Been working its way lower and into contraction ever since the collapse in oil capital expenditures late in 2015, like a slow motion train wreck: There’s been a history of getting a spike up before the collapse: Companies are warning that earnings results are going to be brutal KEY POINTSWith earnings season looming, 77% of companies issuing pre-announcements say their profit picture will be worse than Wall Street is expecting.That’s the second-worst quarter on record going back to 2006, according to FactSet.Two tariff-sensitive sectors, tech and health care, have seen the highest amounts of negative announcements. Stocks may have brushed up against record highs Monday. However, a looming threat is just a couple weeks away once profit reports from the second quarter

Topics:

WARREN MOSLER considers the following as important: Economic Releases

This could be interesting, too:

WARREN MOSLER writes Consumer sentiment, real retail sales, industrial production, wages

WARREN MOSLER writes New manufacturers orders, vehicle sales, unemployment claims, rents, oil prices

WARREN MOSLER writes Saudi price hike, private payrolls, new hires, corporate profits

WARREN MOSLER writes Pending home sales, Durable goods orders, oil rigs and production

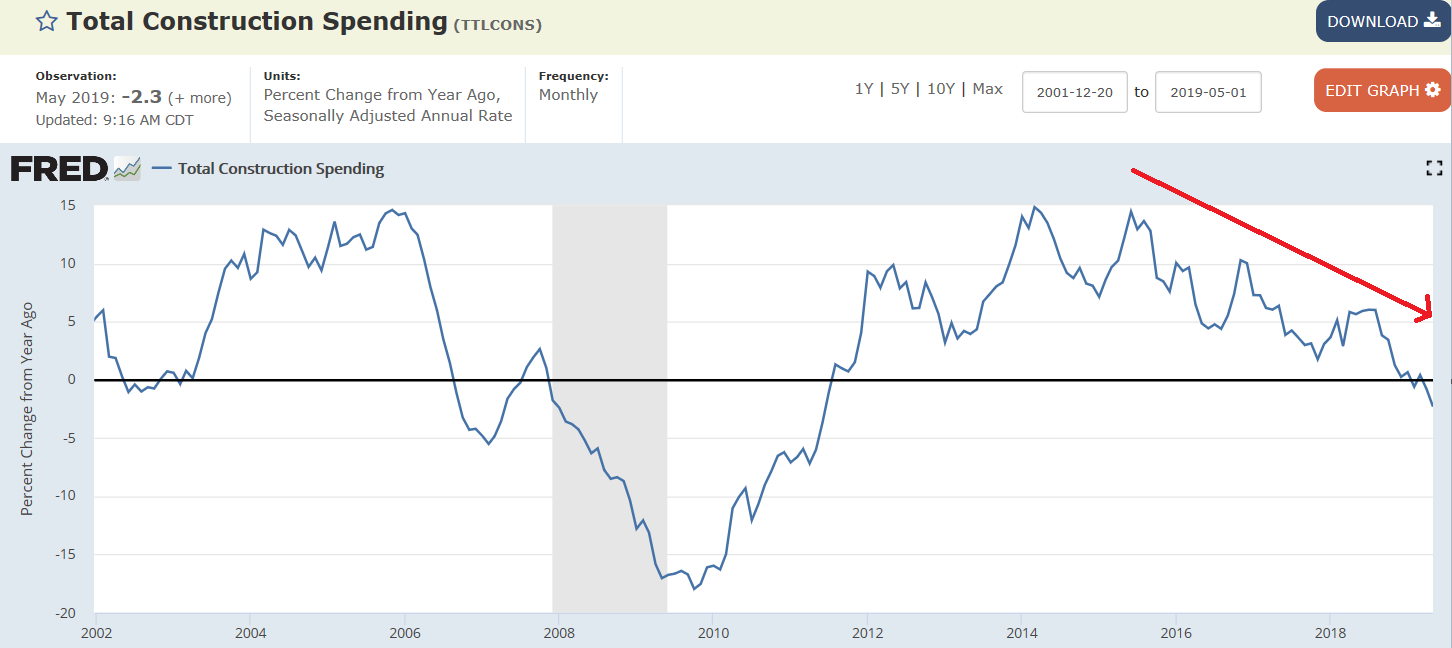

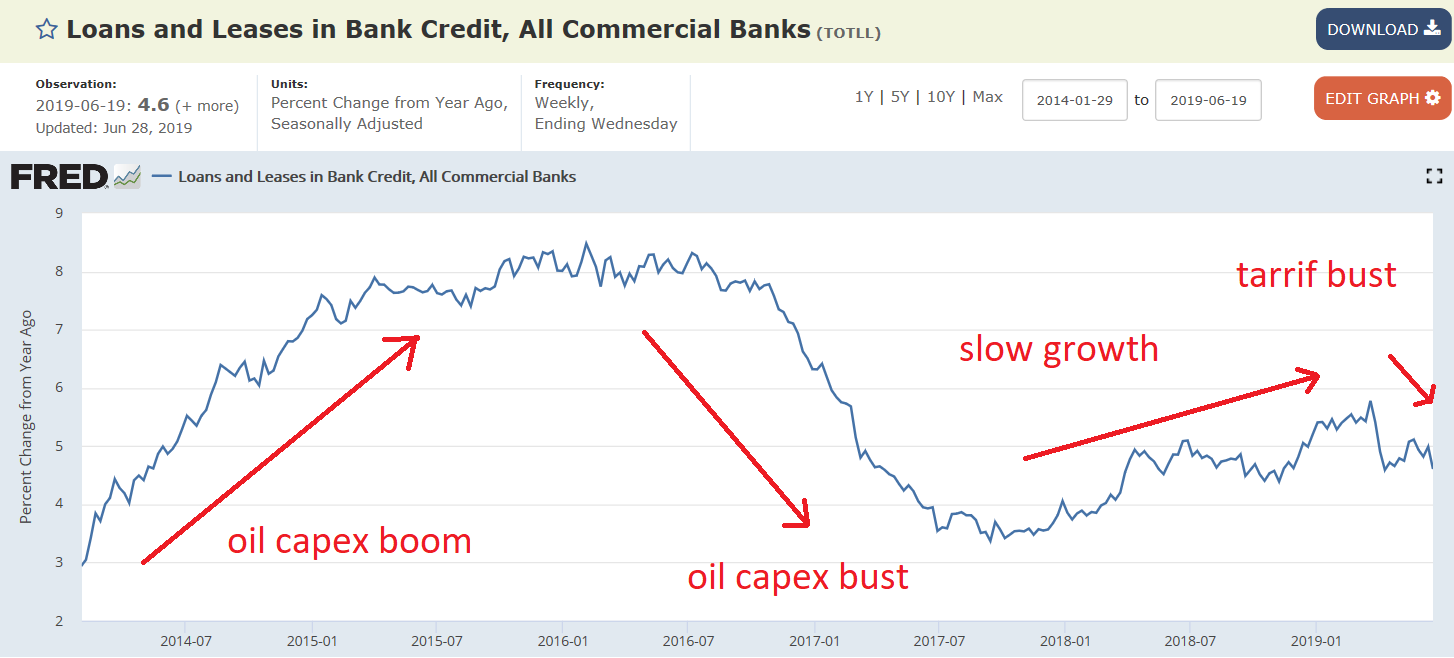

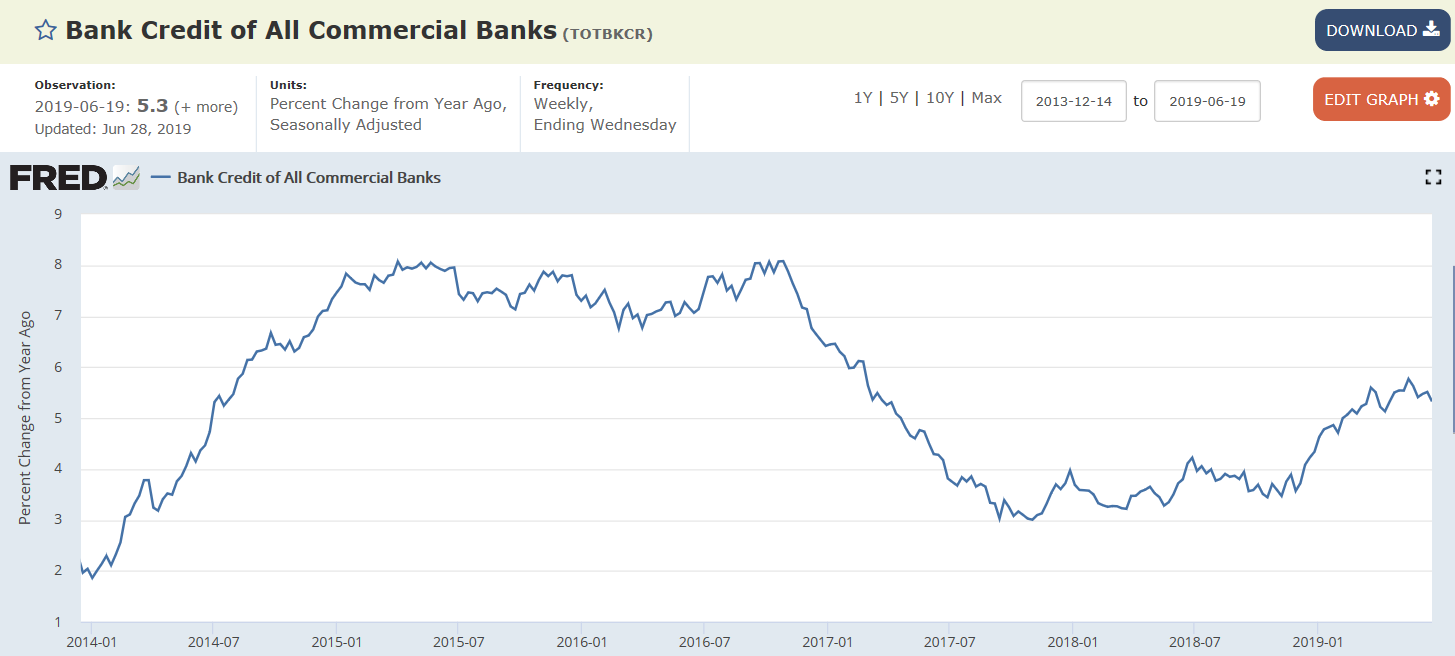

Been working its way lower and into contraction ever since the collapse in oil capital expenditures late in 2015, like a slow motion train wreck:

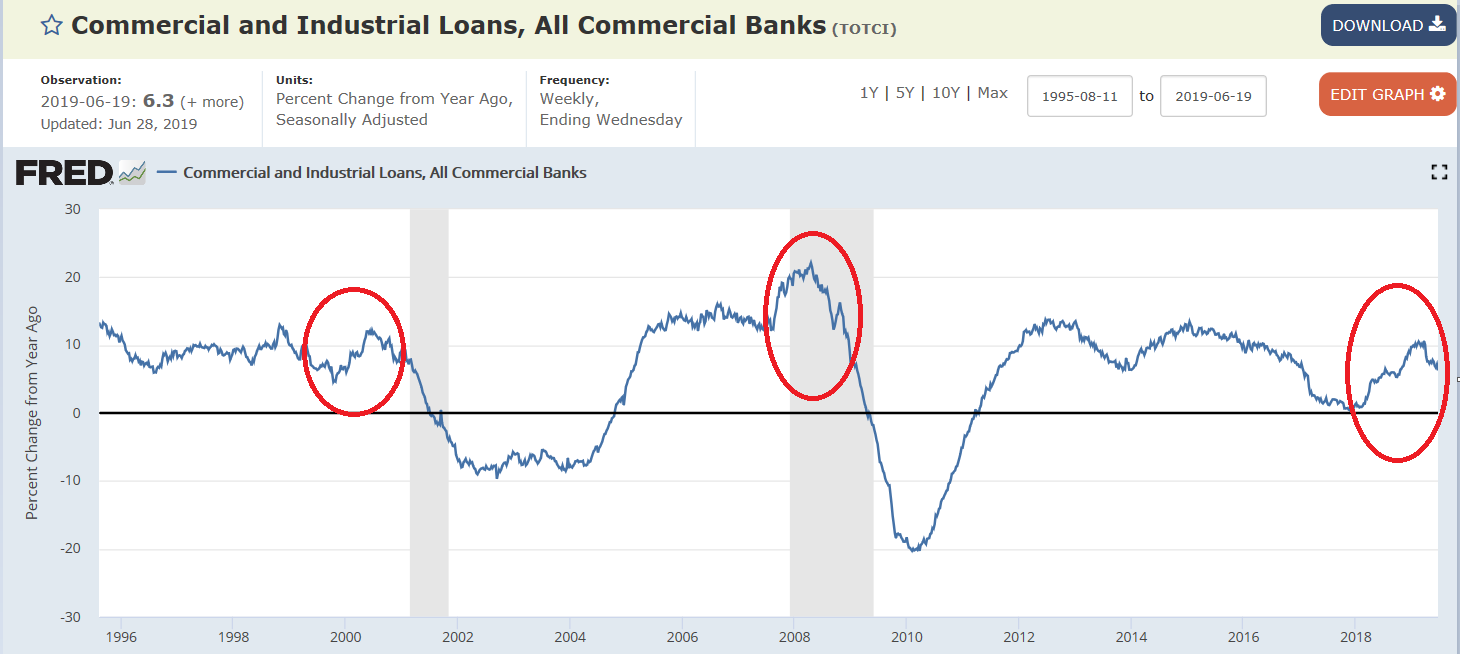

There’s been a history of getting a spike up before the collapse:

Companies are warning that earnings results are going to be brutal

KEY POINTS

With earnings season looming, 77% of companies issuing pre-announcements say their profit picture will be worse than Wall Street is expecting.

That’s the second-worst quarter on record going back to 2006, according to FactSet.

Two tariff-sensitive sectors, tech and health care, have seen the highest amounts of negative announcements.Stocks may have brushed up against record highs Monday. However, a looming threat is just a couple weeks away once profit reports from the second quarter hit.

Analysts have been taking a dimmer view of what is ahead for earnings. They’ve already forecast a decline for the first three quarters of 2019. Now companies are echoing those concerns with a level of pessimism not often seen from corporate America.