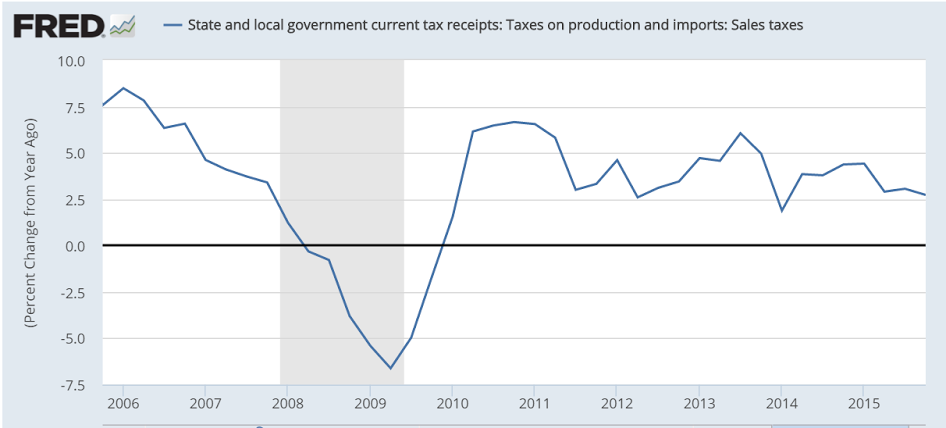

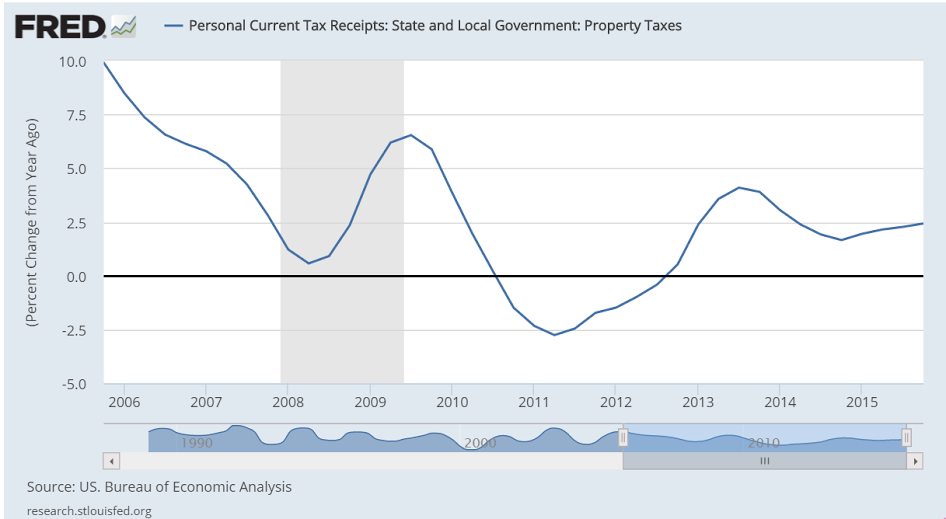

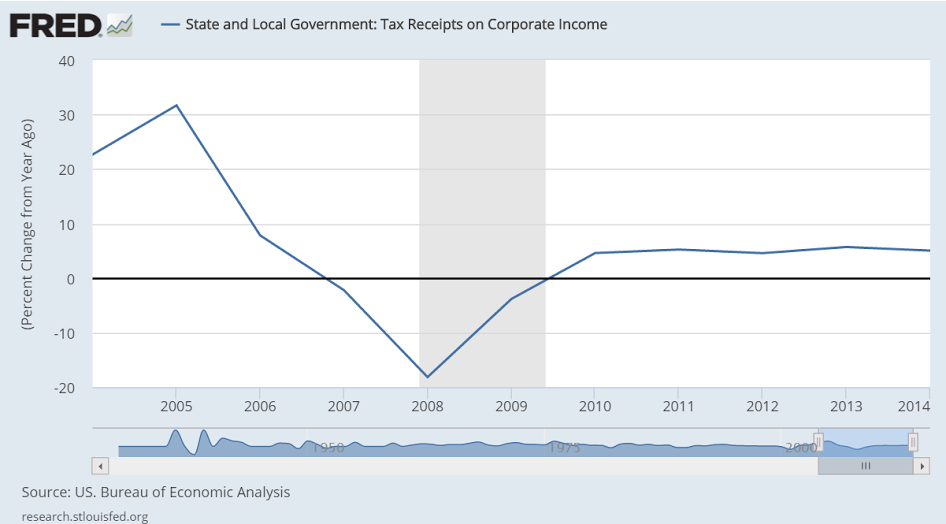

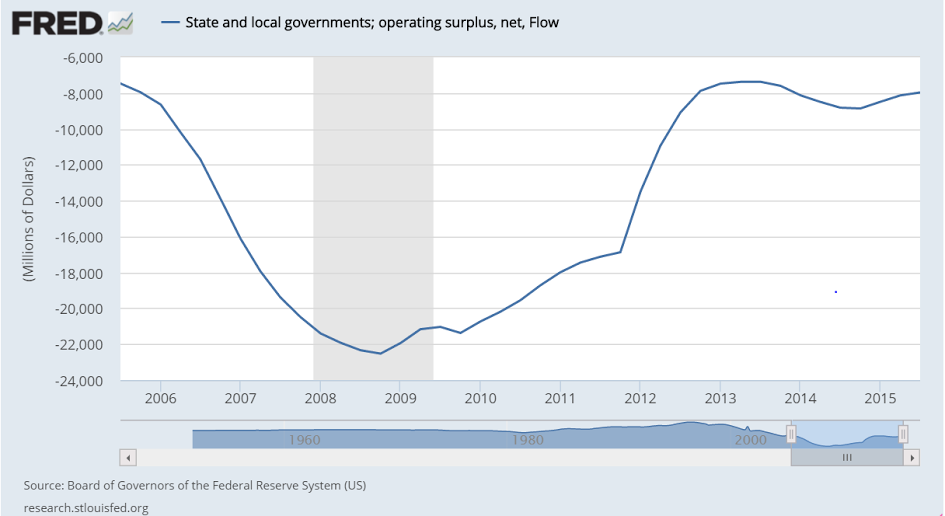

States not doing so well?

This is only through July:

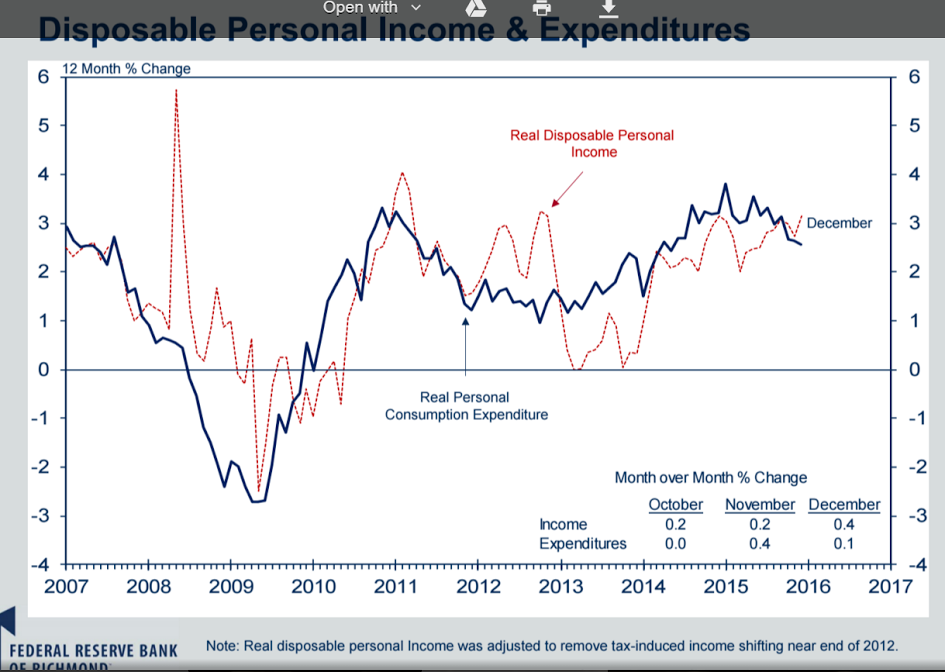

It’s not wrong to think of expenditures as the source of income, as this chart seem to indicate: