Better than expected and some upward revisions as well. Retail SalesHighlightsThe consumer snapped back to life in April, driving retail sales 1.3 percent higher to beat Econoday’s consensus by 4 tenths and the high estimate by 1 tenth. Gains are spread throughout most of the report.Autos are the key component, up a sharp 3.2 percent to reverse the prior month’s decline. Excluding autos, retail sales rose 0.8 percent.Sales at gasoline stations, boosted by higher prices, also contributed strongly, up 2.2 percent in the month. But even excluding both autos and gasoline, sales still rose 0.6 percent for the third straight gain, two of which are very strong.Apparel was a big contributor in April along with nonstore retailers and with restaurants also showing a gain. The only component in contraction was building materials & garden equipment which hints at a little cooling for what has been very solid residential investment.Year-on-year rates all improved though total sales remain very soft at 3.0 percent. Auto sales, pulled down by tough comparisons with very strong sales this time last year, are up only 3.1 percent on the year. But other components show strength with the ex-auto ex-gas rate at a healthy 4.4 percent for a 5 tenths gain in the month.Today’s report points to a solid start for the second quarter and gives some life to the possibility of a June FOMC rate hike.

Topics:

WARREN MOSLER considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

Better than expected and some upward revisions as well.

Retail Sales

Highlights

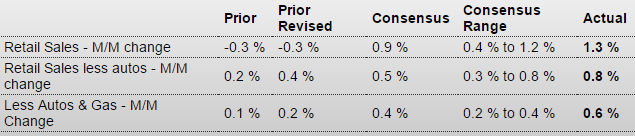

The consumer snapped back to life in April, driving retail sales 1.3 percent higher to beat Econoday’s consensus by 4 tenths and the high estimate by 1 tenth. Gains are spread throughout most of the report.Autos are the key component, up a sharp 3.2 percent to reverse the prior month’s decline. Excluding autos, retail sales rose 0.8 percent.

Sales at gasoline stations, boosted by higher prices, also contributed strongly, up 2.2 percent in the month. But even excluding both autos and gasoline, sales still rose 0.6 percent for the third straight gain, two of which are very strong.

Apparel was a big contributor in April along with nonstore retailers and with restaurants also showing a gain. The only component in contraction was building materials & garden equipment which hints at a little cooling for what has been very solid residential investment.

Year-on-year rates all improved though total sales remain very soft at 3.0 percent. Auto sales, pulled down by tough comparisons with very strong sales this time last year, are up only 3.1 percent on the year. But other components show strength with the ex-auto ex-gas rate at a healthy 4.4 percent for a 5 tenths gain in the month.

Today’s report points to a solid start for the second quarter and gives some life to the possibility of a June FOMC rate hike.

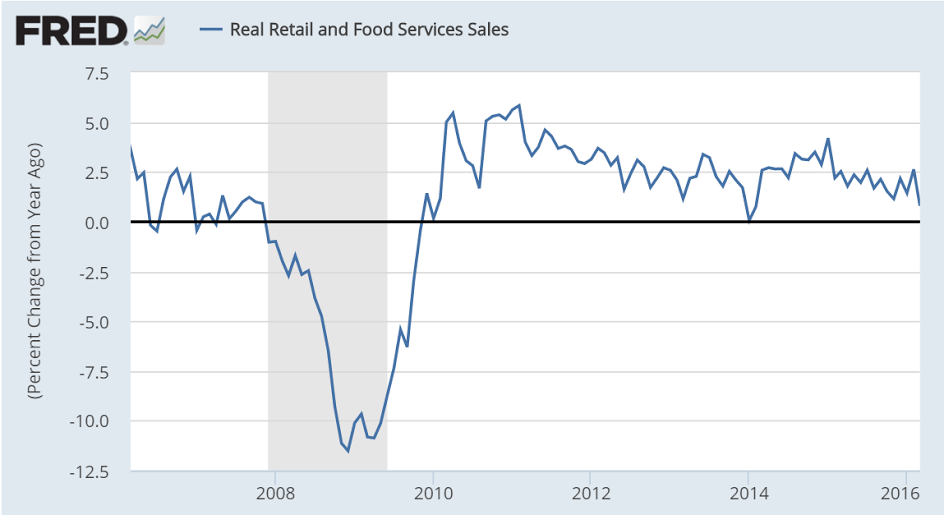

Notice how this has flattened (decelerated):

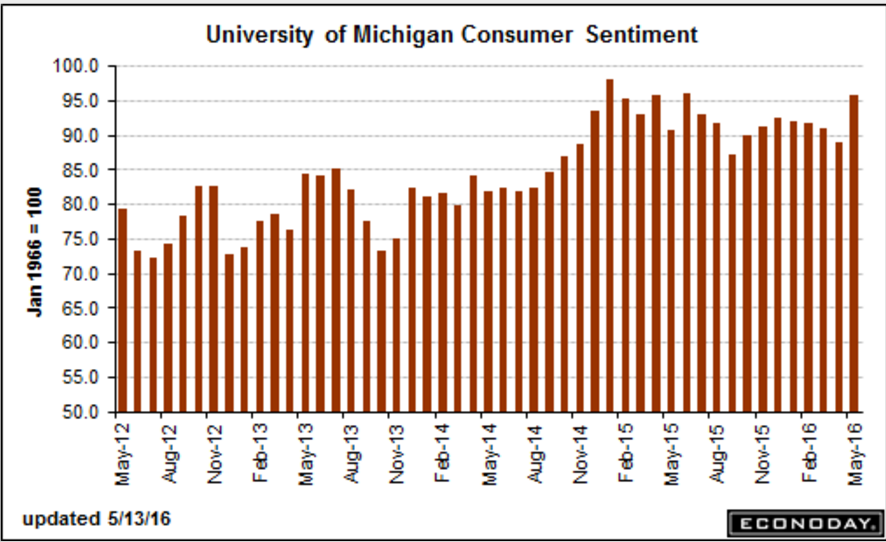

Welcome move back up here:

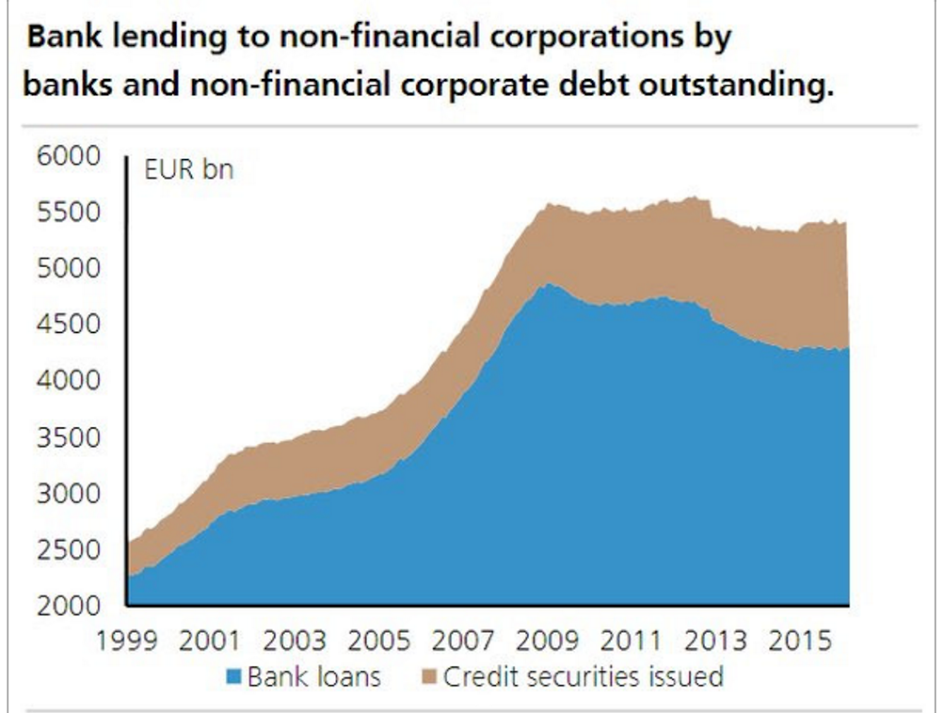

Note how in the euro area it was a sudden shortfall in private sector deficit spending that reduced aggregate demand, and has yet to recover or be ‘replaced’ by either lower taxes or more public spending:

Rail Week Ending 07 May 2016: Rail Continues To Move Deeper Into Contraction

Week 18 of 2016 shows same week total rail traffic (from same week one year ago) declined according to the Association of American Railroads (AAR) traffic data. Rolling averages continue moving deeper into contraction.