Better than expected: HighlightsTaking out a policy-insurance rate cut when the main driver of the economy is booming sounds a little counter-intuitive, in retail sales results that came in much stronger than expected in June. Total sales rose 0.4 percent in the month with ex-auto sales also up 0.4 percent — both of these hit the top end of Econoday’s consensus range. Easily surpassing the top end of the consensus range are two of the report’s key core readings with less auto & less gas and also the control group up very sharply at 0.7 percent gains on the month. Strength abounds in this report with the isolated weak points led by gasoline stations, where price effects tied to lower oil prices pulled down sales by 2.8 percent, and also department stores, an ailing segment

Topics:

WARREN MOSLER considers the following as important: Economic Releases

This could be interesting, too:

WARREN MOSLER writes Consumer sentiment, real retail sales, industrial production, wages

WARREN MOSLER writes New manufacturers orders, vehicle sales, unemployment claims, rents, oil prices

WARREN MOSLER writes Saudi price hike, private payrolls, new hires, corporate profits

WARREN MOSLER writes Pending home sales, Durable goods orders, oil rigs and production

Better than expected:

Highlights

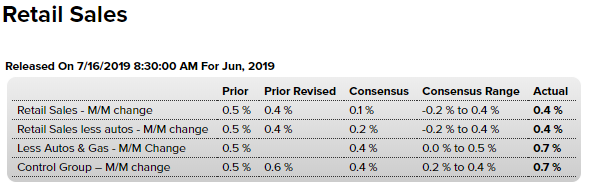

Taking out a policy-insurance rate cut when the main driver of the economy is booming sounds a little counter-intuitive, in retail sales results that came in much stronger than expected in June. Total sales rose 0.4 percent in the month with ex-auto sales also up 0.4 percent — both of these hit the top end of Econoday’s consensus range. Easily surpassing the top end of the consensus range are two of the report’s key core readings with less auto & less gas and also the control group up very sharply at 0.7 percent gains on the month.Strength abounds in this report with the isolated weak points led by gasoline stations, where price effects tied to lower oil prices pulled down sales by 2.8 percent, and also department stores, an ailing segment of the retail sector that seems to be devolving.

The most surprising strength in the report, at least for forecasters, is a 0.7 percent jump in auto sales that conflicts with what was a flat month for unit sales (a series, however, that is clouded with special factors). Not surprising is a another surge, this time 1.7 percent for a second month in a row, for nonretailers which continue to feed off of traditional retailers such as department stores.

A key strength, and one that underscores discretionary power, is yet another strong gain for restaurants, up 0.9 percent following prior gains of 1.0 percent, 0.7 percent, and 0.8 percent. This shows that consumers, flush with confidence and fully employed, are enjoying themselves.

The list of strength goes on with both furniture and building materials snapping back with 0.5 percent gains that point to strength for residential investment. Clothing stores saw sales rise 0.5 percent as did health & personal care stores.

The Federal Reserve may be looking across the oceans for reasons to justify a rate cut, but any justifications aren’t coming from the US consumer which makes up the vast bulk of GDP. And however much inflation may be flat, consumer spending is not to blame.

Not inflation adjusted and June subject to revision next month:

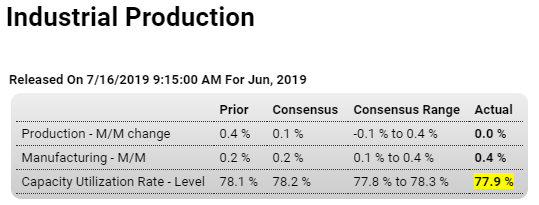

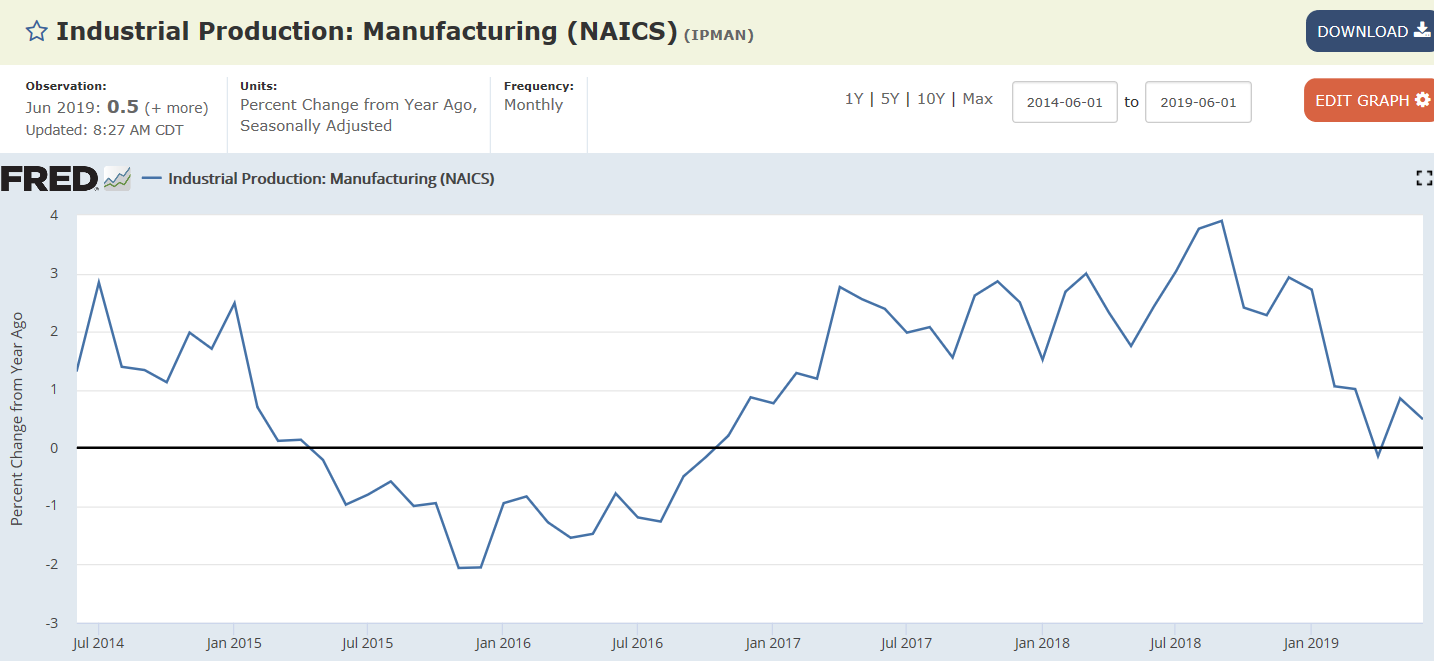

Worse than expected:

Manufacturing:

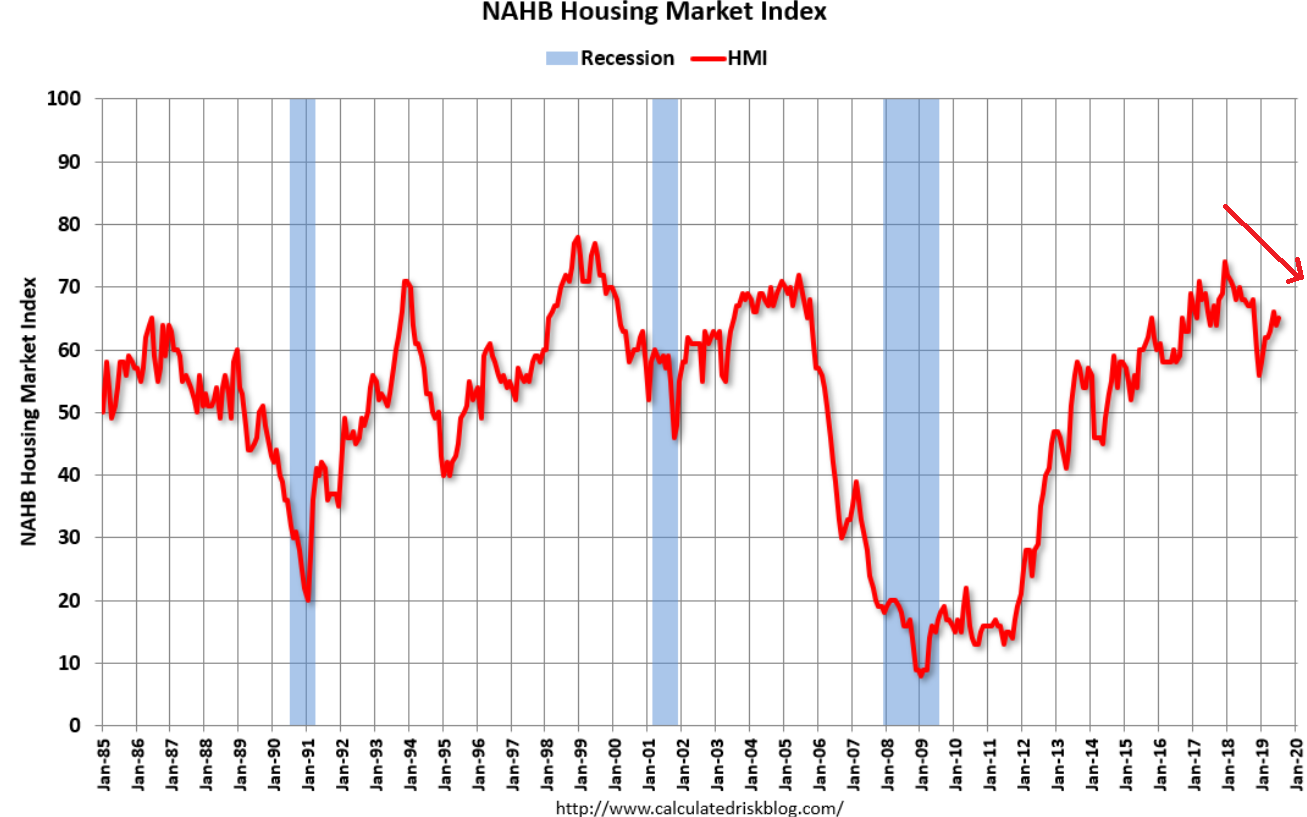

As expected, and still looking like it’s rolled over:

Highlights

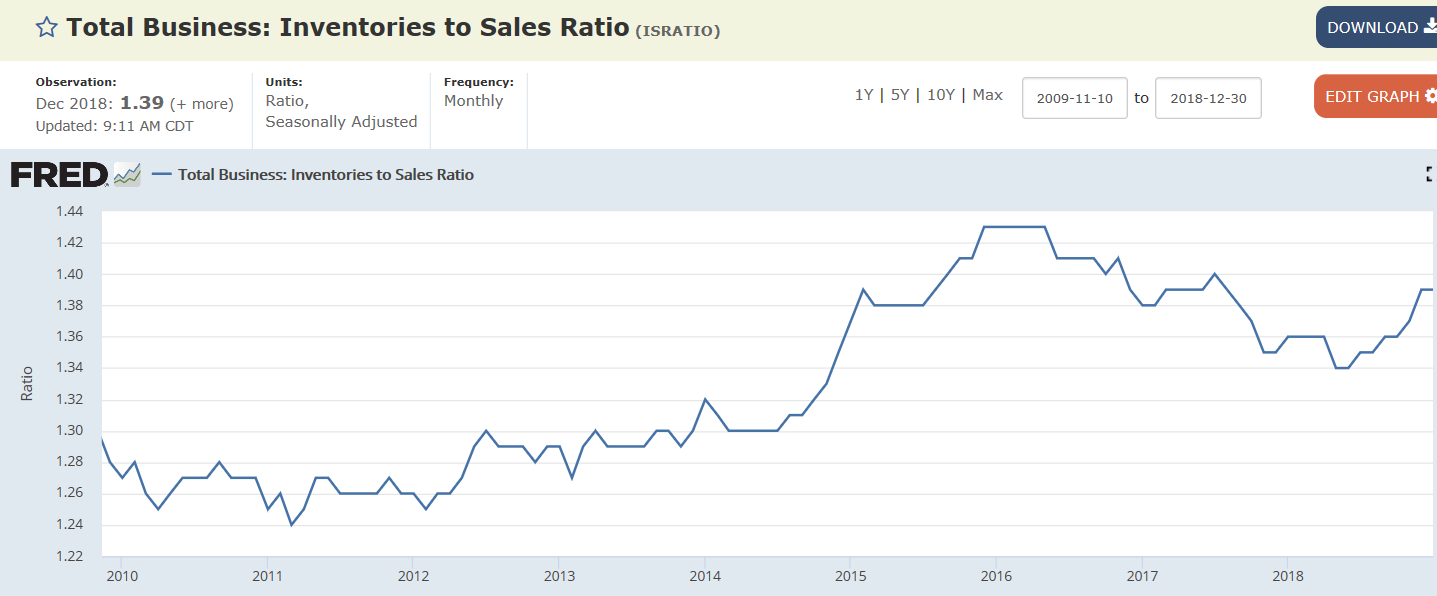

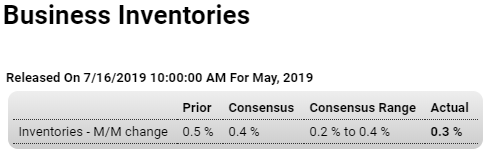

Business inventories rose a slightly lower-than-expected 0.3 percent in May but follow a 0.5 percent rise in April in results that put the outlook for inventory contribution to second-quarter GDP at roughly flat. There are hints that inventory growth is exceeding underlying demand as 5.3 percent year-on-year growth for inventories is well above the 1.5 percent rise for business sales. Yet any imbalances aren’t increasing as the inventory-to-sales ratio in May held steady at 1.39.

Inventory remains high relative to sales: