Sorry, wrote this up yesterday and never sent it. Purchase apps remain depressed, though a bit off the bottom, and depressed housing sales reports indicate the growth in mtg purchase apps is more about how purchases are financed rather than an indicator of total home purchases: MBA Mortgage ApplicationsHighlightsPurchase applications for home mortgages rose by 2 percent in the March 25 week, with the year-on-year increase continuing very strong at 21 percent. Refinance applications declined by 3 percent from the previous week, continuing recent softness in this component as mortgage rates, while still very low, have edged higher of late. The average rate for 30-year conforming loans (7,000 or less) increased by 1 basis point from the prior week to 3.94 percent. Though not weak, the report does little to raise hopes of an awakening of the recently quite dormant housing market. A glimmer of such hope may have appeared after Monday’s report of a surprisingly strong 3.5 percent month-to-month rise in pending home sales in February. Purchase apps:The ADP forecast for Friday’s number is down from last month but not terrible, and note they revised last month’s forecast lower which means they are forecasting a downward revision of last month’s employment number: ADP Employment ReportHighlightsLittle else may be falling into place but the U.S.

Topics:

WARREN MOSLER considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

Sorry, wrote this up yesterday and never sent it.

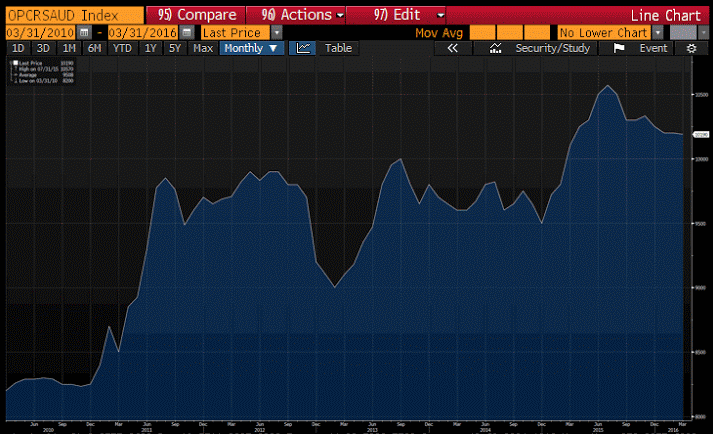

Purchase apps remain depressed, though a bit off the bottom, and depressed housing sales reports indicate the growth in mtg purchase apps is more about how purchases are financed rather than an indicator of total home purchases:

MBA Mortgage Applications

Highlights

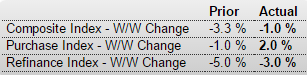

Purchase applications for home mortgages rose by 2 percent in the March 25 week, with the year-on-year increase continuing very strong at 21 percent. Refinance applications declined by 3 percent from the previous week, continuing recent softness in this component as mortgage rates, while still very low, have edged higher of late. The average rate for 30-year conforming loans ($417,000 or less) increased by 1 basis point from the prior week to 3.94 percent. Though not weak, the report does little to raise hopes of an awakening of the recently quite dormant housing market. A glimmer of such hope may have appeared after Monday’s report of a surprisingly strong 3.5 percent month-to-month rise in pending home sales in February.

Purchase apps:

The ADP forecast for Friday’s number is down from last month but not terrible, and note they revised last month’s forecast lower which means they are forecasting a downward revision of last month’s employment number:

ADP Employment Report

Highlights

Little else may be falling into place but the U.S. labor market is likely to show its strength once again in Friday’s March employment report, based at least on ADP’s private payroll count which came in very near expectations at 200,000 on the nose. There’s little change from February when ADP’s sample posted revised growth of 205,000. Expectations for Friday’s private payrolls are also at 200,000 which would prove a very healthy level though down from February’s even stronger 230,000. ADP isn’t always an accurate barometer of the government’s data but it has definitely been useful the last several reports, signaling convincing acceleration in December, slowing in January, then strength again in February.

Recent Fed comments have caused a lot of portfolio shifting that has driven the dollar lower and most commodity prices higher, most likely due to short covering, and not a change in end user demand:

This came out today- Saudi aren’t selling as much as they’ve been hoping to sell, even as US oil production slumps.

If they leave their discount pricing policy in place prices will be heading a lot lower soon. Their new pricing update should be out in the next few days: