Down some, still depressed and going nowhere: MBA Mortgage ApplicationsHighlightsPurchase applications for home mortgages fell back by 1 percent in the March 18 week, bringing down the year-on-year increase to a still very strong 25 percent, though some loss of momentum in this component is evident. Refinancing applications continued in the decline of recent weeks, dropping 5 percent in the latest week despite a 1 basis point slip to 3.93 percent in the average rate for 30-year conforming loans (7,000 or less). Been moving sideways for quite a while: New Home SalesHighlightsA burst of strength in the West supported a roughly as expected 2.0 percent rise in February new home sales to an annualized rate of 512,000. Sales in the West, which is a key region for the new home market, jumped 39 percent to reverse January’s 33 percent flop. The swings in this region are a reminder that new home sales, because of small samples, are subject to extreme month-to-month volatility.February’s gain for sales didn’t come at the expense of discounting, based on the median price which jumped a monthly 6.2 percent to 1,400 but short of September’s record of 7,600. And the median price compared to sales does look high, up a very modest but possibly unsustainable 2.6 percent year-on-year vs a sharp decline of 6.1 percent for sales.

Topics:

WARREN MOSLER considers the following as important: Employment, housing

This could be interesting, too:

Nick Falvo writes Subsidized housing for francophone seniors in minority situations

NewDealdemocrat writes Declining Housing Construction

Ken Houghton writes Just Learn to Code

Nick Falvo writes Homelessness among older persons

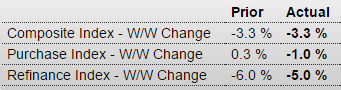

Down some, still depressed and going nowhere:

MBA Mortgage Applications

Highlights

Purchase applications for home mortgages fell back by 1 percent in the March 18 week, bringing down the year-on-year increase to a still very strong 25 percent, though some loss of momentum in this component is evident. Refinancing applications continued in the decline of recent weeks, dropping 5 percent in the latest week despite a 1 basis point slip to 3.93 percent in the average rate for 30-year conforming loans ($417,000 or less).

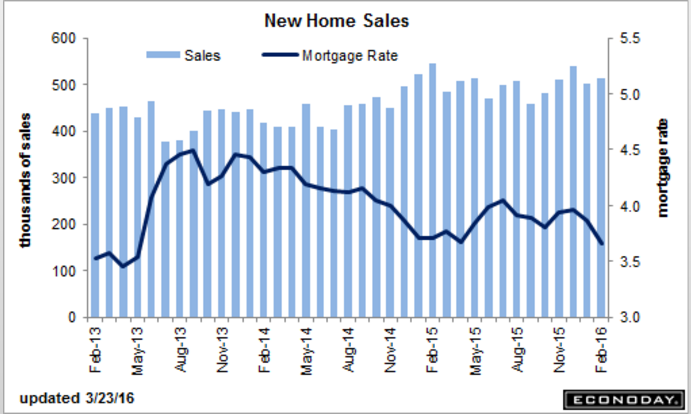

Been moving sideways for quite a while:

New Home Sales

Highlights

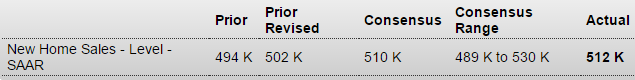

A burst of strength in the West supported a roughly as expected 2.0 percent rise in February new home sales to an annualized rate of 512,000. Sales in the West, which is a key region for the new home market, jumped 39 percent to reverse January’s 33 percent flop. The swings in this region are a reminder that new home sales, because of small samples, are subject to extreme month-to-month volatility.February’s gain for sales didn’t come at the expense of discounting, based on the median price which jumped a monthly 6.2 percent to $301,400 but short of September’s record of $307,600. And the median price compared to sales does look high, up a very modest but possibly unsustainable 2.6 percent year-on-year vs a sharp decline of 6.1 percent for sales.

Lack of supply has been a problem for both existing home sales and also new home sales, with supply in the latter having been held down by a topping out in permits and also by supply constraints in the construction sector including for labor. Supply did edge 4,000 higher to a 7-year high of 240,000 units but supply relative to sales is unchanged at 5.6 months.

Looking at year-on-year sales rates for regions, the West, after its big showing in February, is back in front at plus 10.2 percent. The Midwest is up only 1.9 percent and the Northeast and South are both down, at 3.8 percent and 14.3 percent respectively. These declines, especially for the South which is a very large region, are a reminder of how soft new home sales have been.

Yet today’s report, which includes the gain for prices, is a plus for housing, a sector that has opened the year on a soft note.