More bad stuff: PMI Manufacturing Index FlashHighlightsEarly indications on April factory conditions are no better than mixed with strength in the Empire State report offset by yesterday’s flat readings from the Philly Fed and another set of flat readings from today’s PMI flash. The PMI, at 50.8, is still over 50 to indicate monthly growth but is the least above 50 since the beginning of the recovery, in September 2009. Growth in both output and hiring is slowing as is growth in new orders which are being pulled back by contraction in export orders. The report also cites weakness in the energy sector as a continuing negative.Backlog orders are down, which is a negative for hiring and also points to operating slack. Manufacturers are keeping their inventories down with stocks of purchases dropping sharply. Delivery times are up, not the result of congestion in the supply chain but, the report says, of insufficient stocks and capacity cuts among suppliers. Prices, reflecting oil, are up slightly for the first increase in 7 months.The report, in a first of sorts compared to other reports, cites the nation’s “political climate” and its relation to the economic outlook as a possible negative. Politics aside, it may still be too soon for the factory sector to see the benefits of this year’s depreciation in the dollar and upturn for oil.

Topics:

WARREN MOSLER considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

More bad stuff:

PMI Manufacturing Index Flash

Highlights

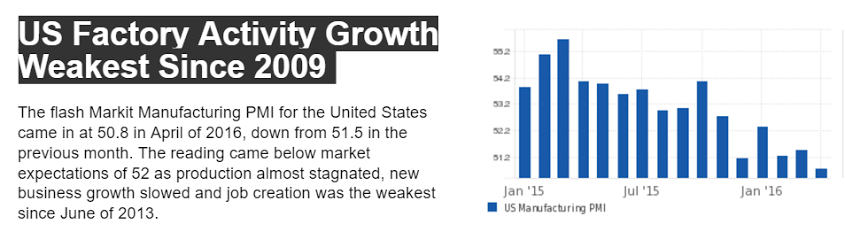

Early indications on April factory conditions are no better than mixed with strength in the Empire State report offset by yesterday’s flat readings from the Philly Fed and another set of flat readings from today’s PMI flash. The PMI, at 50.8, is still over 50 to indicate monthly growth but is the least above 50 since the beginning of the recovery, in September 2009. Growth in both output and hiring is slowing as is growth in new orders which are being pulled back by contraction in export orders. The report also cites weakness in the energy sector as a continuing negative.Backlog orders are down, which is a negative for hiring and also points to operating slack. Manufacturers are keeping their inventories down with stocks of purchases dropping sharply. Delivery times are up, not the result of congestion in the supply chain but, the report says, of insufficient stocks and capacity cuts among suppliers. Prices, reflecting oil, are up slightly for the first increase in 7 months.

The report, in a first of sorts compared to other reports, cites the nation’s “political climate” and its relation to the economic outlook as a possible negative. Politics aside, it may still be too soon for the factory sector to see the benefits of this year’s depreciation in the dollar and upturn for oil. One of next week’s calendar highlights will be durable goods orders for March.

Not so good here either:

Another deflationary bias:

US-led coalition incinerated $500M of ISIS cash stockpiles and cut oil revenues

A U.S.-led coalition air campaign destroyed $500 million in Islamic State cash, reports USA Today.