Loan growth remains uninteresting:And now real estate loan growth, which wasn’t much to begin with, is showing signs of leveling off: In case you thought today’s macro policies were some kind of gift to banks: Again, wouldn’t surprise me if revisions in coming years show the US has been in recession since not long after oil prices got low enough for capex to collapse. And it’s an old fashioned ‘under consumption theory’ slowdown- any agent that spent less than his income needed to be ‘offset’ by another who spent more than his income, or the output wouldn’t have been sold, etc. Unsold output = rising inventories = cutbacks output = reduced income = reduced sales = reduced income = reduced sales = pro cyclical downward spiral, etc. as income reductions in one sector ‘spread’ to cuts into reduced sales in the rest. And it reverses only after deficit spending- public or private- gets large enough to offset desires to ‘save’/not spend income. And it’s happening globally, with maybe some signs of some expansionary fiscal policy in China. But the general policy responses, including those of China, are focused on promoting exports/competitiveness, further promoting a global deflationary 0 sum game race to the bottom, with total trade winding down as well, all from a global lack of aggregate demand.

Topics:

WARREN MOSLER considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

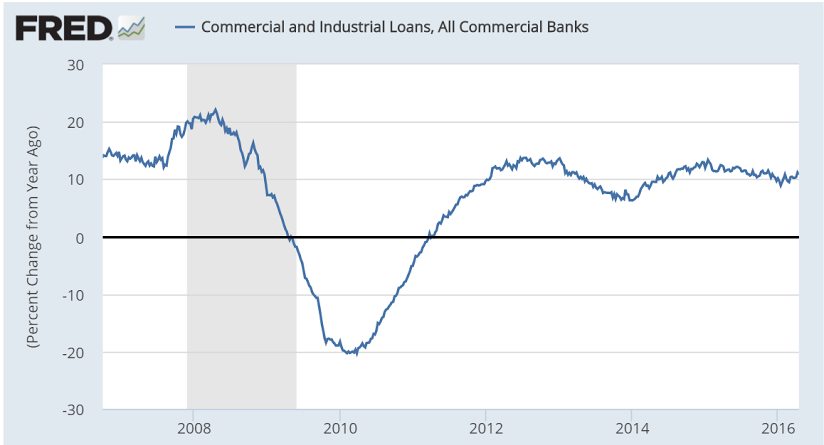

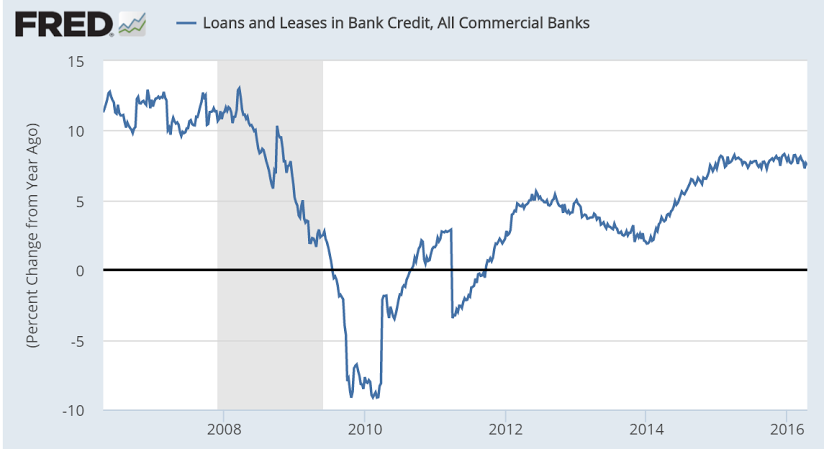

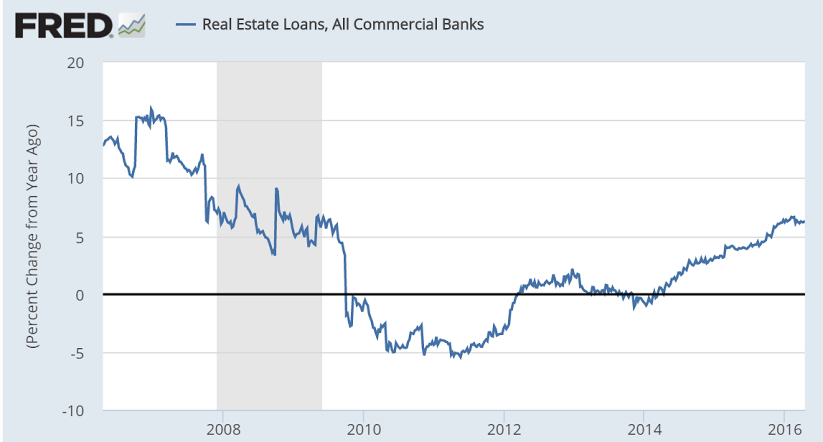

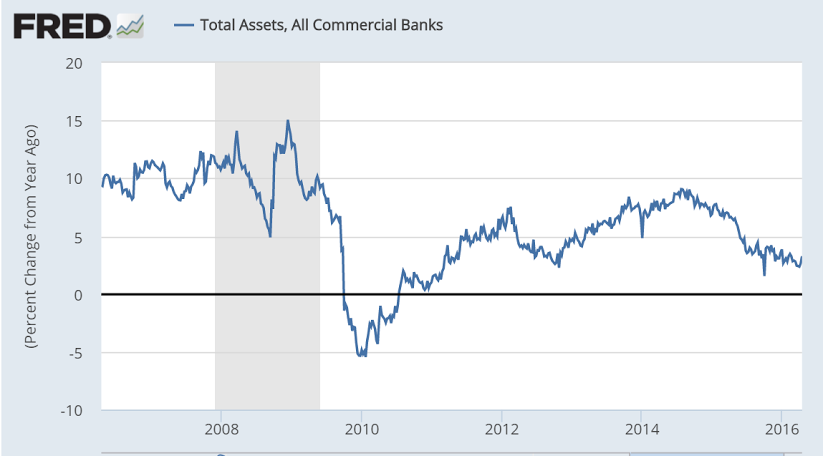

Loan growth remains uninteresting:

And now real estate loan growth, which wasn’t much to begin with, is showing signs of leveling off:

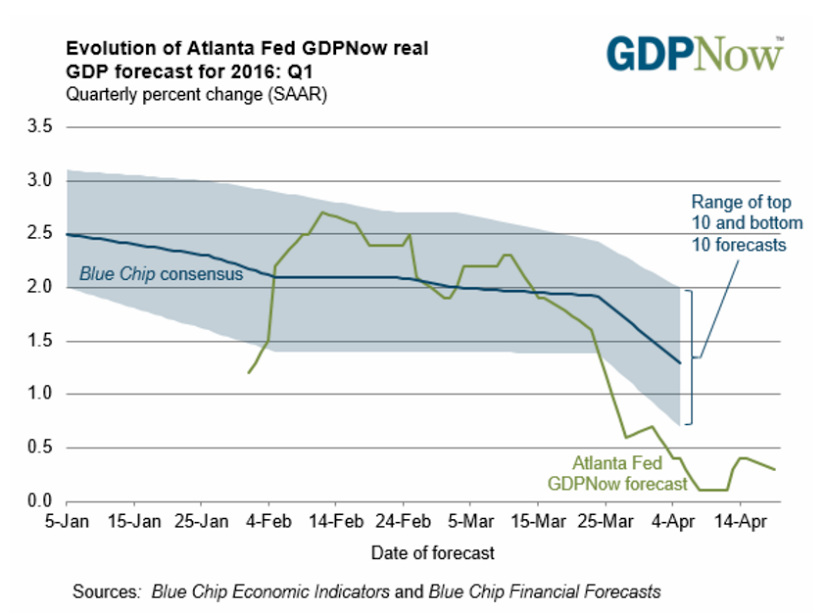

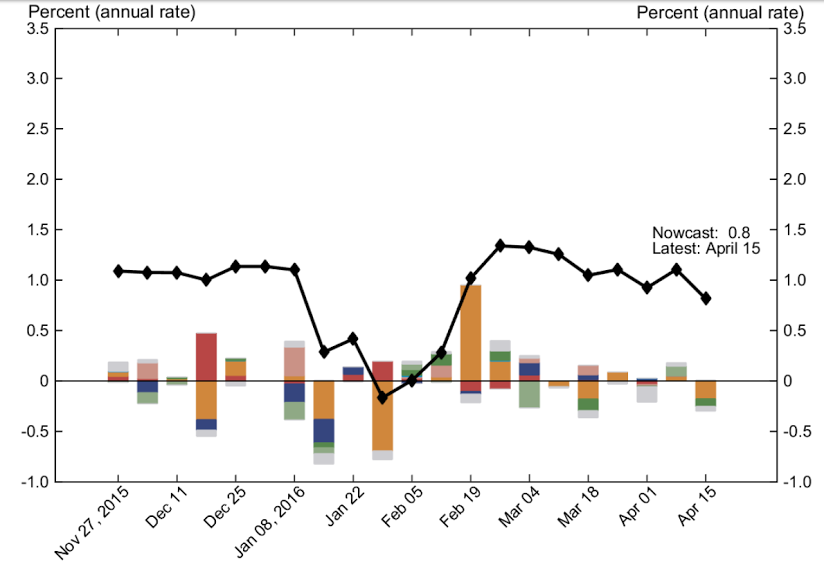

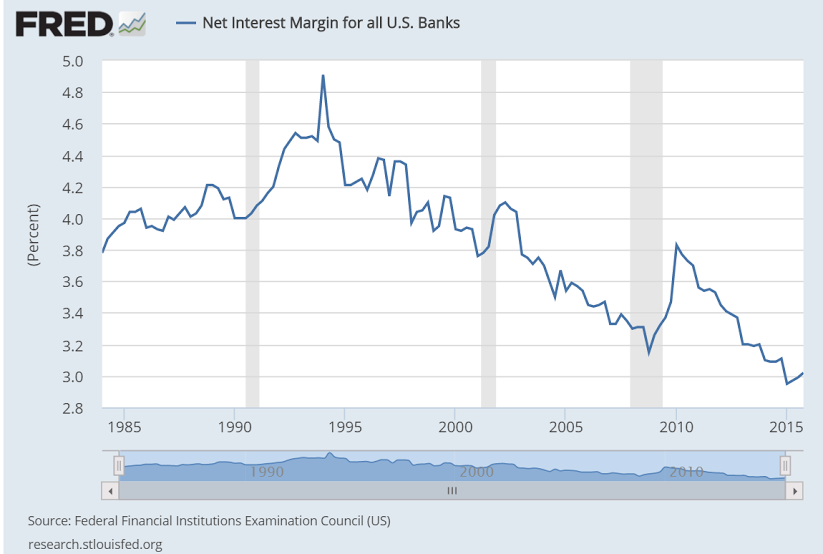

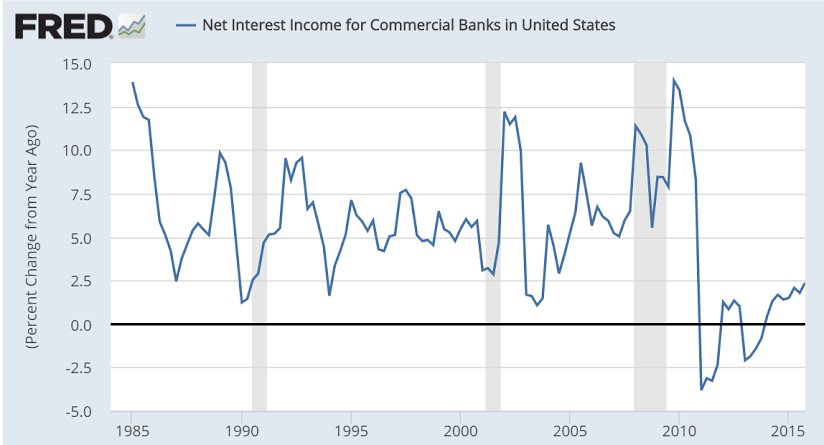

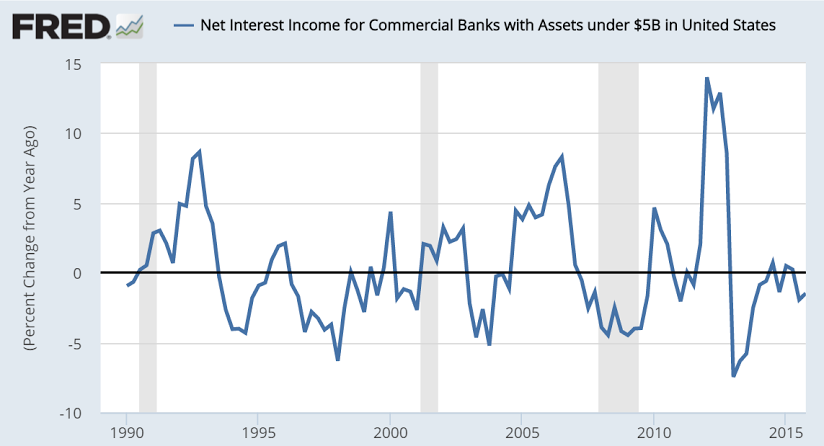

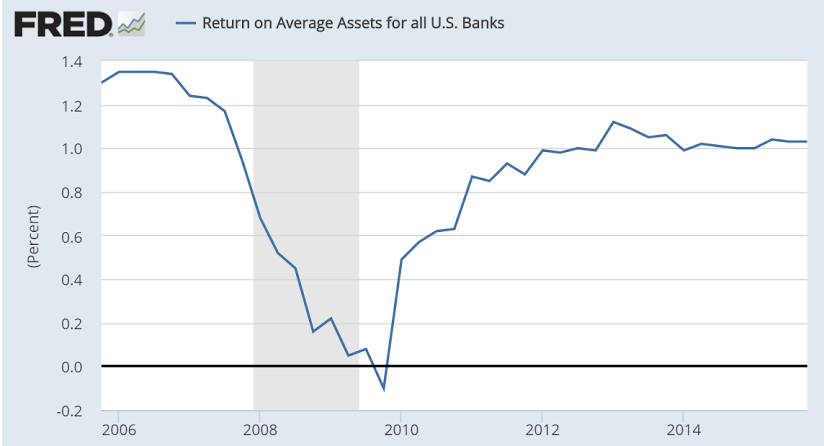

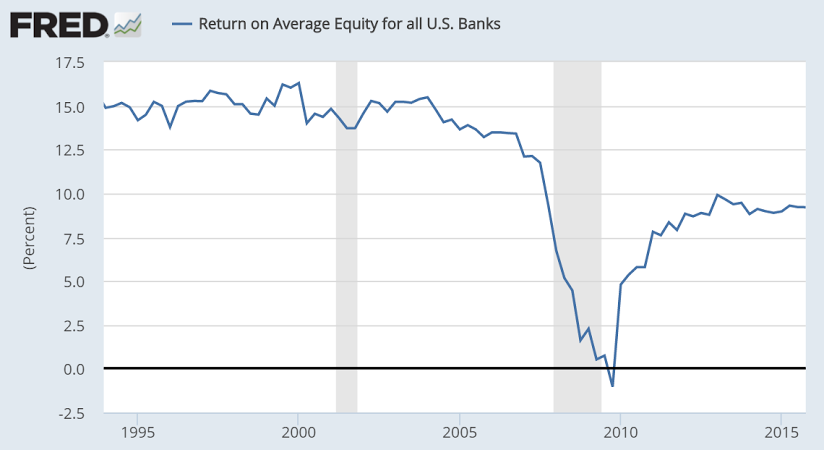

In case you thought today’s macro policies were some kind of gift to banks:

Again, wouldn’t surprise me if revisions in coming years show the US has been in recession since not long after oil prices got low enough for capex to collapse.

And it’s an old fashioned ‘under consumption theory’ slowdown- any agent that spent less than his income needed to be ‘offset’ by another who spent more than his income, or the output wouldn’t have been sold, etc. Unsold output = rising inventories = cutbacks output = reduced income = reduced sales = reduced income = reduced sales = pro cyclical downward spiral, etc. as income reductions in one sector ‘spread’ to cuts into reduced sales in the rest.

And it reverses only after deficit spending- public or private- gets large enough to offset desires to ‘save’/not spend income.

And it’s happening globally, with maybe some signs of some expansionary fiscal policy in China. But the general policy responses, including those of China, are focused on promoting exports/competitiveness, further promoting a global deflationary 0 sum game race to the bottom, with total trade winding down as well, all from a global lack of aggregate demand. And all as evidenced by massive excess capacity, particularly with regard to labor (UNEMPLOYMENT!).

Yes, there are rumblings of a fiscal response, which could in fact immediately restore global demand, but it’s just talk at the moment, with all the ‘action’ coming from monetary policy, which, unfortunately, the CB’s have backwards. They think they are stepping on the gas pedal, when in fact they are stepping on the brake pedal. And when it doesn’t work, they just step on it that much harder. And after 2 decades of supporting data that shows it doesn’t work, they all say they just need a little more time… :(

The Fed’s in a bit of a different position. Rightly or wrongly- it pretty much doesn’t matter if they are right or wrong- they believe the US economy is doing well enough to start tapping the brakes, as they did with their first rate increase. As previously discussed, that in fact adds a bit to aggregate demand via increased federal spending on interest, but so far the rate hike has been tiny and hasn’t been enough to move the demand needle. And if US GDP continues it’s deceleration and the Fed continues to fail to meet its inflation targets, it’s not impossible for them to reverse course and start lowering rates.

Meanwhile, the charts of the real US economy continue to fall/decelerate with most all pointing south, apart from new claims for unemployment which I believe is due to said claims having been made very hard to get, and not labor market conditions. And unemployment looks low only if you believe the drop in the labor participation rates are largely structural (all the women suddenly got too old to work in 2008…) which I find highly doubtful.

Nor do I see any signs of private sector deficit spending stepping up to the plate to replace lost capex spending, which, by the time it collapsed, was all that was left to support GDP growth.

And note that oil related spending cuts are still in progress. Firms are still cutting capex and US states as well as foreign oil producers are just this year cutting back spending due to reduced energy revenues. And all with no ‘offsets’ from other agents increasing their spending. And it all finally got to corporate top line growth and earnings, which have gone negative.

That all means we have to wait for federal deficit spending to increase which could be a long, ugly process.

NY Fed Nowcast report: