Initial jobless claims still negative, but no recession signal As you know, I’ve been monitoring initial jobless claims closely for the past several months, to see if there are any signs of a slowdown turning into something worse. Simply put, if businesses aren’t laying employees off, those same people are consumers who are going to continue to spend, which is 70% of the total economy. So the lack of any such increase has been the best argument that no recession is imminent. Yesterday morning’s report of 222,000 initial claims continues the string of numbers above the 2018-19 average. Superficially the four week average of 233,250 is also enough for a recession flag, but as we will see below this is really an artifact of seasonality. To reiterate, my two

Topics:

NewDealdemocrat considers the following as important: US/Global Economics

This could be interesting, too:

Joel Eissenberg writes How Tesla makes money

Angry Bear writes True pricing: effects on competition

Angry Bear writes The paradox of economic competition

Angry Bear writes USMAC Exempts Certain Items Coming out of Mexico and Canada

Initial jobless claims still negative, but no recession signal

As you know, I’ve been monitoring initial jobless claims closely for the past several months, to see if there are any signs of a slowdown turning into something worse. Simply put, if businesses aren’t laying employees off, those same people are consumers who are going to continue to spend, which is 70% of the total economy. So the lack of any such increase has been the best argument that no recession is imminent.

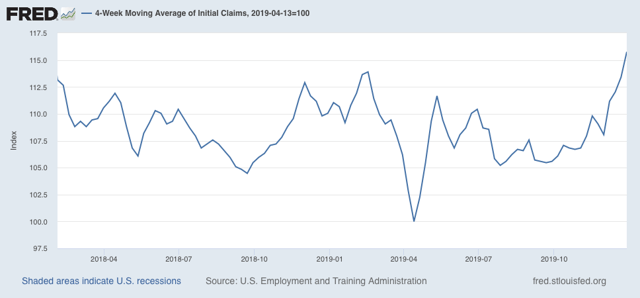

Yesterday morning’s report of 222,000 initial claims continues the string of numbers above the 2018-19 average. Superficially the four week average of 233,250 is also enough for a recession flag, but as we will see below this is really an artifact of seasonality.

To reiterate, my two thresholds for initial claims are:

1. If the four week average on claims is more than 10% above its expansion low.

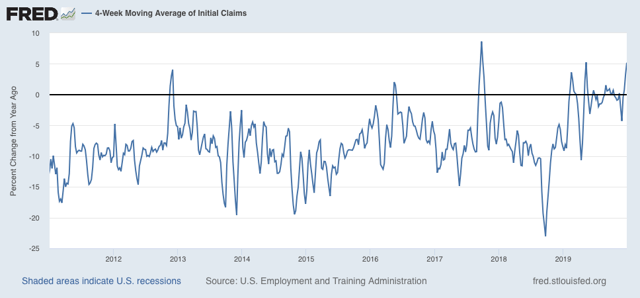

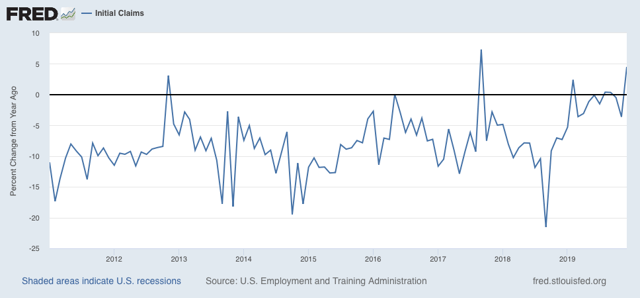

2. If the YoY% change in the monthly average turns higher.

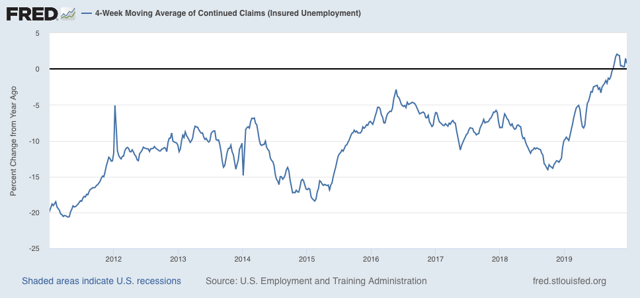

I’ve also added a threshold for the less leading, but also much less volatile 4 week average of continuing claims at 5% higher YoY.

As indicated above, the 4 week moving average of claims has risen to 233,250, which is 15.8% above the lowest reading of this expansion, which occurred back in April

In short, both thresholds for initial claims have been met this week.

But hold your horses: this is only because the 203,000 figure from the last week of November has gone out of the 4 week and monthly average, while the 252,000 number from the first week of December is still in. Almost certainly that wild swing had to do with the change in the week of Thanksgiving this year. If we average the two at 227,500, and use that for our monthly and 4 week averages, then both are 227,000. That puts the 4 week average 12.7% above its low, and higher by 1.7% YoY.

This maintains the “red flag” that began last week, but still remains as consistent with a slowdown as with an impending recession.

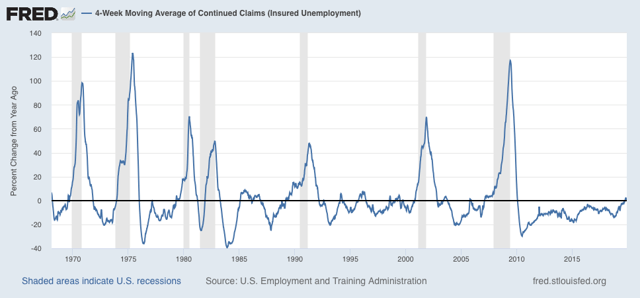

Meanwhile, the less volatile 4 week average of continuing claims is 0.8% above where it was a year ago:

Here is the longer term graph:

This is also consistent with a significant slowdown. But there have been similar readings in 1967, 1985-6, 3 times in the 1990s, and briefly in 2003 and 2005, all without a recession following. So the threshold for continuing claims being a negative (vs. neutral) has not been met.

Unless initial claims are reported in the 230’s without seasonal flukes (or 15%+ higher than their lows), and continuing claims continue to trend higher, into the 1.750 million range or higher, there is no recession flag.

So. this short leading indicator remains weakly negative, a red flag but no imminent downturn.