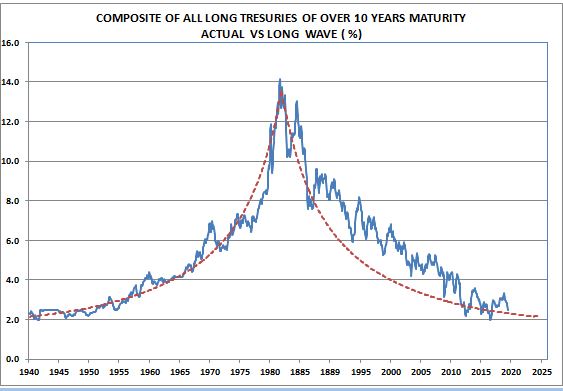

Everybody and their brother has an opinion about the direction of long bond yields so it should be OK for me to stick my two cents worth in. This chart of the composite of all long bond yields versus the long wave is one I published every month on the back cover of my monthly publication for over 20 years before I retired a couple of years ago. Basically, I thought of it as a good way to show that I was a long term bull on interest rates in a way that money managers would remember. But it did get their attention. The basic message was that on the up-sweep of the long wave, bear market were long and deep while on the down-sweep, bear markets were short and shallow while bull markets were long and deep. Figure one Of course it is always nice to have some

Topics:

Spencer England considers the following as important: Featured Stories, US/Global Economics

This could be interesting, too:

Ken Melvin writes A Developed Taste

Joel Eissenberg writes How Tesla makes money

Angry Bear writes True pricing: effects on competition

Angry Bear writes The paradox of economic competition

Everybody and their brother has an opinion about the direction of long bond yields so it should be OK for me to stick my two cents worth in.

This chart of the composite of all long bond yields versus the long wave is one I published every month on the back cover of my monthly publication for over 20 years before I retired a couple of years ago. Basically, I thought of it as a good way to show that I was a long term bull on interest rates in a way that money managers would remember. But it did get their attention. The basic message was that on the up-sweep of the long wave, bear market were long and deep while on the down-sweep, bear markets were short and shallow while bull markets were long and deep.

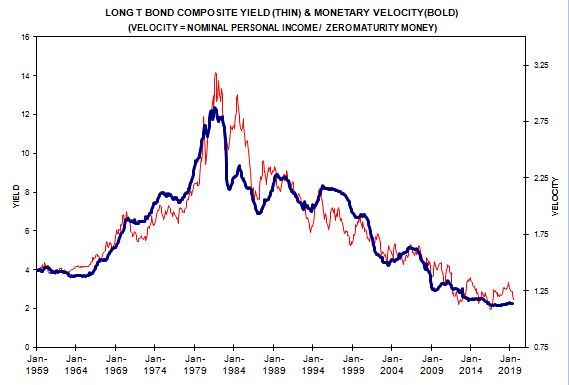

Of course it is always nice to have some basic data to support such a chart and the economic data that seemed to have the best fit over the long run was MZM ( zero maturity money) velocity —

nominal personal income divided by MZM. It seemed quite significant that MZM velocity has only one major turning point that coincided very nicely with the major change in trend for long bond yields. But if you want to identify the long run bottom in bond yields it would not hurt to monitor MZM velocity.