While claims are historically at record lows on a per capita basis, because they are now so hard to get the fact that they are rising some might mean something, but maybe not:Job cuts also look like they are trending a bit higher as well:Note how the chart shows this indicator has been zig zagging lower, so we’ll have to wait until next month to see if it zigs back down again: Chicago PMIHighlightsExpansion is March’s score for the often volatile Chicago PMI which surged 6 full points to a higher-than-expected 53.6. This is once again, for the 4th month in a row, outside of Econoday’s consensus range! Contraction was the score in February at 47.6.Details for March show strength for both new orders and backlog orders which are solid pluses for future activity. Production this month was also strong as was employment which is rising once again and at its best rate since April last year. Inventories are still in contraction and input prices are still falling.Most anecdotal indications on the month of March have been positive including this report which tracks both the manufacturing and non-manufacturing sectors of the Chicago economy.

Topics:

WARREN MOSLER considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

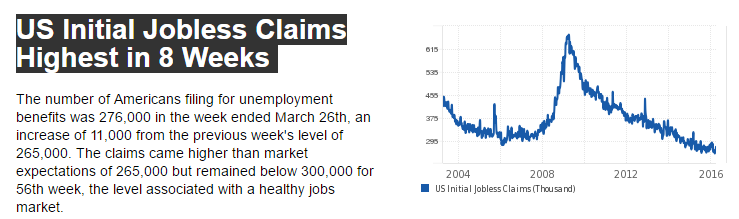

While claims are historically at record lows on a per capita basis, because they are now so hard to get the fact that they are rising some might mean something, but maybe not:

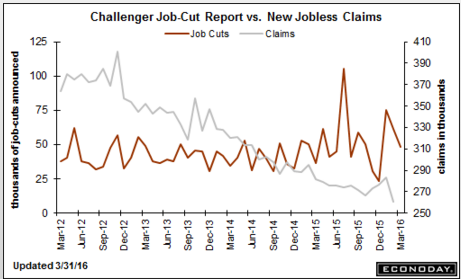

Job cuts also look like they are trending a bit higher as well:

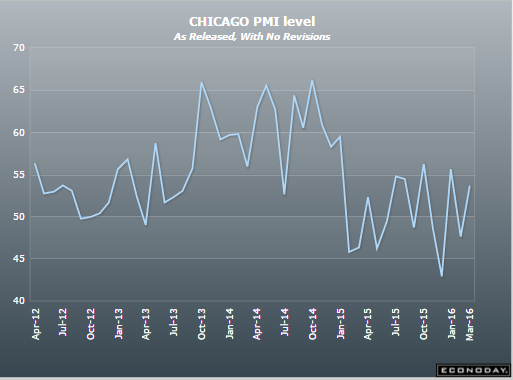

Note how the chart shows this indicator has been zig zagging lower, so we’ll have to wait until next month to see if it zigs back down again:

Chicago PMI

Highlights

Expansion is March’s score for the often volatile Chicago PMI which surged 6 full points to a higher-than-expected 53.6. This is once again, for the 4th month in a row, outside of Econoday’s consensus range! Contraction was the score in February at 47.6.Details for March show strength for both new orders and backlog orders which are solid pluses for future activity. Production this month was also strong as was employment which is rising once again and at its best rate since April last year. Inventories are still in contraction and input prices are still falling.

Most anecdotal indications on the month of March have been positive including this report which tracks both the manufacturing and non-manufacturing sectors of the Chicago economy.

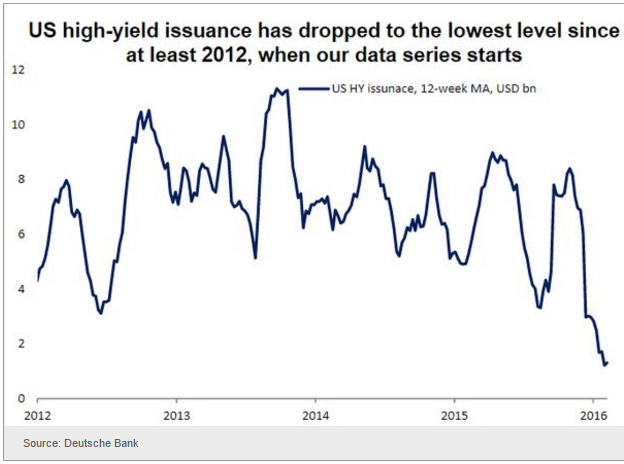

Declining credit growth: