Weak U.S. tax receipts suggest things are not so good for the U.S. consumer even as employment continues to grow, Deutsche Bank Chief U.S. Economist Joseph LaVorgna said Monday.The three-month moving average for U.S. jobs gains remains “good” at around 200,000 positions per month, but growth in tax receipts has fallen from about 6 percent a year ago to 3 percent today, LaVorgna said.”That tells me income growth is a lot weaker than what official numbers show, which would explain why consumer spending has been so soft,” he told CNBC’s “Squawk Box.” The so called ‘control group’ is retail sales minus food, auto dealers, building materials, and gas stations and used as an indication of ‘core’ consumer spending. Note that it was growing faster before 2008, when it collapsed. And while it again has grown since 2008, the annual rate of growth has been working its way lower over time: First, this survey is ‘one man one vote’ and not ‘one dollar one vote’. So when the price of gasoline collapsed even thought it was a transfer of funds, to the penny, from sellers to buyers, there were nominally many more buyers than sellers, so this survey spiked up. And the weak retail sales since the oil related capital expenditures collapsed support this narrative. Second, even so sentiment is not all that high vs prior cycles.

Topics:

WARREN MOSLER considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

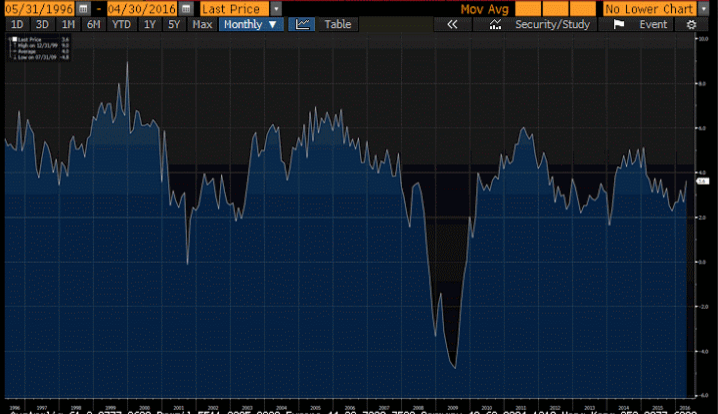

Weak U.S. tax receipts suggest things are not so good for the U.S. consumer even as employment continues to grow, Deutsche Bank Chief U.S. Economist Joseph LaVorgna said Monday.The three-month moving average for U.S. jobs gains remains “good” at around 200,000 positions per month, but growth in tax receipts has fallen from about 6 percent a year ago to 3 percent today, LaVorgna said.”That tells me income growth is a lot weaker than what official numbers show, which would explain why consumer spending has been so soft,” he told CNBC’s “Squawk Box.”

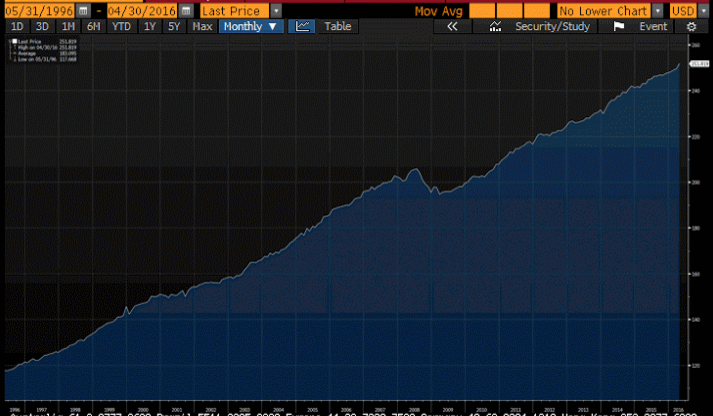

The so called ‘control group’ is retail sales minus food, auto dealers, building materials, and gas stations and used as an indication of ‘core’ consumer spending.

Note that it was growing faster before 2008, when it collapsed. And while it again has grown since 2008, the annual rate of growth has been working its way lower over time:

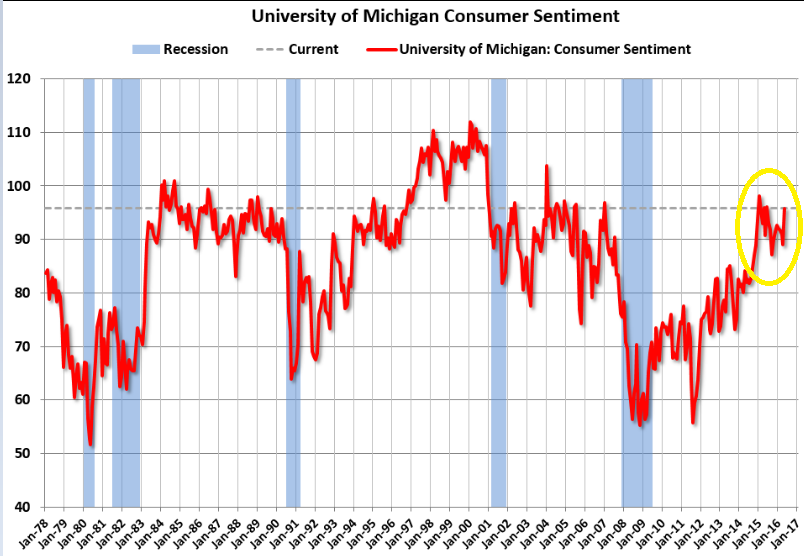

First, this survey is ‘one man one vote’ and not ‘one dollar one vote’. So when the price of gasoline collapsed even thought it was a transfer of funds, to the penny, from sellers to buyers, there were nominally many more buyers than sellers, so this survey spiked up. And the weak retail sales since the oil related capital expenditures collapsed support this narrative.

Second, even so sentiment is not all that high vs prior cycles.