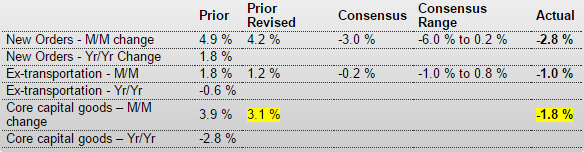

Unambiguously bad. And the downward spiral continues with sales falling faster than inventories: Durable Goods OrdersHighlightsThe manufacturing component of the industrial production report pointed to February strength but the durable goods report certainty isn’t. Orders fell 2.8 percent with the ex-transportation reading, which excludes the up-and-down swings of aircraft orders, down a very sizable 1.0 percent. And capital goods readings, which offer indications on business investment, are once again in the minus column, down 1.8 percent for orders and, in a reading that will pull down first-quarter GDP estimates, were down 1.1 percent for shipments. Total shipments fell a very sharp 0.9 percent with unfilled orders also very weak, at minus 0.4 percent in a reading that is not promising for manufacturing employment. Inventories, at minus 0.3 percent, are coming down but not fast enough with the inventory-to-shipments ratio up one notch to 1.65. This report is always volatile and the weakness in February does follow even greater strength in January, but January now looks like an odd outlier for a sector that, up until last month at least, has been struggling with weak exports and weak demand for energy equipment. Continued claims for unemployment benefits were down again, and, population adjusted, to perhaps the lowest levels in a very long time.

Topics:

WARREN MOSLER considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

Unambiguously bad.

And the downward spiral continues with sales falling faster than inventories:

Durable Goods Orders

Highlights

The manufacturing component of the industrial production report pointed to February strength but the durable goods report certainty isn’t. Orders fell 2.8 percent with the ex-transportation reading, which excludes the up-and-down swings of aircraft orders, down a very sizable 1.0 percent. And capital goods readings, which offer indications on business investment, are once again in the minus column, down 1.8 percent for orders and, in a reading that will pull down first-quarter GDP estimates, were down 1.1 percent for shipments. Total shipments fell a very sharp 0.9 percent with unfilled orders also very weak, at minus 0.4 percent in a reading that is not promising for manufacturing employment. Inventories, at minus 0.3 percent, are coming down but not fast enough with the inventory-to-shipments ratio up one notch to 1.65. This report is always volatile and the weakness in February does follow even greater strength in January, but January now looks like an odd outlier for a sector that, up until last month at least, has been struggling with weak exports and weak demand for energy equipment.

Continued claims for unemployment benefits were down again, and, population adjusted, to perhaps the lowest levels in a very long time.

My suspicion is that this is entirely about the various governments making these claims a lot harder to get, rather than an indication of labor market conditions.

If so, as previously discussed, this automatic fiscal stabilizer may have also been largely disabled:

And from yesterday’s post:

“In fact, the majority of unemployed people in the United States don’t get UI benefits. NELP called attention to the record-low recipiency rate for calendar year 2014 in its report, The Job Ahead. Using the latest data, we find that the recipiency rate in 2015 remained at a record low, with just over one in four jobless workers (27 percent) receiving UI benefits in 2015.”

This is to my concern that we’ve been in recession for perhaps a year or so, but won’t find out until after future GDP revisions are released:

CNBC analysis: Don’t trust those GDP numbers

By Steve Liesman

An in-depth analysis by CNBC of the government’s reports on gross domestic product suggests large and persistent errors that should give investors, business executives and policymakers pause in relying on the data for key decisions.

CNBC looked at each quarterly report going back to 1990 and found an average error rate of 1.3 percentage points. So an initial report of 2 percent growth on average later would be revised to 3.3 percent or 0.7 percent.

The research does not show any systematic overstatement or understatement of growth, just persistently large revisions.