Another worse than expected and details deteriorating as well: Richmond Fed Manufacturing Index A bit better than expected but not the price data, and as the chart shows it’s not going anywhere: Existing Home SalesHighlightsExisting home sales, up 0.4 percent in January to a 5.47 million annualized rate, held on to the bulk of December’s surge. Year-on-year sales growth is in the double digits, at 11.0 percent. In a sign of underlying household strength, the single-family component rose 1.0 percent to 4.86 million for a year-on-year 11.2 percent. Condos, which had been stronger of the two components, are now slowing, at 610,000 and down 4.7 percent for a year-on-year 8.9 percent.Price data are soft which points to discounting. The median price fell 4.2 percent to 3,800 with the year-on-year rate at plus 8.2 percent. But supply, which has been very low and holding back sales, is coming into the market, up 3.4 percent in the month to 1.82 million. Supply relative to sales moved slightly higher, to 4.0 months which, however, is well below 4.5 months in January last year.The housing market is sloping upward but not in bumpy away. Today’s report is moderate but constructive. Watch for new home sales on tomorrow’s calendar which are expected to fall back from prior strength.

Topics:

WARREN MOSLER considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

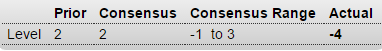

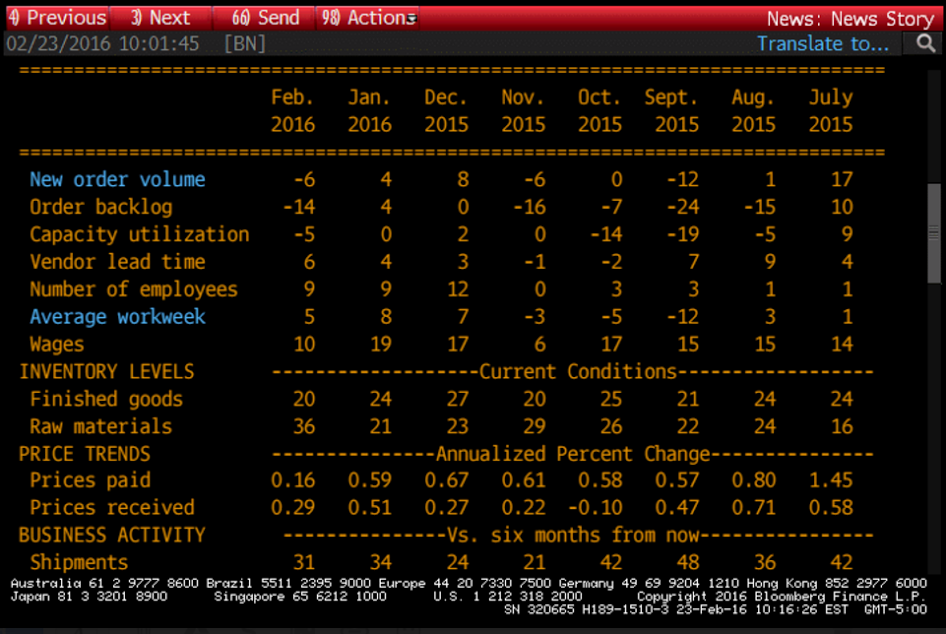

Another worse than expected and details deteriorating as well:

Richmond Fed Manufacturing Index

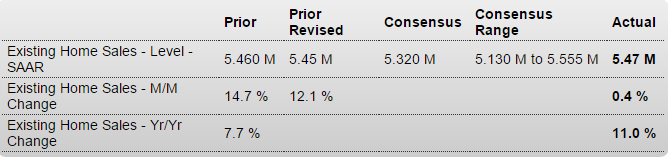

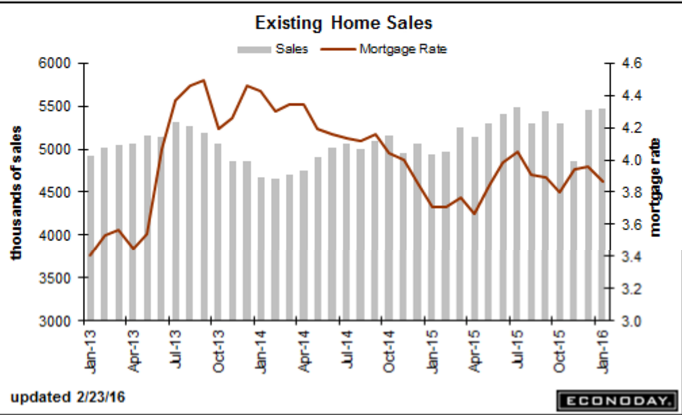

A bit better than expected but not the price data, and as the chart shows it’s not going anywhere:

Existing Home Sales

Highlights

Existing home sales, up 0.4 percent in January to a 5.47 million annualized rate, held on to the bulk of December’s surge. Year-on-year sales growth is in the double digits, at 11.0 percent. In a sign of underlying household strength, the single-family component rose 1.0 percent to 4.86 million for a year-on-year 11.2 percent. Condos, which had been stronger of the two components, are now slowing, at 610,000 and down 4.7 percent for a year-on-year 8.9 percent.Price data are soft which points to discounting. The median price fell 4.2 percent to $213,800 with the year-on-year rate at plus 8.2 percent. But supply, which has been very low and holding back sales, is coming into the market, up 3.4 percent in the month to 1.82 million. Supply relative to sales moved slightly higher, to 4.0 months which, however, is well below 4.5 months in January last year.

The housing market is sloping upward but not in bumpy away. Today’s report is moderate but constructive. Watch for new home sales on tomorrow’s calendar which are expected to fall back from prior strength.

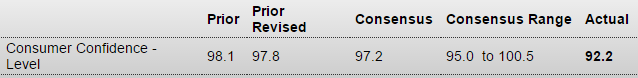

Big drop here, which reflects consumer spending plans:

Consumer Confidence

So I’ve been told senior Tsy staffers have read my book. Hoping for the best!

US to push for greater fiscal spending at G20 -Treasury official

Feb 23 (Reuters) — The United States will call on G20 countries this week to use fiscal policy in order to boost global demand, a senior U.S. Treasury official said on Monday. “We will urge greater use of policy space, including fiscal space, to bolster global demand. That would lead to strengthened confidence and I would expect reduce volatility,” the Treasury official said in a preview call with reporters ahead of a G20 meeting later this week.

Two more signs a recession could be coming

By Jeff Cox

Feb 22 (CNBC) — The withholdings data show taxes taken out of worker paychecks and are considered by some economists to be a strong indicator of overall economic growth. Released daily by the Treasury Department, the count is a simple nonadjusted measure of how much wages are growing.

The latest numbers showed a 0.2 percent annualized decline over the past four weeks, compared to growth rates of 2 percent in December and 3 percent in January, according to market research firm TrimTabs.

The data show “the U.S. economy is already stalling out,” TrimTabs CEO David Santschi said.

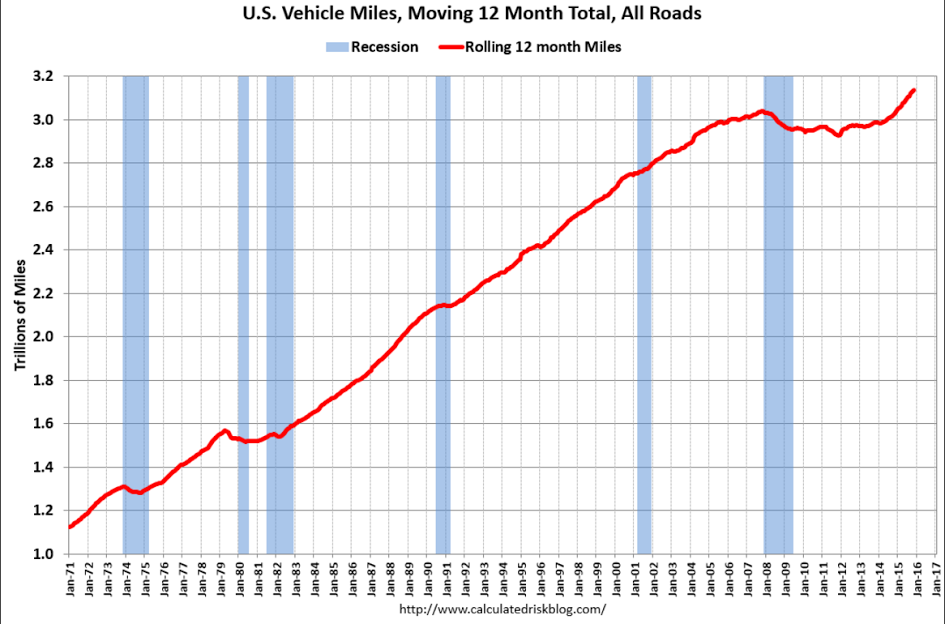

Moving up: